- Dollar and stocks take another battering as virus fears grip markets

- Investors continue to flock to safety, euro a surprise beneficiary

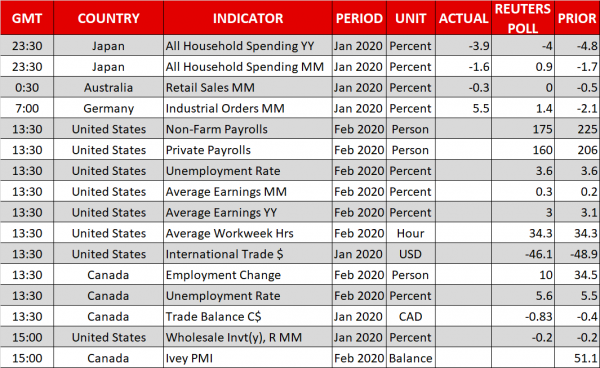

- US jobs report not expected to trim Fed rate cut expectations; OPEC eyed too

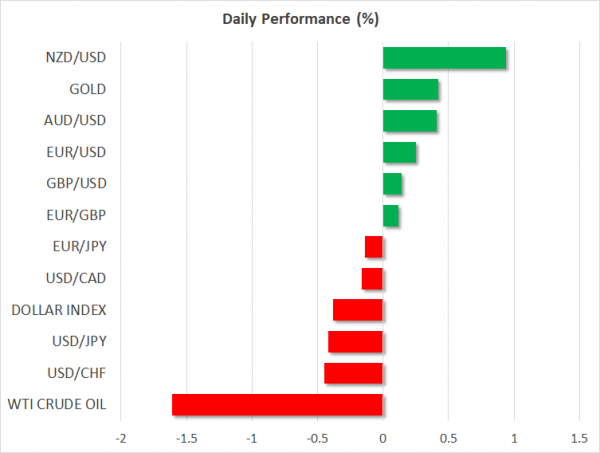

No reprieve for dollar sell-off

The US dollar extended its losing streak on Friday, skidding to two-month lows against a basket of currencies and 6-month lows versus the safe-haven yen. Contagion fears continue to spread panic in the markets as the number of coronavirus cases outside of China are accelerating fast with no sign yet that the outbreak is close to peaking. The United States, France, Italy, Germany and the United Kingdom have all reported huge increases in the number of infections in recent days, fuelling concerns that the global economy is headed for a recession.

Although several central banks, including the Federal Reserve, have been quick to respond to the crisis by slashing rates, investors are losing confidence as to how much policymakers can do to avert economic devastation from a prolonged period of supply disruptions and travel restrictions. Nonetheless, this isn’t stopping traders from betting that the Fed will have to make further aggressive easing and a rate cut of at least 25 basis points is fully priced in for the March 17-18 meeting.

Consequently, the expectations of lower rates have pushed Treasury prices higher and yields lower. The 10-year yield has been plunging to record lows all week, breaching below 0.80% today and further evaporating the dollar’s relative yield advantage over other currencies.

Stocks were also on the backfoot on Friday as more and more investors begin to fear the worst about the economic fallout from the virus outbreak. US stocks yesterday wiped out almost all of Wednesday’s gains, the Nikkei nosedived to a 6-month low today and European shares opened 2% lower.

Euro joins yen, franc and gold in the safety march higher

As the dollar loses its shine, traditional safe havens such as the yen, Swiss franc and gold are investors’ preferred alternatives. The greenback dipped below the 106-yen level for the first time since September, while against the Swiss franc, it’s slumped to 2-year lows. Gold edged higher to approach February’s 7-year high of $1688.66 an ounce.

One side effect, though, of investors dumping US assets and the subsequent unwinding of carry trades is that this has given rise to the euro, which was the main funding currency for these trades. The single currency extended its surge against the dollar today to hit an 8-month peak of $1.1279. The euro’s sudden bullish turn is likely to be raising some eyebrows at the European Central Bank and may provide an added incentive for policymakers to cut interest rates next week when they meet amid resistance by the hawks to further easing.

The dollar even struggled against commodity currencies such as the aussie and the kiwi, with the latter jumping 1%, as well as the troubled pound. Cable climbed to a more than one-week high nearing the $1.30 level even as the tight timeline for the Brexit trade talks faces being derailed by the virus epidemic.

Low hopes of strong NFP lifting market mood; Oil slips ahead of OPEC decision

There may be some reprieve for the greenback later today if the latest nonfarm payrolls report out of the US shows there were a healthy 175k jobs added in February as expected. However, even if the data confirms that the US labour market remained robust in February, it’s unlikely to allay worries about the outlook given the fast deteriorating virus situation. Hence, it will probably have no impact on fed funds futures.

Job numbers will also be released in Canada and a weak report may pose a significant risk for the loonie as the economy is anticipated to have struggled in February. Another danger for the Canadian dollar is the imminent decision by OPEC+ on production cuts.

OPEC is seeking to cut production by 1.5 million bpd but it’s unclear if Russia will back the cuts as non-OPEC countries join the discussion today. Oil traders were not too optimistic, however, as WTI last stood almost 2% down on the day.