Asian stocks declined as investors began to worry about a second wave of the virus. That is after several cases of the virus were reported in Beijing. On Saturday, the country confirmed 43 new cases followed by 49 new cases confirmed on Sunday. These cases were all traced to the Xinfadi wholesales seafood and vegetable market. Similarly, the US confirmed more cases in some states during the weekend. The country reported more than 44,000 new cases and there is a possibility that they will climb due to the recent protests. In China, the Shanghai Composite and the Hang Seng declined by 0.10% and 0.60% respectively while in Japan, the Nikkei fell by 0.50% respectively.

The Australian dollar was little changed after China released important economic data. The numbers showed that the country’s unemployment rate declined from the previous 6.0% to 5.9%, a sign that firms had retained their workers. Retail sales declined by 2.8%, which was better than the previous decline of 7.5%. Meanwhile, industrial production rose by 4.4% in May after rising by 3.9% in the previous month while the fixed asset investment fell by 6.3%. These numbers show that the country’s economy is experiencing a slow comeback after a significant decline in the first quarter.

The Japanese yen gained slightly against the US dollar as the Bank of Japan started its meeting. Analysts expect that the bank will leave rates unchanged at -0.10% tomorrow. They also expect that the bank will continue with its open-ended quantitative easing program and continue with its yield curve control. Other banks that will deliver their rates decision this week will be the Swiss National Bank, Bank of England, Norges Bank, and the Russian central bank.

EUR/USD

The EUR/USD pair rose slightly during the Asian session. It is trading at 1.1255, which is slightly above the day’s low of 1.1215. On the four-hour chart, the price is below the 25-day and 50-day EMAs. The two EMAs are forming a bearish crossover. The RSI has declined from the previous high of 79.23 to the current level of 42. The pair may resume the downward trend as bears attempt to test the next support at 1.1150.

AUD/USD

The AUD/USD pair was little changed during the Asian session. It is trading at 0.6826, which is slightly above Friday’s close of 0.6792. On the four-hour chart, the price is below the 50-day and 25-day EMA while the signal line and the histogram of the MACD have been falling. The pair will likely continue falling as bears attempt to test the next support at 0.67500 and even the 23.6% retracement level of 0.6700.

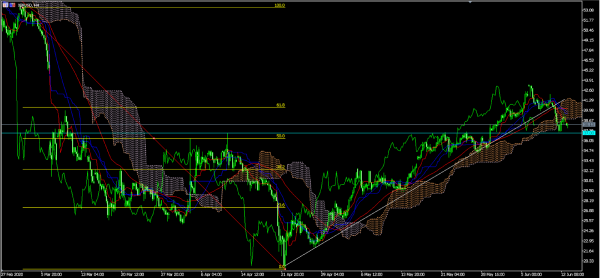

XBR/USD

The XBR/USD pair declined to an intraday low of 37.55 as traders increased their fears of a second wave of the virus. The pair is below the white ascending trendline and below the 50-day and 25-day EMAs. It is also between the 50% and 61.8% Fibonacci levels. Also, the price is slightly below the Ichimoku cloud. This means that there is a possibility that it will continue moving lower as bears attempt to move below 37.00.