Euro opens the week broadly lower as the Catalonian referendum for independence on Sunday turned into chaos. Legally recognized or not, preliminary results show that 90% votes were in favor of independence with a turnout rate of 42.3% (2.3M votes). What shocked the world is that the the peaceful campaign had met with violent suppression of the Spanish government, with brutal attack by the national police (firing rubber bullets, seizing ballot boxes from polling stations, etc). It’s believed the violence of the government provoked more "yes" vote for independence.

Catalan President Carles Puigdemont declared that "the citizens of Catalonia have won the right to have an independent state". He pledged to act in line with the referendum law, which could lead to a unilateral declaration of independence within 48 hours after notifying the regional parliament of the voting results. Calling the referendum illegal, the Spanish prime minister, Mariano Rajoy, noted that the vote "only served to cause serious harm to coexistence" among Spaniards. The EU leaders have yet to comment on the results, as well as the act of Spanish national police. A huge strike has been called across Catalonia on October 3 in response to the violence.

Tankan large manufacturers index hit decade high

In Japan, the quarterly Tankan survey painted a positive picture for the economy. The large manufacturers index jumped to 22 in Q3, up from 17 and beat expectation of 18. That’s also the highest reading in a decade since 2007. Large manufacturers outlook rose to 19, up from 15 and beat expectation of 16. That is seen as a result from a weaker Yen, that helped exports. However, non-manufacturing index was unchanged at 23, missing expectation of 24. Non-manufacturing outlook improved to 19, missing expectation of 21. All industrial capex rose 7.7%, slowed from 8.0% and missed expectation of 8.4%. The overall upbeat data could provide Prime Minister Shinzo Abe a mild lift going into the snap election on October 22.

China PBoC cut RRR, PMI upbeat

In China, PBoC announced targeted cuts to the reserve requirement ratio (RRR) ranging from 0.5% to 1.5%. The moves should apply to the majority of banks (90% of city commercial banks, and 95% of rural commercial lenders) in order to spur lending to small firms. This is the first reduction in RRR since February 2016. An RRR cut is regarded as an accommodative monetary policy in nature and the PBOC’s move is estimated to release around RMB300-400B to the market. But the central bank claimed that it has not derailed from the prudent and neutral policy stance.

The official manufacturing PMI added 0.7 points to 52.4 in September, highest since April 2012. Looking into the details, the new orders index gained 1.7 points to 54.8 while the new export orders index added 0.9 point to 51.3. The input prices index jumped 3.1 points to 68.4, highest since December 2016. The Caixin manufacturing PMI, however, slipped -0.6 points to 51 for the month. On the non-manufacturing sector, official PMI added 2 points to 55.4, highest since May 2014.

Economic data return to spotlights

Looking ahead, focus will be back on economic data this week. US ISM indices and non-farm payroll will be part of the features. UK will release PMIs too. Canada will also release job data. Meanwhile, Australia will release retail sales and trade balance. On central bank activities, RBA is widely expected to stand pat on Tuesday. ECB will release monetary policy meeting accounts on Thursday. A number of Fed officials will also speak this week including Fed Chair Yellen, regional Fed presidents Kaplan, Powell, Williams, Harker, George, Bostic, Dudley, Bullard and Rosengren. Here are some highlights for the week ahead:

- Monday: Swiss retail sales, SVME PMI; Eurozone PMI manufacturing final, unemployment rate; UK PMI manufacturing; US ISM manufacturing

- Tuesday: Japan monetary base; RBA rate decision, Australia building approvals; Japan consumer confidence; UK construction PMI; Eurozone PPI

- Wednesday: Eurozone PMI services final, retail sales; UK PMI services; US ADP employment, ISM non-manufacturing

- Thursday: Australia retail sales, trade balance; Swiss CPI; ECB meeting accounts; US jobless claims, trade balance, factory orders; Canada trade balance

- Friday: Japan average cash earnings, leading indicators; German factory orders; Swiss foreign currency reserves; Canada employment, Ivey PMI; US non-farm payroll

EUR/GBP Daily Outlook

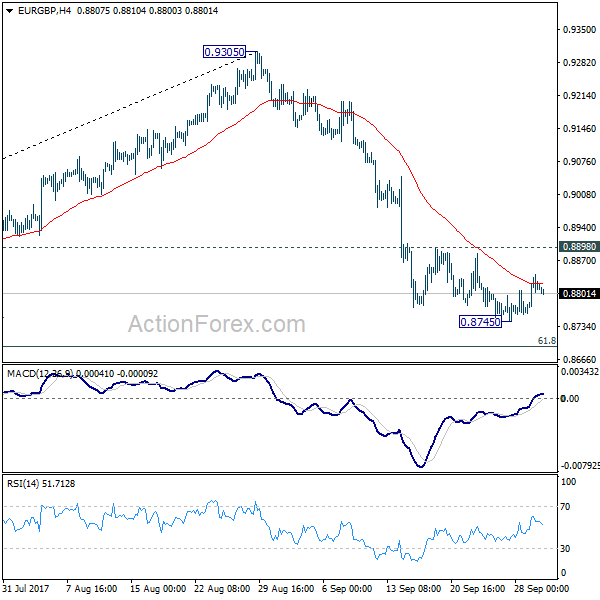

Daily Pivots: (S1) 0.8772; (P) 0.8806; (R1) 0.8849; More…

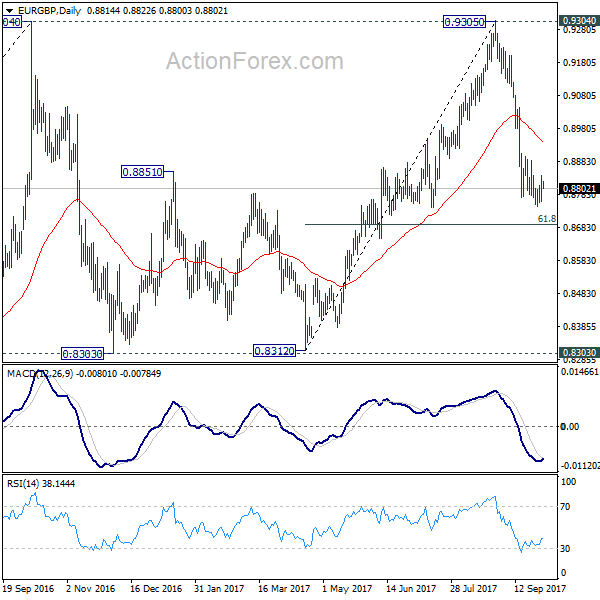

EUR/GBP dips mildly today but it’s staying above 0.8745 temporary low. Intraday bias remains neutral first. Below 0.8745 will target 61.8% retracement of 0.8312 to 0.9305 at 0.8691 and below. Fall from 0.9305 is seen as the third leg of consolidation pattern from 0.9304. We’ll look for bottoming signal again at it approaches 0.8303 support. On the upside, break of 0.8898 will indicate near term reversal and turn bias back to the upside for 55 day EMA (now at 0.8945) first.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s still in progress with fall from 0.9305 as the third leg. Break of 0.8303 could be seen. But even in that case, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturers Index Q3 | 22 | 18 | 17 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q3 | 19 | 16 | 15 | |

| 23:50 | JPY | Tankan Non-Manufacturing Index Q3 | 23 | 24 | 23 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q3 | 19 | 21 | 18 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 7.70% | 8.40% | 8.00% | |

| 23:50 | JPY | Tankan Small Mfg Index Q3 | 10 | 8 | 7 | |

| 23:50 | JPY | Tankan Small Mfg Outlook Q3 | 8 | 6 | 6 | |

| 23:50 | JPY | Tankan Small Non-Mfg Index Q3 | 8 | 7 | 7 | |

| 23:50 | JPY | Tankan Small Non-Mfg Outlook Q3 | 4 | 2 | 2 | |

| 0:00 | AUD | TD Securities Inflation M/M Sep | 0.30% | 0.10% | ||

| 0:30 | JPY | PMI Manufacturing Sep F | 52.9 | 52.6 | 52.6 | |

| 7:15 | CHF | Retail Sales (Real) Y/Y Aug | 0.50% | -0.70% | ||

| 7:30 | CHF | SVME PMI Sep | 60.5 | 61.2 | ||

| 7:45 | EUR | Italy Manufacturing PMI Sep | 56.8 | 56.3 | ||

| 7:50 | EUR | France Manufacturing PMI Sep F | 56 | 56 | ||

| 7:55 | EUR | Germany Manufacturing PMI Sep F | 60.6 | 60.6 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Sep F | 58.2 | 58.2 | ||

| 8:30 | GBP | PMI Manufacturing Sep | 56.2 | 56.9 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Aug | 9.00% | 9.10% | ||

| 13:30 | CAD | Canada Manufacturing PMI Sep | 54.6 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 53 | 53 | ||

| 14:00 | USD | ISM Manufacturing Sep | 58 | 58.8 | ||

| 14:00 | USD | ISM Prices Paid Sep | 64 | 62 | ||

| 14:00 | USD | Construction Spending M/M Aug | 0.40% | -0.60% |