The USD was unchanged in the American and Asian sessions. This was after the market received a number of key economic data from the United States. The pending home sales rose by 1.2% in November. This refers to signed contracts for homes where transactions have not yet closed. The number was in line with expectations and was the highest level since September. The Chicago manufacturing PMI rose to 48.9 from the previous 46.3. Meanwhile, the preliminary trade deficit declined to $63.19 billion from the previous $66.53 billion. Later today, the market will receive the Redbook and consumer confidence data from the United States.

The so-called Santa Rally faded yesterday as the year started to wind down. US stocks have had a successful year, with all the main indices rising by more than 25%. Most of these gains have been attributed to Apple and Microsoft, the two biggest companies in the world. Apple’s stock has gained by more than 70% this year. The Dow Jones Industrial Average decline by 183 points while the Nasdaq index declined by 60 points. Part of the reason for the declines was the so-called tax loss harvesting. This is the process of buying stocks that have experienced losses to offset taxes.

Asian stocks were mixed as the market received positive PMI data from China. Data from China Logistics showed that the manufacturing PMI remained unchanged at 50.2 in December. This was slightly above the consensus estimates of 50.1. The non-manufacturing PMI declined from 54.4 to 53.5 while the composite PMI declined from 53.7 to 53.4. Caixin will release its PMI data on Thursday. Meanwhile, most European markets will be closed today with others ending the day early.

EUR/USD

The EUR/USD pair declined slightly in the Asian session. The pair is trading at 1.1200, which is slightly below yesterday’s high of 1.1220. The price is along the middle line of the Bollinger Bands and along the important resistance line shown in blue. The RSI has been declining. The pair may remain at the current levels as volumes remain thin.

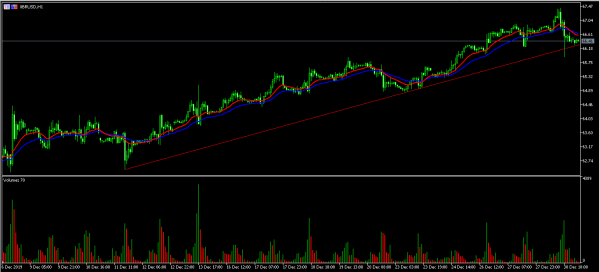

XBR/USD

The XBR/USD pair declined to a low of 65.92 in the American session. It then rose slightly and is currently trading at 66.40. The pair’s 14-day and 28-day EMAs have made a bearish crossover. The price is also along the important support shown in red below. The volume indicator continues to show low volume. The pair could continue declining if it moves past the current support.

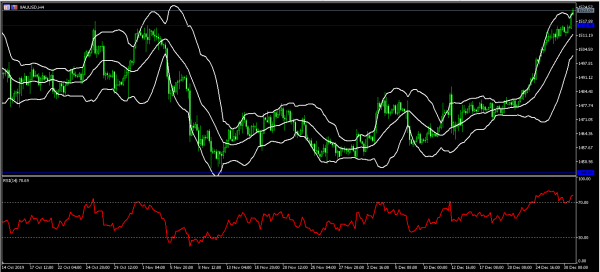

XAU/USD

The XAU/USD pair rose sharply in the Asian session. The pair reached a high of 1525, which was the highest level since September. The pair moved above the important resistance level of 1515. On the four-hour chart, the price is along the upper line of the Bollinger Bands. It is also above the 14-day and 28-day moving averages. The RSI is above the overbought level of 70. The pair may continue moving higher, to test the important level of 1550.