Australian dollar surges broadly today as GDP grew 0.3% qoq in Q1, meeting market expectations, even though it’s sharply slower than prior quarter’s 1.1% qoq. But after all, it’s the 103rd successive quarter, or 26 years, without recession. And it’s now a new world record of a country without a recession. Treasurer Scott Morrison said that "the results demonstrate the continued resilience of the Australian economy:" Some analysts noted that the slowdown in Q1 showed that the economy is "tired". But Morrison blamed the weather for the slowdown in Q1 and argued that improvements would be seen ahead. He noted that RBA Governor Philip Lowe reiterated yesterday that he expects the economy to grow above 3% in the next couple of years.

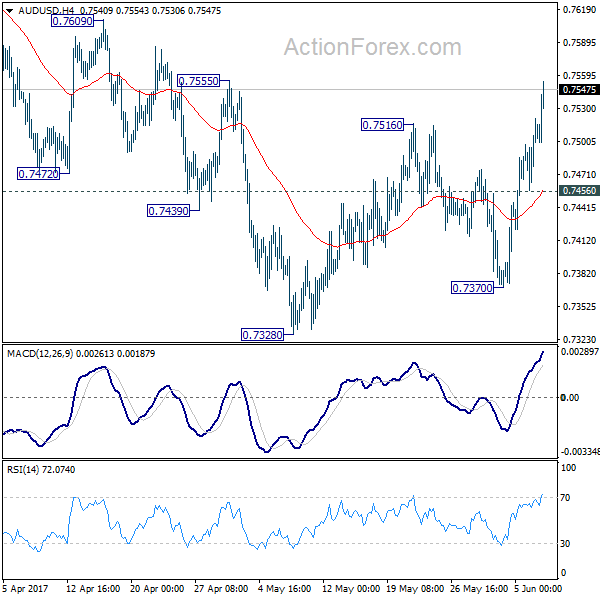

Technically, AUD/USD took out 0.7516 resistance rather decisively today. The development suggests that recent decline from 0.7748 has reversed and more upside is expected in near term. EUR/AUD’s break of 1.4927 support also indicates near term topping at 1.5226. Deeper fall is now in favor for the cross to head back to 55 day EMA at 1.4654.

Sterling mixed as election awaited

Sterling continues to trade mixed as markets await the highly uncertain election tomorrow. The latest Survation poll found that Prime Minister Theresa May’s Conservatives at 41.5% and Labour at 40.4%, just 1.1% apart. According to YouGov’s model, Conservatives could get just 304 seats in the Commons, down 26 from prior parliament. On the other hand, Labour could get 266 seats, up 37. That is, neither one will get the 323 seats required for absolute majority.

We’ll try not to predict the outcome of the election, which now becomes too hard to predict. But we do have anticipation on market reactions depending on the outcome. It should be noted again that Sterling surged sharply when May announced the snap election. Conservatives had over 20 pts lead over Labour back then. And the Pound started to struggle when Labour gained momentum recently. We’d expect to see such pattern continue as the vote counts are being released.

Dollar mixed with eyes on Comey

Dollar is trading mixed ahead of former FBI Director James Comey’s hearing with Senate intelligence committee tomorrow. It’s reported that Director of National Intelligence Daniel Coats and CIA Chief Mike Pompeo received closed-door complaint by US President Donald Trump regarding Comey’s handling of the investigation of Russia’s intervention in the 2016 election. But the Office of the Director of National Intelligence declined to comment. Meanwhile, it’s reported that Comey has asked Attorney General Jeff Sessions not to leave him alone with Trump.

On the data front

New Zealand manufacturing activity rose 2.8% in Q1. Australia GDP rose 0.3% qoq in Q1. Japan leading index dropped to 104.5 in April. German factory orders dropped -2.% mom in April. Swiss foreign currency reserves dropped slightly to CHF 694b in May. Canada building permits will be released later in the day.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7468; (P) 0.7495; (R1) 0.7533; More…

AUD/USD’s strong rally and break of 0.7516 resistance indicates that the decline from 0.7748 is already completed at 0.7328. Intraday bias is back on the upside for 0.7748 and possibly above. But then, we’ll be cautious on topping again as it approaches medium term fibonacci level at 0.7849. On the downside, below 0.7456 minor support will turn bias back to the downside for 0.7328 short term bottom.

In the bigger picture, we’re still treating price actions from 0.6826 low as a corrective pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8091) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Activity Q1 | 2.80% | 0.30% | 0.80% | 1.30% |

| 1:30 | AUD | GDP Q/Q Q1 | 0.30% | 0.30% | 1.10% | |

| 5:00 | JPY | Leading Index Apr P | 104.5 | 104.3 | 105.5 | |

| 6:00 | EUR | German Factory Orders M/M Apr | -2.10% | -0.30% | 1.00% | 1.10% |

| 7:00 | CHF | Foreign Currency Reserves May | 694B | 696B | 697B | |

| 7:30 | GBP | Halifax House Prices M/M May | -0.20% | -0.10% | ||

| 12:30 | CAD | Building Permits M/M Apr | -5.80% | |||

| 14:30 | USD | Crude Oil Inventories | -6.4M |