Canadian Dollar and Swiss Franc continue to be the stronger ones in subdued trading. Euro and Dollar and trailing for now. On the other hand, Aussie and Kiwi are still the underperformer, despite recovery attempt in Asian session. Stock markets are also sluggish while gold and oil are range bound. Focuses will turn to ECB forum today, with attention particularly on Chief Economist Philip Lane’s session.

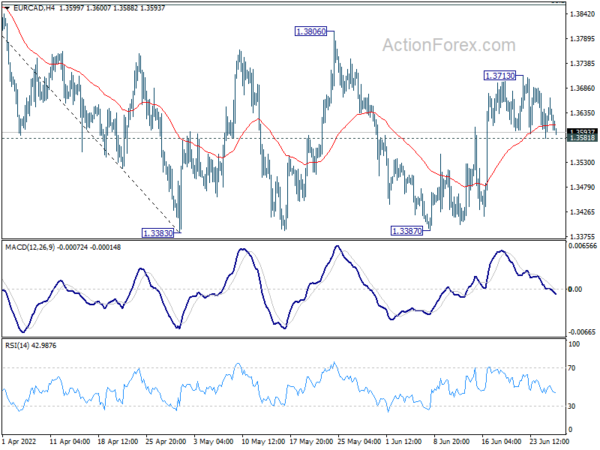

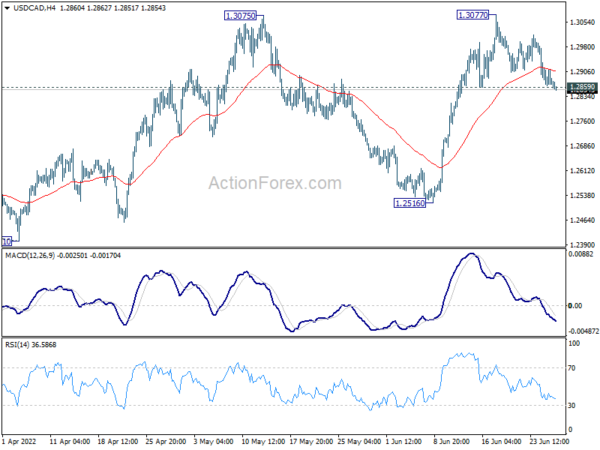

Technically, USD/CAD’s breach of 1.2859 minor support now argues that it’s at least in a deeper correction to rise from 1.2516. To gauge CAD’s strength, eyes will also be on whether EUR/CAD would break through 1.3518 minor support, and head back towards 1.3383/3387 support zone.

In Asia, at the time of writing, Nikkei is up 0.34%. Hong Kong HSI is down -0.33%. China Shanghai SSE is up 0.31%. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is down -0.0018 at 0.236. Overnight, DOW dropped -0.20%. S&P 500 dropped -0.30%. NASDAQ dropped -0.72%. 10-year yield rose 0.0069 to 3.194.

GBP/CHF in downside acceleration as SNB halted intervention

Swiss Franc is trading as the strongest one for the month so far. It was boosted by SNB’s surprised 50bps rate hike earlier. Also, latest data showed that total level of the central bank’s sight deposits fell by CHF -3.37B to CHF 748.46B last week, the biggest drop since early 2012. That’s seen as a sign that SNB had halted interventions in stopping Franc’s appreciation.

GBP/CHF extended the down trend from 1.3070 and hit as low as 1.1716 so far. The break of the near term channel support is a sign of downside acceleration. But the biggest test lies in 100% projection of 1.3070 to 1.2134 from 1.2598 at 1.1662. Sustained break there could prompt even steeper selloff towards 1.1107 (2020 low). In any case, risk will stay heavily on the downside as long as 1.1969 support turned resistance holds.

Bitcoin lacks momentum for rebound, 20k still vulnerable

While bitcoin stabilized after the selloff earlier this month, there is little momentum for a sustainable recovery. 20k handle is still looking vulnerable. The massive selling by miners are not giving bitcoin much help.

According to a Reuters report, the number of coins miners are sending to crypto exchanges has been steadily climbing since June 7. MacroHive’s researchers noted that “miners have been increasingly liquidating their coins on exchanges.” Also, according to Arcane Research, several publicly listed bitcoin miners collectively sold more than 100% of their entire output in May.

At this point, outlook in bitcoin will remain bearish as long as 25083 support turned resistance holds. Current medium term down trend could target 13855 long term support (2019 high), before forming a realistic bottom.

Looking ahead

Germany Gfk consumer confidence will be released in European session. Later in the day, US will release goods trade balance, house price index and consumer confidence.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2854; (P) 1.2885; (R1) 1.2906; More…

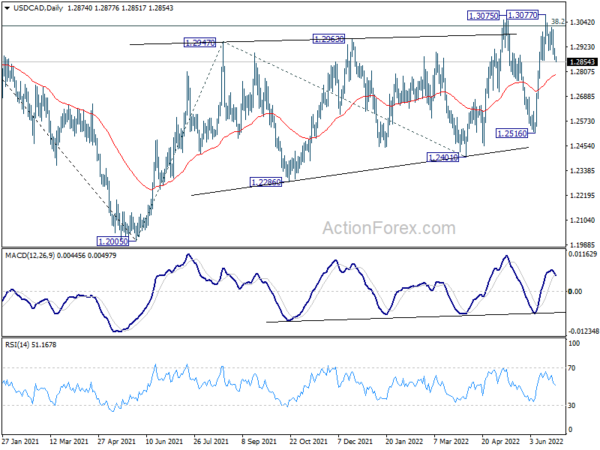

Break of 1.2859 minor support suggest that deeper correction is underway in USD/CAD. Intraday bias is back on the downside for 55 day EMA (now at 1.2789. Sustained break there will target 1.2516 support next. On the upside, break of 1.3077 and sustained trading above 1.3022 fibonacci level will carry larger bullish implications, and bring up trend resumption.

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Gfk Consumer Confidence Jul | -27.7 | -26.0 | ||

| 12:30 | USD | Goods Trade Balance (USD) May P | -101.7B | -106.7B | ||

| 12:30 | USD | Wholesale Inventories May P | 2.20% | 2.20% | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Apr | 21.00% | 21.20% | ||

| 13:00 | USD | Housing Price Index M/M Apr | 1.00% | 1.50% | ||

| 14:00 | USD | Consumer Confidence Jun | 100.0 | 106.4 |