Markets continue to be very quiet in Asian session today. Investors are clearly holding their bets ahead of tomorrow’s FOMC rate hike. Dollar is a softer one together with Yen and Swiss Franc. On the other hand, Canadian Dollar is firmer together with Aussie. Euro and Sterling are mixed. Generally speaking, most major pairs and crosses are still stuck inside last week’s range.

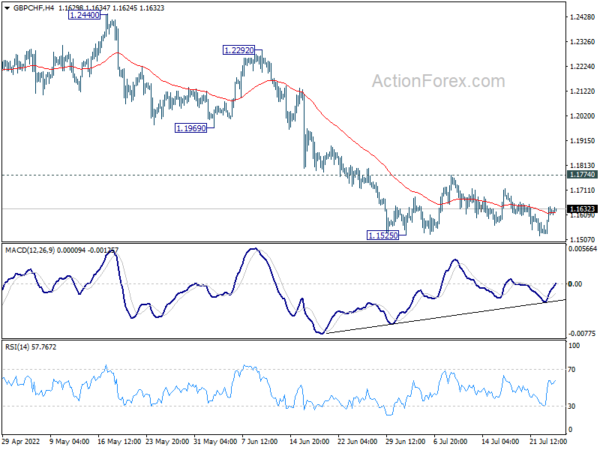

Technically, some attention remains on whether Sterling could build up more upside momentum. Levels to watch include 0.8456 minor support in EUR/GBP and 165.13 minor resistance in GBP/JPY. Additionally, 1.1774 minor resistance in GBP/CHF would be used as a gauge to determine buying in the Pound. Break there will complete a double bottom pattern, and set the stage for a stronger near term rebound at least.

In Asia, at the time of writing, Nikkei is down -0.22%. Hong Kong HSI is up 1.43%. China Shanghai SSE is up 0.60%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is up 0.0077 at 0.214. Overnight, DOW rose 0.28%. S&P 500 rose 0.13%. NASDAQ dropped -0.43%. 10-year yield rose 0.037 to 2.820.

BoJ minutes: Board members spoke of importance of wage increases

In the minutes of June meeting, BoJ board said price rises have been broadening. But massive support is still needed for the economy while uncertainty surrounding the outlook was “extremely high”.

“Many members spoke about the importance of wage increases from the perspective of achieving the BoJ’s price target in a sustained and stable fashion.”

“Japan must create a resilient economy at which consumption continues to rise even when companies raise prices,” one board member said.

“The BOJ must maintain monetary easing until wage hikes become a trend, and help Japan achieve the bank’s price target sustainably and stably,” another member said.

Bitcoin and Ethereum stay bearish as rebound lost momentum

Bitcoin dips notably this week, following overall risk sentiment. Overall outlook stays bearish, with price actions from 17575 low displaying clear corrective structure. Upside of the recovery was also capped below 25083 support turned resistance. Rejection by 55 day EMA is also another bearish sign. On resumption, next target is 61.8% projection of 32368 to 17575 from 24264 at 15121.

Ethereum’s corresponding rebound from 878.50 low was relatively stronger, as it’s support by medium term calling channel line. Yet, upside was also limited below 1674.60 support turned resistance. Thus, outlook is staying bearish for now. Break of 1316.80 minor support should resume larger down trend through 878.50 low.

On the data front

Japan corporate price index rose 2.0% yoy in June, matched expectation. Later in the day, US will release consumer confidence, house price index and new home sales.

AUD/USD Daily Report

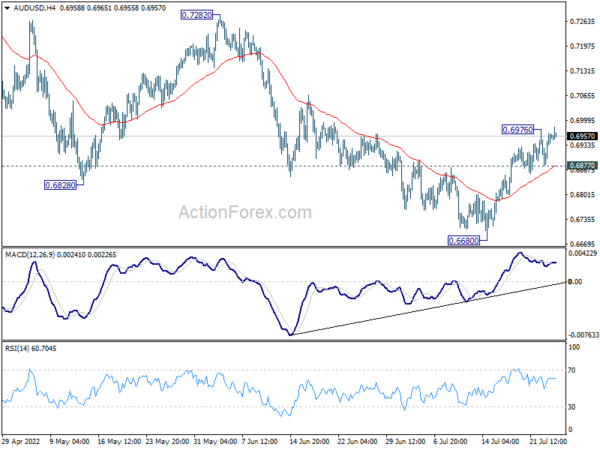

Daily Pivots: (S1) 0.6903; (P) 0.6934; (R1) 0.6988; More…

AUD/USD’s rebound from 0.6680 resumed after brief retreat and intraday bias is back on the upside. Sustained trading above 55 day EMA (now at 0.6967) will pave the way to 0.7282 resistance next. Nevertheless, break of 0.6877 will turn bias back to the downside for retesting 0.6680 low.

In the bigger picture, price actions from 0.8006 (2021 high) could still be a corrective pattern to rise from 0.5506 (2020 low). But current downside acceleration, as seen in weekly MACD), is raising the chance that it’s a bearish impulsive move. In either case, outlook will remain bearish as long as 0.7282 resistance holds. Next target is 61.8% retracement of 0.5506 to 0.8006 at 0.6461.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 2.00% | 2.00% | 1.80% | 1.90% |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y May | 20.50% | 21.20% | ||

| 13:00 | USD | Housing Price Index M/M May | 1.00% | 1.60% | ||

| 14:00 | USD | Consumer Confidence Jul | 96.3 | 98.7 | ||

| 14:00 | USD | New Home Sales Jun | 670K | 696K |