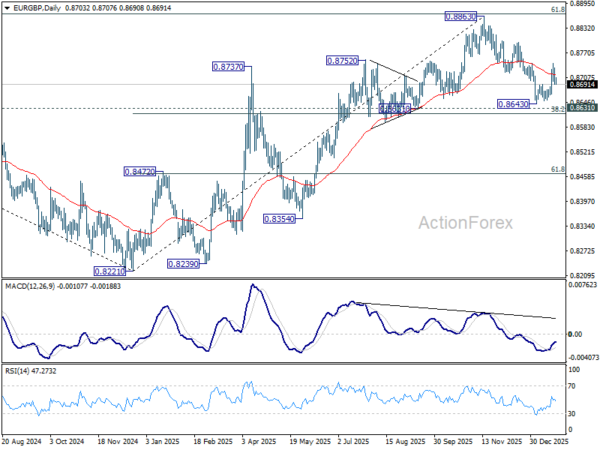

Daily Pivots: (S1) 0.8688; (P) 0.8711; (R1) 0.8728; More…

Intraday bias in EUR/GBP stays neutral for the moment. On the downside, firm break of 0.8691 resistance turned support will suggest that rebound from 0.8643 has completed as a corrective bounce. Rejection by 55 D EMA (now at 0.8717) will keep the fall from 0.8863 intact. Intraday bias will be back on the downside for 0.8643 low first, and then 0.8631 cluster support (38.2% retracement of 0.8221 to 0.8663 at 0.8618).

In the bigger picture, rise from 0.8221 medium term bottom (2024 low) is seen as a corrective move. Upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Sustained trading below 55 W EMA (now at 0.8623) should confirm that this corrective bounce has completed. In this case, deeper fall would be seen back to 0.8201/21 key support zone. However, decisive break of 0.8867 will suggest that EUR/GBP is already reversing whole decline from 0.9267 (2022 high). That should pave the way back to 0.9267.