The Economic Sentiment Indicator (ESI) and preliminary inflation readings will be the data highlights in the Eurozone this week. The ESI is out on Thursday and the flash inflation estimate will follow on Friday; both are due at 09:00 GMT. The two reports are expected to paint contrasting pictures as the ESI should tick higher – in line with other business surveys – as the lockdowns are relaxed, while the price data may sound alarm bells about the deflationary impact of the COVID-19 pandemic. But with the European Central Bank meeting in just over a week’s time, an anticipated policy easing is likely to keep a lid on the euro.

Growing evidence of economic rebound

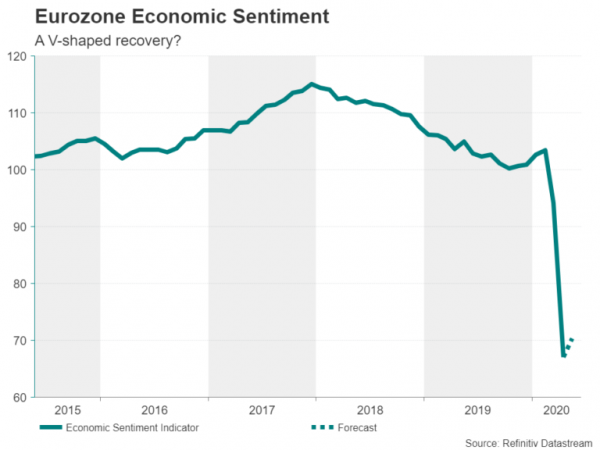

As Europe emerges out of lockdown and many businesses reopen for the first time in two months, there are encouraging signs that the euro area could be headed for a V-shaped recovery. The flash PMI prints by IHS Markit have already indicated there was a significant rebound in economic activity in the first few days of May when social distancing guidelines started being slowly lifted in most EU member states.

The ESI gauge – an economic survey conducted by the European Commission – will probably keep in trend with the PMIs as the index is forecast to edge up from 67.0 to 70.3 in May. Assuming there is no need for another lockdown from any second wave of the virus, it might be all too easy to dismiss the gloomy predictions as economic output bounces back from the brief collapse suffered during the shutdowns.

Outlook uncertain despite recovery hopes

However, investors should be wary about confusing the initial rebound, when business activity picks up from non-existent levels, with a full recovery, when consumers are feeling confident enough to return to their pre-crisis spending habits. It is this uncertainty about the outlook that is the biggest worry for businesses and policymakers and the reason why expectations of additional monetary and fiscal stimulus have not receded.

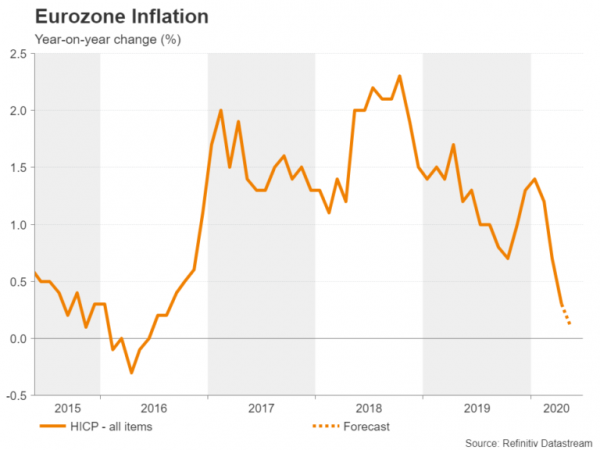

Friday’s inflation numbers are likely to serve as a reminder of the side-effects of a draconian lockdown policy as the year-on-year change in the Eurozone’s harmonized consumer price index (HICP) is forecast to have slowed to a four-year low of 0.1% in May. The combined slump in demand for fuel and consumer goods has reignited negative price pressures just a few years after the last oil crash triggered a global deflationary spiral, adding to the urgency for central bankers to step up their policy responses to the coronavirus.

More ECB stimulus may cap euro

And that is what the European Central Bank is looking increasingly likely to do when it holds its next policy gathering on June 3-4, following dovish messages in the minutes of its last meeting. The ECB is widely anticipated to increase the size of its pandemic emergency purchase program (PEPP) by at least 500 billion euros as politicians squabble over how to raise funds for a European virus recovery package.

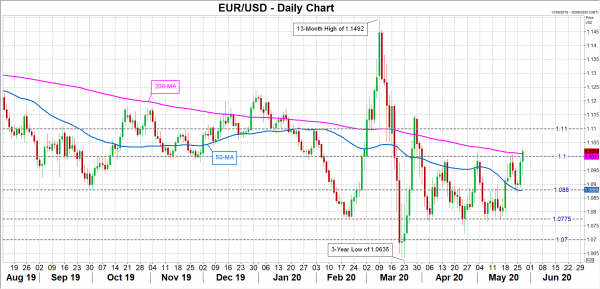

Those expectations, along with some doubts about whether fiscal hawks like the Netherlands and Austria will approve the Franco-German plan for a 500-billion-euro recovery fund, are holding back the euro, which has repeatedly been capped by the $1.10 level in the past.

Should the incoming survey data continue to point to improving conditions and additionally, if there is quick progress on reaching a compromise on an EU fiscal package, the euro should be in a position to make a convincing break above the $1.10 barrier – where the 200-day moving average is fast closing in on – and aim for the next big obstacle at $1.11.

However, should things falter again for the single currency, support can be found at the 50-day moving average in the $1.0880 region. If this support is breached, the decline may extend towards the recently congested area of $1.0775.