The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.08105

Open: 1.07919

% chg. over the last day: -0.11

Day’s range: 1.07833 – 1.08772

52 wk range: 1.0777 – 1.1494

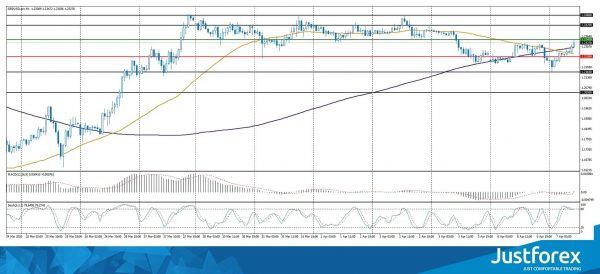

EUR/USD quotes have been growing after a prolonged fall. The trading instrument has updated local highs. At the moment, the EUR/USD currency pair is testing the 1.08800 mark. The level of 1.08250 is already a “mirror” support. The technical pattern signals a further recovery of the single currency. Today, senior eurozone officials should hold a videoconference to agree on economic measures in the context of the COVID-19 epidemic. Positions should be opened from key support and resistance levels.

The publication of important economic releases is not expected.

Indicators do not give accurate signals: the price has fixed between 50 MA and 100 MA.

The MACD histogram has started to rise, indicating the development of bullish sentiment.

Stochastic Oscillator is in the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.08250, 1.07750

Resistance levels: 1.08800, 1.09200, 1.09700

If the price fixes above 1.08800, further growth of the EUR/USD currency pair is expected. The movement is tending to 1.09200-1.09500.

An alternative could be a drop in the EUR/USD quotes to 1.07900-1.07700.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.22341

Open: 1.22303

% chg. over the last day: +0.10

Day’s range: 1.21643 – 1.23472

52 wk range: 1.1466 – 1.3516

There is an ambiguous technical pattern on the GBP/USD currency pair. The British pound is being traded in a flat. Financial market participants expect additional drivers. At the moment, the local support and resistance levels are 1.22500 and 1.23450, respectively. British Prime Minister Boris Johnson has been moved to intensive care unit after his COVID-19 symptoms worsened. We recommend opening positions from key levels.

The news feed on the UK economy is quite calm.

Indicators do not give accurate signals: the price has crossed 50 MA and 100 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.22500, 1.21650, 1.20500

Resistance levels: 1.23450, 1.24250, 1.24800

If the price fixes below 1.22500, GBP/USD is expected to fall. The movement is tending to 1.21700-1.21200.

An alternative could be the growth of the GBP/USD currency pair to 1.24250-1.24800.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.42242

Open: 1.41104

% chg. over the last day: -1.01

Day’s range: 1.40123 – 1.41432

52 wk range: 1.2949 – 1.4668

The USD/CAD currency pair has been declining after a prolonged consolidation. The trading instrument has updated local lows. At the moment, USD/CAD quotes are testing support of 1.40100. The 1.41000 round level is already a “mirror” resistance. The recovery of oil quotes supports the loonie. The Canadian dollar has the potential to further strengthen against the greenback. Positions should be opened from key levels.

At 17:00 (GMT+3:00), Ivey PMI will be published in Canada.

Indicators do not give accurate signals: 50 MA has crossed 100 MA.

The MACD histogram is in the negative zone and below the signal line, which gives a strong signal to sell USD/CAD.

Stochastic Oscillator is in the oversold zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.40100, 1.39250

Resistance levels: 1.41000, 1.41750, 1.42600

If the price fixes below 1.40100, a further drop in the USD/CAD quotes is expected. The movement is tending to 1.39500-1.39000.

An alternative could be the growth of the USD/CAD currency pair to 1.41500-1.42000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.350

Open: 109.216

% chg. over the last day: +0.46

Day’s range: 108.672 – 109.280

52 wk range: 101.19 – 112.41

The USD/JPY currency pair has become stable. The trading instrument is currently consolidating. There is no defined trend. USD/JPY quotes are testing local support and resistance levels: 108.700 and 109.300, respectively. Investors expect additional drivers. We recommend paying attention to the dynamics of US government bonds yield. Positions should be opened from key levels.

The news feed on Japan’s economy is calm enough.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 108.700, 108.200, 107.600

Resistance levels: 109.300, 110.100

If the price fixes above 109.300, further growth of USD/JPY quotes is expected. The movement is tending to 110.000-110.200.

An alternative could be a decrease in the USD/JPY currency pair to 108.200-107.800.