Dollar remains the worst performing one for today, after earlier downside breakout. Though, selling focus has shifted away from Euro. Currently, Australian Dollar an Sterling are the strongest one, followed by New Zealand Dollar. But Yen buying is accelerating in early US session. It’s unsure who will end up as the best performer for the week eventually.

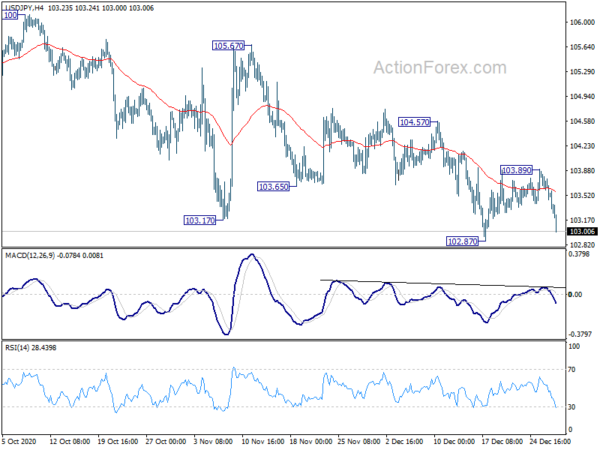

Technically, 1.3624 resistance in GBP/USD is a focus as firm break there will confirm up rally resumption. Similarly, USD/JPY is accelerating down towards 102.87 support. Firm break there would confirm down trend resumption. Separately, EUR/AUD is back pressing 1.6033 low. Firm break there will also confirm down trend resumption in the cross.

In Europe, currently, FTSE is down -0.09%. DAX is down -0.31%. CAC is down -0.15%. Germany 10-year yield is up 0.002 at -0.569. Earlier in Asia, Nikkei dropped -0.45%. Hong Kong HSI rose 2.18%. China Shanghai SSE rose 1.05%. Singapore Strait Times rose 0.74%. Japan 10-year JGB yield dropped -0.0015 to 0.025.

An early Happy New Year to our readers. See you again on Jan 4.

US goods trade deficit widened to USD 84.8B in Nov

US goods exports rose USD 1.1B November to USD 127.2B. Goods imports rose USD 5.5B to USD 212.0B. Trade deficit widened to USD -84.8B, up 5.5% mom. That’s larger than expectation of USD -81.5B deficit. Wholesale inventories dropped -0.1% mom to USD 649.0B. Retail inventories rose 0.7% mom to USD 616.9B.

Swiss KOF rose to 104.5 in Dec, driven by manufacturing and private consumption

Swiss KOF Economic Barometer rose to 104.3 in December, up from 103.7, above expectation of 100.5. The barometer reached a value above the long-term average back in August, and was able to maintain throughout the second half of the year.

KOF noted: “The slight increase is driven by bundles of indicators from the manufacturing sector and private consumption. An additional positive signal is sent by indicators for the financial and insurance service sector. By contrast, negative impulses are coming from indicators for foreign demand.”

Also from Swiss, Credit Suisse Economic Expectations rose to 46.8 in December, up from 30.0.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | CHF | KOF Leading Indicator Dec | 104.3 | 100.5 | 103.5 | 103.7 |

| 09:00 | CHF | Credit Suisse Economic Expectations Dec | 46.8 | 30 | ||

| 13:30 | USD | Goods Trade Balance (USD) Nov | -84.8B | -81.5B | -80.3B | -80.4B |

| 14:45 | USD | Chicago PMI Dec | 56.6 | 58.2 | ||

| 15:00 | USD | Pending Home Sales M/M Nov | 0.00% | -1.10% | ||

| 15:30 | USD | Crude Oil Inventories | -1.7M | -0.6M |