Dollar was sold off broadly overnight, following risk-on sentiments. Investors appeared to welcome the results of US mid-term election so far. But the decline in the greenback is not too committed so far. Dollar is still holding on to near term support levels against European majors, and even Aussie. The skepticism about risk sentiment is also seen with softness in commodity currencies. For now, Sterling is slightly stronger than other European majors, which are together the strongest on for the week.

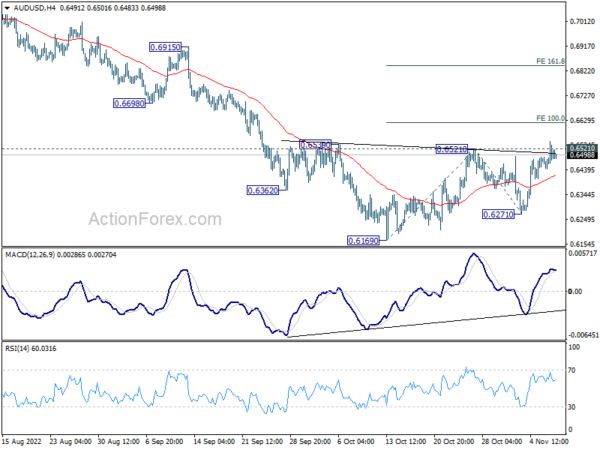

Technically, USD/CAD’s head and should top is taking shape with yesterday’s fall. One focus is now on 0.6521 resistance in AUD/USD. Decisive break there will complete a head and should bottom pattern (ls: 0.6362; h: 0.6169; rs: 0.6271). Next target will be 100% projection of 0.6169 to 0.6521 from 0.6271 at 0.6623, and then 161.8% projection at 0.6841.

In Asia, Nikkei dropped -0.56%. Hong Kong HSI is down -1.62%. China Shanghai SSE is down -0.53%. Singapore Strait Times is up 0.64%. Japan 10-year JGB yield is up 0.0016 at 0.254. Overnight, DOW rose 1.02%. S&P 500 rose 0.56%. NASDAQ rose 0.49%. 10-year yield dropped -0.0088 to 0.4126.

Bitcoin resuming down trend on broad crypto selloff

Cryptocurrencies stumbled overnight with Bitcoin crashing to the lowest level since June, eyeing 2022 low. The moves came on news that Binance offered to FTX’s non-US operations to fix “liquidity crunch”.

Technically, current downside moment, and the break of September’s low at 18144 suggests that Bitcoin is ready for down trend resumption. For now, further decline is expected as long as 19272 resistance holds.

Bitcoin is ready to taken on 61.8% projection of 25198 to 18144 from 21460 at 17100 first. Firm break there could prompt downside acceleration to 100% projection at 14406.

Gold surges, will complete double bottom?

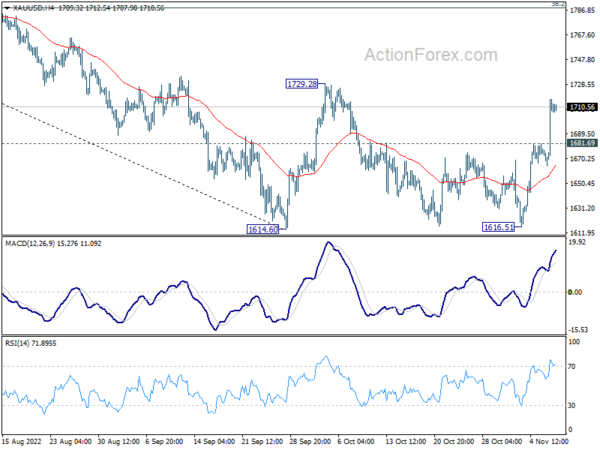

Gold surged notably on the back of selloff in the greenback, which came with rally in the US stocks. So far, the markets are expecting Republicans to take back control of the House after mid-term elections. Meanwhile, the race for Senate remains tight. Yet, in either case, the result would be a divided Congress and Administration. Investors would welcome such as result as that would limit new taxes and regulations.

Immediate focus is now on 1729.28 resistance in Gold. Decisive break there would complete a double bottom pattern (1614.60; 1616.51), which is at least a near term bullish sign. Stronger rally should be seen to 38.2% retracement of 2070.06 to 1614.60 at 1788.58 at least. Nevertheless, break of 1681.69 minor support will retain near term bearishness, and turn bias neutral first.

On the data front

Japan bank lending rose 2.7% yoy in October, versus expectation of 2.5% yoy. Current account surplus widened from JPY 0.10T to 0.67% in September, above expectation of JPY 0.41T. From China, CPI slowed from 2.8% yoy to 2.1% yoy in October, below expectation of 2.5% yoy. PPI dropped -1.3% yoy, versus expectation of -1.4% yoy.

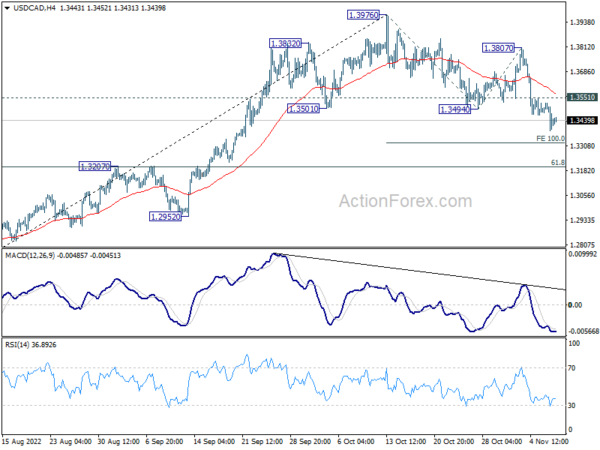

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3368; (P) 1.3447; (R1) 1.3507; More….

Intraday bias in USD/CAD stays on the downside at this point. As noted before, a head and should top pattern (1.3832; h: 1.3976; rs: 1.3807) was formed already. Deeper decline would be seen to 100% projection of 1.3976 to 1.3494 from 1.3807 at 1.3325 and possibly below. But downside should be contained by 1.3207 cluster support (61.8% retracement of 1.2726 to 1.3976 at 1.3204) to bring rebound. On the upside, above 1.3551 minor resistance will turn intraday bias neutral first.

In the bigger picture, up trend from 1.2005 (2021 low) is still in progress. Based on current impulsive momentum, it could be resuming long term up trend from 0.9056 (2007 low). Whether it is or it isn’t, retest of 1.4689 (2016 high) should be seen next. This will now remain the favored case as long as 1.3222 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Oct | 2.70% | 2.50% | 2.30% | |

| 23:50 | JPY | Current Account (JPY) Sep | 0.67T | 0.41T | -0.53T | 0.10T |

| 01:30 | CNY | CPI Y/Y Oct | 2.10% | 2.50% | 2.80% | |

| 01:30 | CNY | PPI Y/Y Oct | -1.30% | -1.40% | 0.90% | |

| 05:00 | JPY | Eco Watchers Survey: Current Oct | 49.9 | 50.5 | 48.4 | |

| 15:00 | USD | Wholesale Inventories Sep F | 0.80% | 0.80% | ||

| 15:30 | USD | Crude Oil Inventories | 0.3M | -3.1M |