- China’s CPI continued to deflate in January to -0.8% y/y from -0.3% y/y in December 2023 while the pace of contraction has slowed slightly in PPI (factory gate prices) to -2.5% y/y from -2.7% y/y in December.

- The spread of PPI over CPI has widened which in turn may see a turnaround in the current negative profitability growth rate of China’s industrial enterprises.

- Technical analysis suggests the minor countertrend rally in the Hang Seng Index may extend.

Since the start of this week, the China and Hong Kong stock markets have rallied after one of the benchmark China stock indices sank to a 5-year low due to more forceful measures that clamped down on short-selling activities and President Xi’s in-person meeting with the China Securities Regulatory Commission that led to the intermediate replacement of the regulator party chief yesterday, 7 February.

The involvement of President Xi, the pinnacle of China’s top policymakers in an attempt to stop the rout that has wiped out close to US$7 trillion in market capitalization of the China and Hong Kong stock markets since the highs in 2021; has sent a potential signal to the markets that a stock market stabilization fund is likely to be announced soon after an idea of it backed by a fund size of US$278 billion from offshore accounts of Chinese state-owned enterprises was floated two week ago.

The benchmark CSI 300 Index has gained by +4.6% week-to-date as of 8 February at this time of the writing, similar positive movements are seen in the Hong Kong benchmark stock indices as well over the same period; Hang Seng Index (+2.6%), Hang Seng TECH Index (4.5%), and Hang Seng China Enterprises Index (+3.1%).

Previous attempts to shore up investors’ confidence over the past 12 months via piecemeal stimulus and policies have failed to enact sustainable bullish movements in the China and Hong Kong stock benchmark indices other than several bouts of “dead cat bounces”.

A silver lining within the deflationary forces

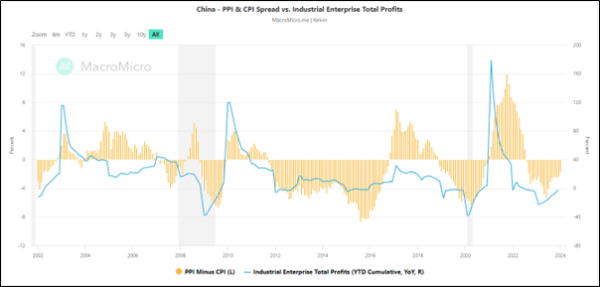

Fig 1: China PPI/CPI spread with Industrial Enterprise Total Profits as of Jan 2024 (Source: MacroMicro, click to enlarge chart)

Can this time round be different? The answer lies with the crux of the problem, the heightened deflationary risk spiral via the wealth effect destruction from a persistently weak property market in China.

No doubt, the latest data has indicated further weakness in consumer prices where the monthly CPI inflation rate for January has further decelerated in the negative territory to -0.8% y/y from -0.3% y/y in December 2023, its longest stretch of contraction since October 2009, and below consensus of -0.5% y/y.

On a slightly positive note, China’s producer prices have continued to fall for the 16th consecutive month but at a slower pace where PPI for January came in at -2.5% y/y, above -2.7% y/y in December, and consensus of -2.6% y/y, notching its softest drop in four months.

Given the slower pace of contraction in PPI, the spread between PPI and CPI has widened significantly in the past six months to -1.70 in January from -3.10 printed in August 2023.

This spread can be used as a proxy to measure the profitability of China’s industrial enterprises. A widening of the spread below zero is likely to indicate some form of recovery or turnaround in the current negative profitability growth of industrial enterprises. The cumulative Industrial Enterprise Total Profits y/y trend has indeed shown modest signs of recovery in the past six months; improving from -15.50% y/y recorded in July 2023 to -2.30% y/y in December 2023 (see Fig 1).

If the spread of PPI and CPI continues to widen, it may reduce the current bout of deflationary forces which in turn ignite more confidence in the stock market that potentially led to more pronounced countertrend rallies.

That said, consumer and business sentiment in China also needs to improve significantly to inspire major multi-month bullish trends to kickstart in the China and Hong Kong stock markets where the required catalysts are direct fiscal stimulus measures to boost spending which are lacking at this juncture.

Minor countertrend rally may extend in Hang Seng Index

Fig 2: Hong Kong 33 short-term trend as of 8 Feb 2024 (Source: TradingView, click to enlarge chart)

The price actions of the Hong Kong 33 Index (a proxy of the Hang Seng Index futures) have shed -3.5% in the past session from an intraday high of 16,420 printed yesterday, 7 February.

There are still several positive short-term technical elements to note; the current price action of the Index is still oscillating above its 20-day moving average, and the hourly MACD trend indicator has dipped down to retest its ascending support which in turn may translate into a bullish inflection for price actions.

Watch the 15,640 key short-term pivotal support (close to the 20-day moving average & 61.8% Fibonacci retracement of the prior minor rally from the 5 February low to 7 February high) and clearance above the near-term resistance of 16,250 (also the 50-day moving average) may see the next intermediate resistance coming in at 16,525/16,725 (upper boundary of the minor ascending channel from 22 January low & 4/5 January minor swing highs area).

However, failure to hold at 15,640 invalidates the bullish tone for a further slide to expose the next intermediate support at 15,300. Failure to hold at 15,300 increases the risk of a retest on the major support of 14,600.