The euro is holding firm after a notable rally in recent weeks. Both the EUR/USD and EUR/JPY currency pairs are showing signs of consolidation, as markets cautiously assess the outlook against the backdrop of a packed economic calendar. Traders remain in wait-and-see mode — a stance that could serve as a platform for either a renewed upward impulse or a potential correction, should upcoming data disappoint expectations.

Investors are closely monitoring a series of key macroeconomic indicators set for release in the coming hours, including Germany’s consumer price index, Italy’s industrial production figures, and the PCSI consumer sentiment index across major eurozone economies. These reports will help gauge whether the euro’s current strength is justified, and how consumers and businesses are responding to a strong currency.

Meanwhile, European Central Bank (ECB) policy remains in the spotlight. In June, the ECB cut interest rates amid a strengthening euro and easing inflationary pressures. The market will now scrutinise the rhetoric of ECB officials to assess their concerns about further euro appreciation and its implications for exports and inflation targets. Remarks from Luis de Guindos, who recently warned against “excessive appreciation”, underscore how sensitive monetary policy has become to current exchange rate levels.

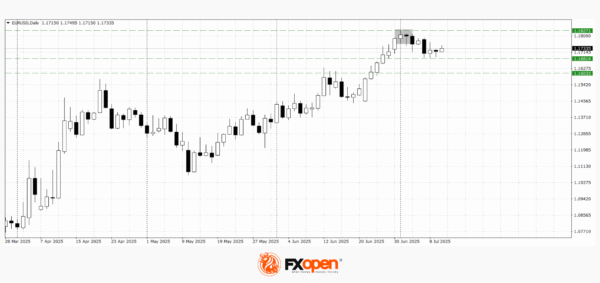

EUR/USD

The EUR/USD pair has been consolidating in the 1.1680–1.1800 range for a second consecutive week. Technical analysis of EUR/USD suggests the potential for a deeper correction, as a bearish harami pattern has emerged on the daily timeframe. However, if buyers manage to hold the price above 1.1700, the pair could resume its upward trend toward the 1.1900–1.2000 zone.

Key data releases that may influence EUR/USD movements include:

- 09:00 (GMT+3): Germany CPI

- 13:00 (GMT+3): Germany PCSI Consumer Sentiment Index (Thomson Reuters/Ipsos)

- 15:30 (GMT+3): US Initial Jobless Claims

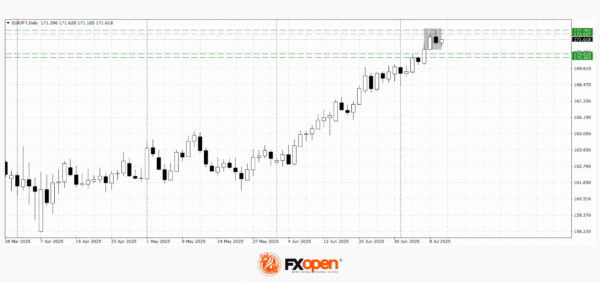

EUR/JPY

The recent sharp rally in EUR/JPY culminated in a test of major resistance near 172.30, accompanied by the formation of a dark cloud cover pattern on the daily chart. This signals the possibility of a pullback, with support likely to be tested around 170.30–170.60. Still, in the event of positive eurozone data, the pair could attempt to retest recent highs at 172.00–172.30.

Upcoming events that could impact EUR/JPY pricing:

- Today, 20:15 (GMT+3): Speech by Fed Governor Christopher Waller

- Tomorrow, 09:00 (GMT+3): Germany Wholesale Price Index

- Tomorrow, 15:00 (GMT+3): Germany’s Current Account Balance (seasonally adjusted)

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.