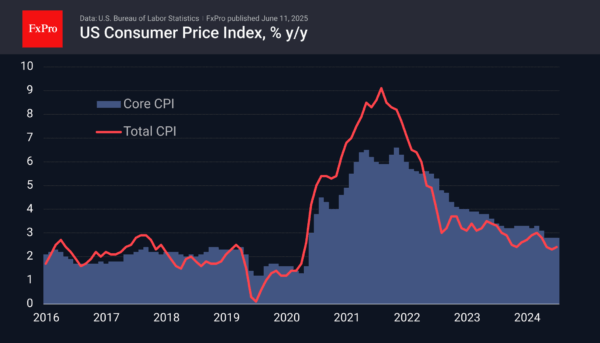

Consumer prices in the US rose by 0.1% in May against the expected 0.2%, falling below analysts’ average forecasts for four months in a row. The annual growth rate was 2.4% for the overall index and 2.8% for the core index (excluding food and energy). In the latter case, the current rate of price growth has remained unchanged for the third month in a row, being the lowest in the last four years.

Tariff disputes have not yet caused a significant surge in inflation. This is understandable, as goods at the new prices have not yet reached consumers. However, it is also important to note that sellers are not rushing to pass on costs in advance, as is the case in many countries. We saw the same slowness in price increases and an insignificant impact on overall inflation during the first trade wars of 2018.

In response to the publication, the dollar index lost 0.5% in the first few minutes but recovered about half of that afterwards. Overall, this is bearish news for the dollar, bolstering the arguments of the doves in the Fed and playing into the hands of stock indices.