Sterling continues to underperform today, though losses remain contained. The lack of aggressive selling suggests markets are already well positioned for near-term policy easing and are now grappling with uncertainty further along the curve rather than reacting to fresh surprises.

This week’s string of weaker UK employment data has erased any remaining doubt over a BoE rate cut tomorrow. The decision has become a formality, shifting attention to guidance and the sequencing of subsequent moves.

There is no consensus on what follows. Some analysts caution that November’s softer inflation reading was influenced by temporary discounting effects tied to early Black Friday promotions. If so, inflation could firm again in coming months.

Still, even a cut in February or March would not represent a shift in policy tempo. The BoE has clearly signaled a preference for a measured approach, and with inflation still far above target, there is little scope for a faster pace than one cut per quarter.

From a trading standpoint, the exact timing of the next cut is unlikely to be a major market driver. February may be marginally favored due to the release of new forecasts, but the broader message of gradual easing remains intact regardless.

The larger uncertainty lies in the terminal rate. How far policy ultimately moves into neutral territory is still an open question, and one that markets are in no position to answer with confidence given lingering inflation risks.

In FX markets today, Sterling is still the weakest performer, followed by Yen and Loonie. Dollar leads the pack, with Swiss Franc and Kiwi also firmer. Euro and Aussie sit in the middle.

Oil prices, meanwhile, are staging a notable rebound after hitting multi-year lows earlier this week. The move follows US President Donald Trump’s decision to label Venezuela’s government a terrorist organization and impose a full blockade on sanctioned oil tankers. That move injects fresh supply risk, while optimism around a Ukraine–Russia peace deal has yet to deliver concrete follow-through.

In Europe, at the time of writing, FTSE is up 1.49%. DAX is down -0.06%. CAC is down -0.27%. UK 10-year yield is down -0.056 at 4.467. Germany 10-year yield is up 0.013 at 2.859. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI rose 0.92%. China Shanghai SSE rose 1.19%. Singapore Strait Times fell -0.09%. Japan 10-year JGB yield rose 0.029 to 1.985.

Silver outpaces sluggish Gold, pushes towards 70 as record run extends

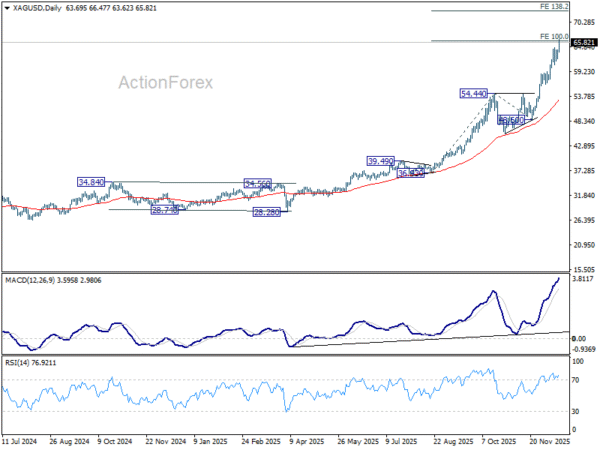

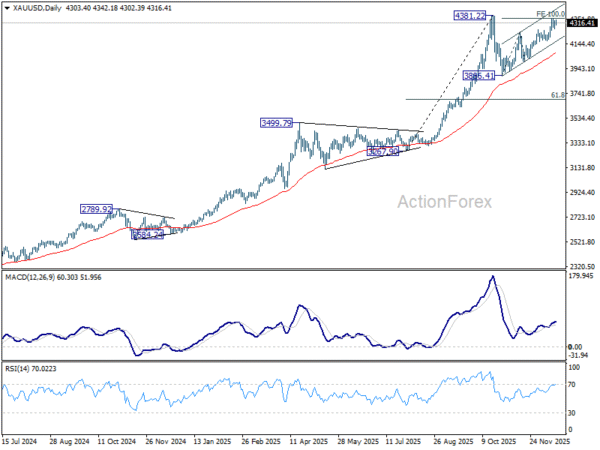

Silver’s uptrend extended again today, pushing to fresh record highs above the 66 mark and reinforcing its status as the standout precious metal. Momentum remains firmly on the upside, with prospects growing for a move toward 70 psychological level and potentially beyond. By contrast, Gold continues to struggle near its recent highs, with momentum turning sluggish and risks skewed toward a near-term bearish extension of its medium-term corrective pattern.

One key advantage for Silver lies in its structural fundamentals. As of late 2025, the Silver market is in its fifth consecutive year of supply deficit, with mine production and recycling consistently falling short of global demand from both industry and investors. This persistent imbalance has tightened the market in a way gold has not experienced.

Silver has also benefited from a policy-driven tailwind. In November, the US officially added Silver to its Critical Minerals List for the first time, reflecting its essential role in modern technology and national security. Demand from solar energy, electric vehicles, defense, and high-tech manufacturing continues to accelerate, while supply growth remains constrained.

The US currently imports more than 70% of its Silver needs, highlighting a growing vulnerability as global demand outpaces mine supply. That backdrop strengthens the case for sustained investment demand and reinforces Silver’s appeal relative to Gold.

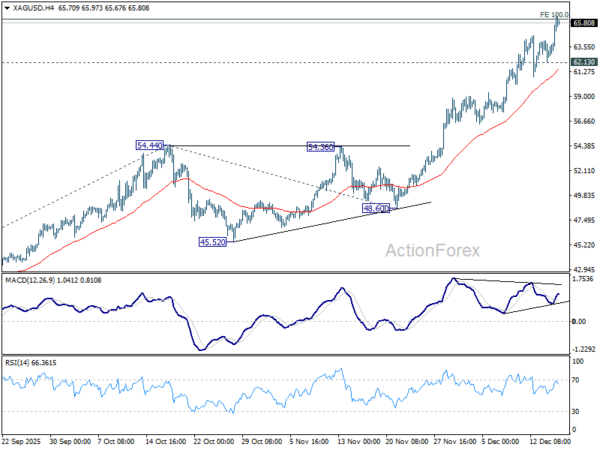

Technically, Silver has already met 100% projection of 36.93 to 54.44 from 48.60 at 66.11 and there is no clear sign of topping yet. Near term outlook will stay bullish as long as 62.13 support holds. The focus is on whether the next up leg of pull 4H MACD above its falling trend line to confirm revival of upside momentum. Sustained trading above 66.11 will pave the way 70 psychological level or even further to to 138.2% projection at 72.98.

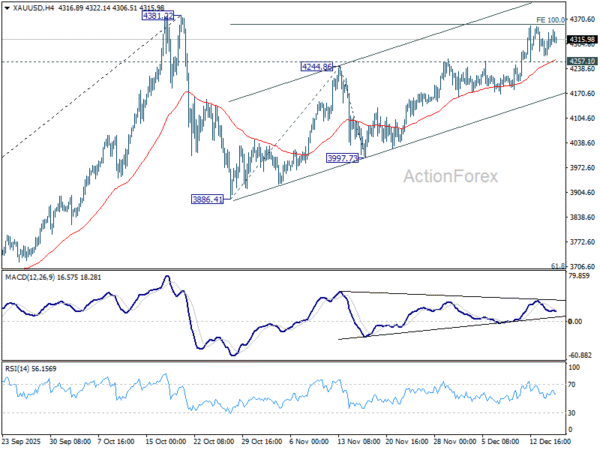

Meanwhile, Gold’s momentum as turned sluggish ahead of 4381.22 high. Break of 4257.10 support will turn bias to the downside for deeper pullback. Further break of the near term rising channel will argue that corrective pattern from 4381.22 has already started the third leg down. Nevertheless, decisive break of 4381.22 will confirm long term up trend resumption.

Eurozone CPI finalized at 2.1% in November, services remain main inflation driver

Eurozone inflation was finalized unchanged in November, confirming a stable price environment heading into year-end. Headline CPI held at 2.1% yoy, the same as in October. Core CPI excluding energy, food, alcohol, and tobacco was also unchanged at 2.4%.

Services continued to dominate inflation dynamics, contributing 1.58 percentage points to the annual rate. Food, alcohol, and tobacco added 0.46 pp, while non-energy industrial goods contributed a modest 0.14 pp. Energy prices continued to exert a slight drag, subtracting -0.04 pp from the headline rate.

Across the wider EU, CPI was finalized at 2.4% yoy. Inflation was lowest in Cyprus (0.1%), France (0.8%), and Italy (1.1), while Romania (8.6%), Estonia (4.7%), and Croatia (4.3%) recorded the highest rates. Compared with October, inflation eased in twelve member states, was unchanged in five, and rose in ten.

German Ifo sentiment falls to 87.7, ends year on downbeat note

Germany’s Ifo survey delivered weaker-than-expected readings in December, confirming that business confidence remains under strain. The headline Business Climate index fell to 87.7 from 88.0, missing forecasts of 88.5. Current Assessment remained unchanged at a subdued 85.6. Expectations also softened to 89.7, pointing to a more cautious outlook.

Sector-level details showed little relief. Manufacturing confidence deteriorated further from -13.8 to -14.8. Services sentiment turned negative again fro 0.6 to -2.1. Trade conditions weakened from -22.6 to -24.6. Construction remained stuck at deeply negative levels of -15.2.

According to Ifo, the year is ending “without any sense of optimism”. The combination of weak current conditions and declining expectations suggests Germany is struggling to build momentum heading into the new year.

UK CPI undershoots at 3.2% as disinflation broadens in November

UK inflation eased more than expected in November, reinforcing signs that price pressures are moderating. Headline CPI slowed from 3.6% yoy to 3.2%, undershooting expectations of 3.5% and marking a second consecutive monthly decline. On a month-on-month basis, CPI fell -0.2% mom, adding to the disinflationary signal.

Underlying inflation also cooled. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 3.4% yoy to 3.2%, below forecasts of 3.4%, suggesting easing price pressures beyond volatile components.

The moderation was driven mainly by goods, where inflation eased from 2.6% yoy to 2.1% Services inflation edged slightly lower from 4.5% to 4.4%.

Japan posts first trade surplus in five months, US-bound shipments rebound

Japan’s trade data for November delivered a positive surprise, with exports rising 6.1% yoy to JPY 9.72 trillion, beating expectations of 4.8% yoy, and marking the third consecutive month of growth. The strength helped Japan record a JPY 322.2 billion trade surplus, the first in five months.

Exports to the US were a key driver, climbing 8.8% yoy. Auto shipments to the US rose 1.5%, marking the first increase since March and suggesting the drag from higher US tariffs is beginning to ease.

By contrast, exports to mainland China fell -2.4% yoy, weighed down by a sharp -5.9% decline in foodstuff shipments. That weakness came against a backdrop of renewed political tension, after Prime Minister Sanae Takaichi warned that a Chinese attempt to seize Taiwan could prompt Japanese military intervention, followed by Beijing restricting imports of Japanese seafood. Offsetting some of that drag, exports to Hong Kong surged 11.4%.

On the import side, growth was more subdued. Imports rose just 1.3% yoy to JPY 9.39 trillion, undershooting expectations of 2.5%.

GBP/USD Mid-Day Outlook

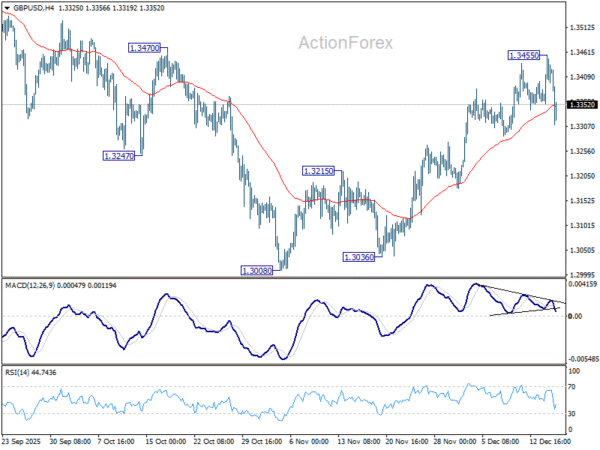

Daily Pivots: (S1) 1.3366; (P) 1.3411; (R1) 1.3467; More…

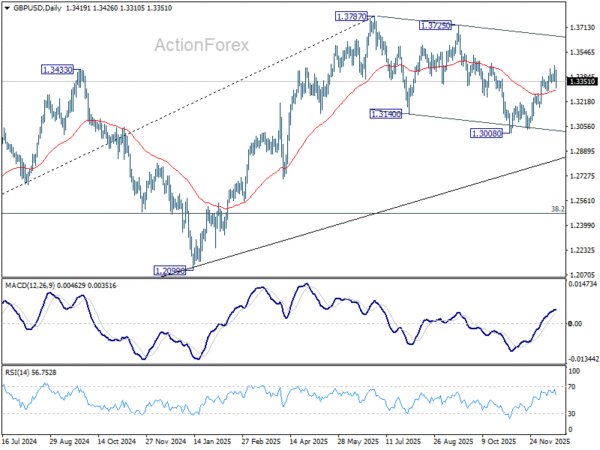

GBP/USD is staying in consolidations below 1.3455 and intraday bias remains neutral. On the upside, above 1.3455 will resume the rebound from 1.3008. Firm break of 1.3470 resistance will pave the way to retest 1.3787 high. However, sustained break of 55 D EMA (now at 1.3293) will argue that the rebound has completed. Deeper fall would be seen back to 1.3008 support to resume the whole corrective pattern from 1.3787 high.

In the bigger picture, current development suggests that fall from 1.3787 is merely a corrective move, and larger rise from 1.0351 (2022 low) is still in progress. Firm break of 1.3787 will target 1.4248 (2021 high) key structural resistance. This will remain the favored case as long as target 38.2% retracement of 1.0351 to 1.3787 at 1.2474 holds, in case of another fall.