The Bank of Japan will be the first of the major central banks to hold its first monetary policy meeting of 2020 on January 20-21. The Bank will also be releasing its quarterly Outlook Report together with its decision on Tuesday. Those hoping for some fireworks would have better luck holding out for the Bank of Canada’s and European Central Bank’s meetings later in the week as the BoJ is not expected to alter policy or its language. However, the Bank’s latest projections may contain some vital clues for future policy direction and will therefore be studied carefully.

Japanese exports still reeling from trade war

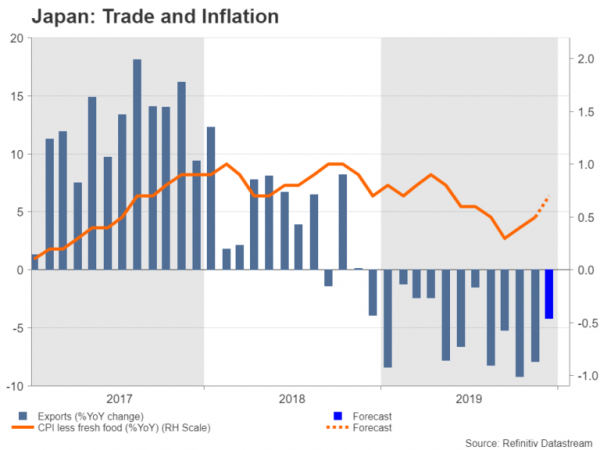

Having held off from easing policy in 2019 as exports slumped and consumption wobbled following the October sales tax hike, policymakers may find some solace in the economic data that will be published later in the week. Twenty nineteen was not a very good year for Japanese exports as shipments have been declining year-on-year every month since December 2018 as the US-China trade war has hurt American and Chinese demand for Japanese goods.

Domestic consumption had provided some relief for Japan’s manufacturers and kept the economy growing from Q4 2018 through Q3 2019. However, the increase in the sales tax on October 1, which coincided with a typhoon hitting the country in the same month, led to a plunge in household spending, recovering only modestly in November.

Inflation and trade expected to have improved in December

Making matters worse for the BoJ, core CPI, which it targets for its inflation goal, has been weakening for most of the year. Further deterioration in the data in the coming months would make it increasingly difficult for policymakers to justify their wait-and-see stance.

However, there’s likely to be some good news this week from the trade and CPI reports due on Thursday and Friday, respectively, which may ease the pressure on the central bank to act soon. The rate of decline in exports is expected to have moderated to -4.2% y/y in December and the core consumer price index is forecast to have ticked higher to 0.7% y/y.

Rebound in consumption will be critical for BoJ policy

If consumption also rebounds further in the coming months, the BoJ is almost certain to stay on hold in January and for the rest of the year as the improving global growth picture on the back of the signing of the ‘phase one’ trade agreement by the US and China weakens the case for additional stimulus. Aside from easing trade tensions, the Japanese economy is also expected to receive a boost from the fiscal package announced by the government in December as well as the Summer Olympics to be held in Tokyo this year.

Yen impact to be determined by outlook report

Assuming there’s no new setbacks to growth, a neutral BoJ would be negative for the yen as there would be nothing to counter receding safe-haven demand from the positive risk sentiment. In the more near term, however, the focus will be on the Bank’s economic projections. Investors will be looking at possible updates to the forecasts to gauge whether the Bank is becoming more optimistic or pessimistic about the outlook.

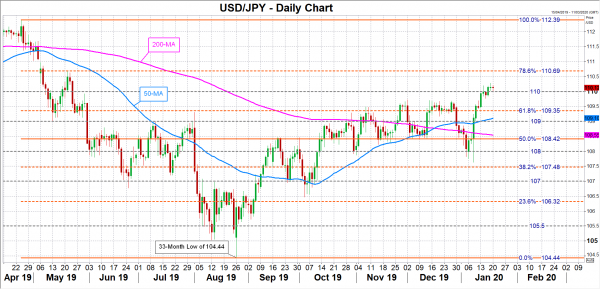

If the BoJ revises up its 2020 growth forecast as many analysts are predicting, dollar/yen could face some downside pressure and retreat back towards its 50-day moving average just above the 109 level. If, though, there are no substantial positive revisions in the growth and inflation forecasts, dollar/yen may find enough juice to extend its latest uptrend to the 78.6% Fibonacci retracement level of the downleg from 112.39 to 104.44 at 110.69.