Key Highlights

- EUR/USD failed to extend gains and declined below 1.1700.

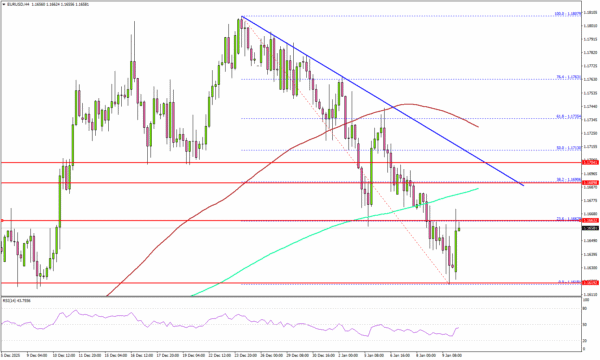

- A major bearish trend line is forming with resistance at 1.1705 on the 4-hour chart.

- GBP/USD is showing some bearish signs below 1.3450.

- USD/JPY started another increase and climbed above 157.75.

EUR/USD Technical Analysis

The Euro struggled to stay above 1.1740 and started a fresh decline against the US Dollar. EUR/USD declined below 1.1700 to enter a bearish zone.

Looking at the 4-hour chart, the pair settled below 1.1700, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour). The pair even tested 1.1620. A low was formed at 1.1618, and the pair is now recovering some losses.

Immediate resistance sits near 1.1665 or the 23.6% Fib retracement level of the downward move from the 1.1807 swing high to the 1.1618 low. The first key hurdle is seen near 1.1690.

There is also a major bearish trend line forming with resistance at 1.1705. A close above 1.1705 could open the doors for a move toward 1.1735 and the 100 simple moving average (red, 4-hour).

Any more gains could set the pace for a steady increase toward 1.1800. If there is no break above 1.1705, there could be a bearish reaction. On the downside, immediate support is near the 1.1635 level.

The first major area for the bulls might be near 1.1620. A close below 1.1620 might spark heavy bearish moves. The next support could be 1.1550, below which the bears might aim for a move toward 1.1520.

Looking at GBP/USD, the bears remain in action, and they could soon aim for a sustained move below 1.3400.

Upcoming Key Economic Events:

- Euro Zone Sentix Investor Confidence for Jan 2025 – Forecast -6.1, versus -6.2 previous.