The GBP/USD pair held around 1.3430 USD on Thursday, with the pound strengthening yesterday following better-than-expected UK economic growth data. These figures may shape market expectations for Bank of England policy in the coming months.

Since the start of January, sterling has made limited headway against the US dollar but has strengthened notably against the euro. Dollar sentiment remains cautious due to geopolitical tensions involving Iran and Greenland, as well as renewed comments from President Donald Trump questioning the Federal Reserve’s independence.

Investor sentiment toward the pound has turned more constructive at the start of 2026. According to the US Commodity Futures Trading Commission (CFTC), traders reduced bearish bets on the pound at the fastest pace in five months during the first week of January. The net long dollar position against sterling fell sharply to 2.577 billion USD, down from 6.586 billion USD at the end of December—marking the steepest weekly decline since September 2019.

Inflation in the UK eased faster than expected toward the end of 2025, and markets are currently pricing in two BoE rate cuts this year. However, analysts view this as overly optimistic: persistently weak growth and subdued inflation could ultimately weigh on the currency. Upcoming soft employment and inflation data for December will be key to reassessing the likelihood of a rate cut as early as February, though markets currently assign low odds to such a move.

Next week brings key releases, including consumer prices and labour market data, followed by GDP figures on Thursday. A Reuters poll suggests the UK economy contracted by 0.2% in the three months to November, with annual growth estimated at around 1.1%.

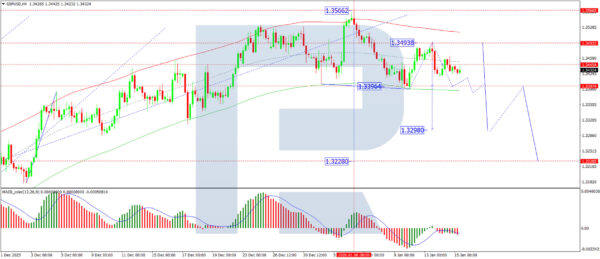

Technical Analysis: GBP/USD

H4 Chart:

On the H4 chart, GBP/USD is forming a broad consolidation range around 1.3455 USD. The range is expected to extend toward 1.3395 USD, followed by a corrective bounce to 1.3415 USD. Once complete, the downtrend may resume toward 1.3290 USD, with further potential to 1.3220 USD. The MACD indicator supports this bearish near-term outlook, with its signal line below zero and pointing firmly downward.

H1 Chart:

On the H1 chart, the pair has established a tight consolidation range around 1.3440 USD. A downward move toward 1.3395 USD is in progress, and a break below this level would open the door to further declines toward 1.3290 USD. The Stochastic oscillator aligns with this view, as its signal line is below 20 and trending lower, indicating sustained selling momentum.

Conclusion

Despite improving sentiment and a sharp reduction in speculative short positions, the pound remains vulnerable to downside risks from domestic data and shifting BoE expectations. Technically, the pair retains a near-term bearish bias, with key support levels at 1.3395 USD and 1.3290 USD. A break below these levels could accelerate declines, while any sustained recovery would likely require stronger-than-expected UK data in the coming week.