Overall sentiment appears to be positive in very quiet trading today. Major European indexes are trading higher while US and Germany benchmark yields are recovering mildly. Aussie is leading commodity currencies higher, as well as Sterling. Yen is currently the weaker one, followed by Swiss Franc and Dollar. Euro is mixed despite poor Germany business climate data.

Technically, GBP/USD’s break of 1.2055 minor resistance suggests that 1.1759 is already a short term bottom. Rebound from there should extend to have a take on 55 day EMA (now at 1.2258). Attention will now be firstly on 0.8456 minor support in EUR/GBP and 165.13 minor resistance in GBP/JPY. Break of these levels will indicate underlying strength in the Pound. Secondly, 1.0277 minor resistance in EUR/USD, 0.6976 temporary top in AUD/USD,. and 1.2821 temporary low in USD/CAD will be monitored. Break will indicate deeper near term selloff in Dollar. But of course, both scenarios could happen at the same time.

In Europe, at the time of writing, FTSE is up 0.24%. DAX is up 0.41%. CAC is up 0.56%. Germany 10-year yield is up 0.0498 at 1.076. Earlier in Asia, Nikkei dropped -0.77%. Hong Kong HSI dropped -0.22%. China Shanghai SSE dropped -0.60%. Japan 10-year JGB yield dropped -0.0077 to 0.206.

Germany Ifo dropped to 88.6, on the cusp of recession

Germany Ifo Business Climate Dropped from 92.2 to 88.6 in July, below expectation of 90.5. That’s the lowest level since June 2020. Current Assessment index dropped from 99.4 to 97.7, below expectation of 98.2. Expectations index dropped from 85.5 to 80.3, below expectation of 83.0.

By sector, manufacturing dropped from 0 to -7.1. Services dropped from 10.9 to 0.9. Trade dropped from -14.7 to -21.6. Construction dropped from -9.7 to -17.0.

Ifo said: “Companies are expecting business to become much more difficult in the coming months. They were also less satisfied with their current situation. Higher energy prices and the threat of a gas shortage are weighing on the economy. Germany is on the cusp of a recession.”

ECB Kazaks: September rate hike needs to be quite significant

ECB Governing Council member Martins Kazaks said that even after last week’s 50bps hike, stronger rate hikes may not be over.

“I would not say that this was the only front-loading,” Kazaks said. “I would say that the rate increase in September also needs to be quite significant.”

Nevertheless, he admitted that uncertainty is clouding the plans for later moves.

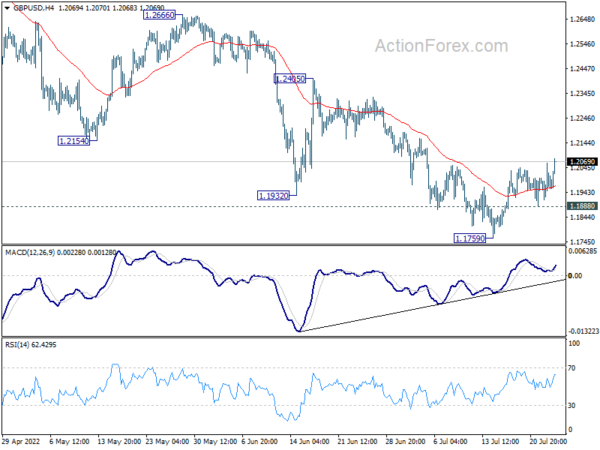

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1929; (P) 1.1996; (R1) 1.2076; More…

GBP/USD’s break of 1.2055 minor resistance confirms short term bottoming at 1.1759, on bullish convergence condition in 4 hour MACD. Intraday bias is back on the upside for 55 day EMA (now at 1.2258). Sustained trading above there will pave the way to 1.2405 resistance and above. On the downside, below 1.1888 minor support will bring retest of 1.1759 low instead.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2666 resistance holds. Next target is 1.1409 low. However, firm break of 1.2666 will bring stronger rise back to 55 week EMA (now at 1.2986).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Jul | 88.6 | 90.5 | 92.3 | 92.2 |

| 08:00 | EUR | Germany IFO Current Assessment Jul | 97.7 | 98.2 | 99.3 | 99.4 |

| 08:00 | EUR | Germany IFO Expectations Jul | 80.3 | 83 | 85.8 | 85.5 |