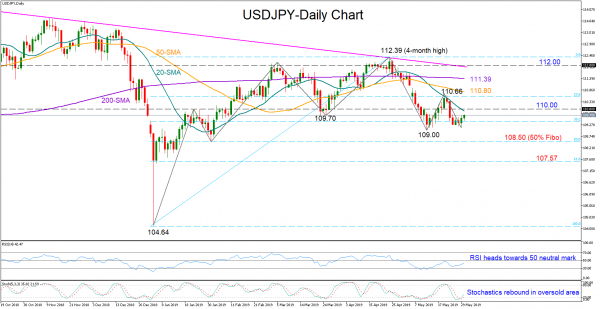

USDJPY is struggling to recover last week’s losses which drove the pair back into the 109 area but the positive slope of the RSI and the rebound in the Stochastics provide some optimism that the bears could stay on the sidelines in the short-term trading. The trend signals, however, are still negative as the pair has violated its January uptrend by creating a lower low and a lower high this month.

A descent rally above the 110 level and the 20-day simple moving average (SMA) could add more buyers into the market, pushing resistance towards the previous high of 110.66 and the 50-day SMA currently around 110.80. The 200-day SMA (111.34) could be another obstacle on the way up, though the main target remains the descending line drawn from the 114.54 peak.

On the downside, a drop below the 109 mark would bring the 50% Fibonacci of 108.50 of the upleg from 104.64 to 112.39 into view. Breaking that barrier, the market could come under fresh selling until the 61.8% Fibonacci of 107.57.

In the medium-term picture, the outlook holds neutral within the 112.39 and 107.57 boundaries.