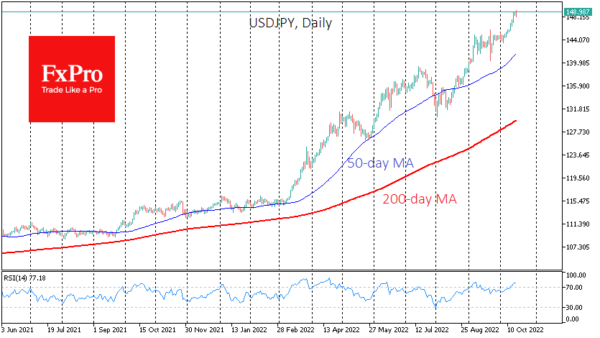

The exchange rate of the Japanese yen to the dollar is renewing its 32-year lows since the beginning of the week, and there is no end to the move. The USDJPY has touched and exceeded 149 and has gained about 3% since the beginning of the month. The pair has gained an astounding 45% since the beginning of this new cycle in 2021, and there is no solid fundamental reason for the JPY to latch on to this decline.

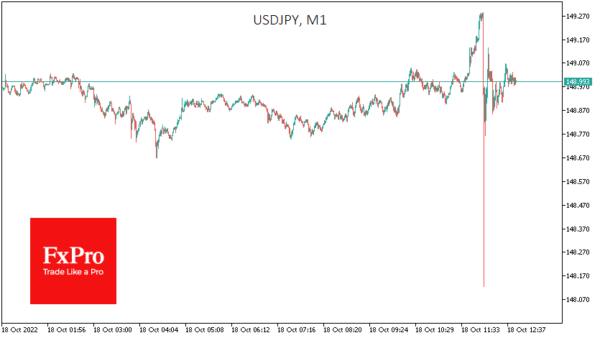

A few moments ago, we saw another intervention from Japan’s Ministry of Finance to stop the yen’s accelerating fall. The USDJPY was trading close to 149.30, and that sent the pair falling back to 148.12 within a minute.

The latest attempt of the authorities to stop the yen’s unilateral decline can only make the markets smile for now. On Tuesday, Finance Minister Suzuki warned that Japan is ready to take appropriate and drastic measures against speculators.

But the speculators are more than a cohort of traders looking for a quick profit. In this case, the market is betting that Japan will not be able to sit on two chairs simultaneously. Even with a trillion dollars in U.S. treasuries as a safety cushion, it is impossible to keep long-term bond rates near zero in the face of extreme rate hikes and seriously assert its intention to defend the yen.

Sooner rather than later, Japan must choose one action, defend the yen, or defend bond yields by abandoning its current controversial policy.