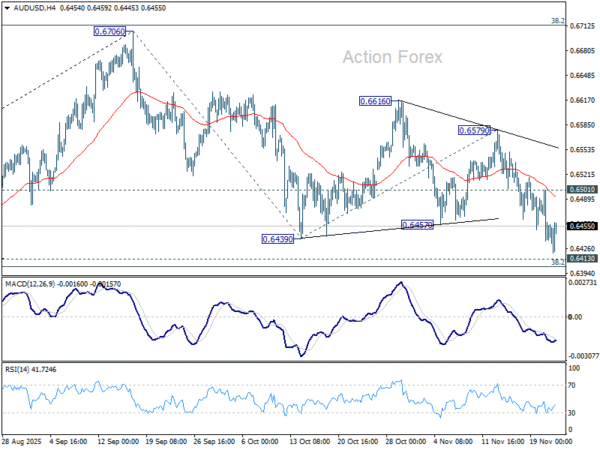

AUD/USD’s fall from 0.6706 resumed by breaking through 0.6439 support last week. Initial bias stays on the downside for 0.6413 cluster (38.2% retracement of 0.5913 to 0.6706 at 0.6403). Decisive break there should confirm near term bearish reversal. Next target is 100% projection of 0.6706 to 0.6439 from 0.6579 at 0.6312. ON the upside, though, above 0.6501 minor resistance will turn intraday bias neutral first.

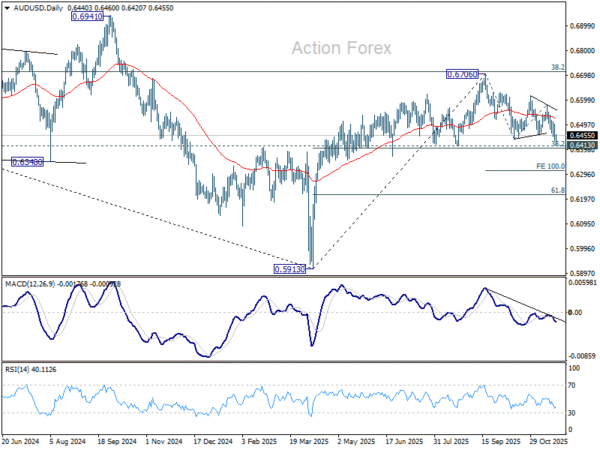

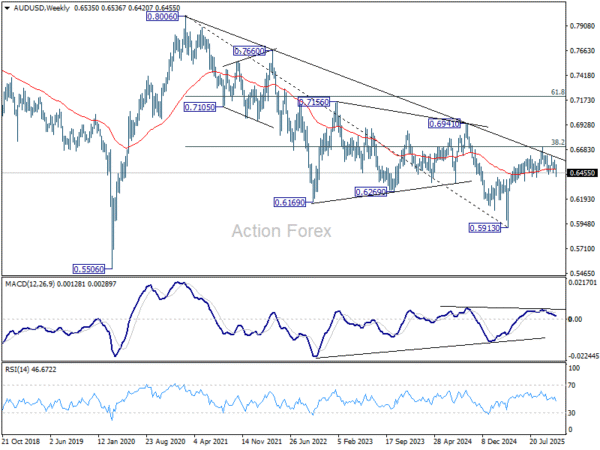

In the bigger picture, there is no clear sign that down trend from 0.8006 (2021 high) has completed. Rebound from 0.5913 is seen as a corrective move. Outlook will remain bearish as long as 38.2% retracement of 0.8006 to 0.5913 at 0.6713 holds. Break of 0.6413 support will suggest rejection by 0.6713 and solidify this bearish case. Nevertheless, considering bullish convergence condition in W MACD, sustained break of 0.6713 will be a strong sign of bullish trend reversal, and pave the way to 0.6941 structural resistance for confirmation.

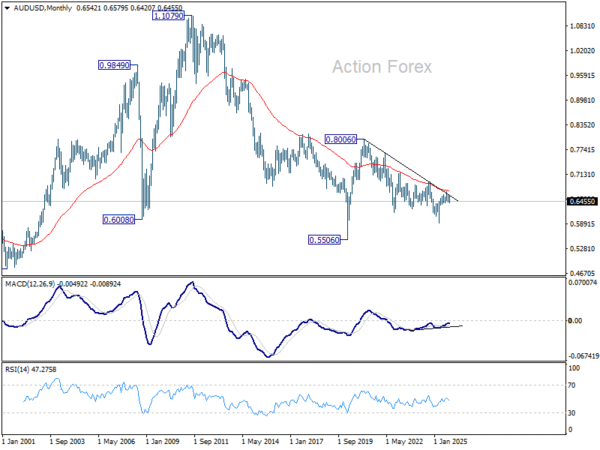

In the long term picture, fall from 0.8006 is seen as the second leg of the corrective pattern from 0.5506 long term bottom (2020 low). Hence, in case of deeper decline, strong support should emerge above 0.5506 to contain downside to bring reversal. On the upside, firm break of 0.6941 will argue that the third leg has already started back to 0.8006.