Dollar is slightly on the softer side in Asian session today. Fed Chair Jerome Powell’s affirmed the markets overnight that disinflation process has started. The comments give risk sentiment a lift and pulled the greenback lower. It remains to be seen if Dollar is just digesting the near term gains or topping. Some more time is needed for it to reveal the path. As for the week, Aussie is currently the strongest one, followed by Swiss France and then Canadian. Euro is the worst performer, followed by Sterling, as both was pressured by selling against Swissy. Dollar is mixed in between.

Technically, Bitcoin’s rebound from 15452 halted after hitting 24245 and turned into sideway trading. For now, further rally is in favor as long as 22314 support holds. Yet, the real test lies in 25198 resistance. It’s probably just a matter of topping after one more surge, or having topped. The development in Bitcoin would be used as a gauge on broader risk sentiment, in particular NASDAQ. That would in turn affect Dollar’s next move.

In Asia, at the time of writing, Nikkei is down -0.40%. Hong Kong HSI is down -0.03%. China Shanghai SSE is down -0.21%. Singapore Strait Times is up 0.23%. Japan 10-year JGB yield is up 0.0007 at 0.496. Overnight, DOW rose 0.78%. S&P 500 rose 1.29%. NASDAQ rose 1.90%. 10-year yield rose 0.040 to 3.674.

Fed Powell: Disinflationary process has begun, but still a long way to go

Fed Chair Jerome Powell reiterated yesterday, “The disinflationary process, the process of getting inflation down, has begun and it’s begun in the goods sector. But it has a long way to go. These are the very early stages of disinflation.”

Regarding last week’s surprisingly strong non-farm payroll data, Powell said, “it is good that we have seen a very strong labor market”, and “we didn’t expect it to be this strong.”

But he declined to comment directly on whether the job data would affect the 25bps hike path. Powell said the data “shows you why this will be a process that takes a significant period of time,” when it comes to tightening monetary policy.

ECB Schnabel: Monetary policy not having impact on inflation as hoped

ECB Executive Board member Isabel Schnabel said yesterday, “you can’t say that monetary policy is having such an impact that we can hope for inflation to reach our 2% target in the medium term.”

“We’ll closely look at what’s happening on labor markets, what’s happening to investments, how the economy develops overall,” she added.

“We have to ask ourselves is for how long we need to stay in restrictive territory,” Schnabel said. “It’ll depend on whether we have robust evidence that inflation, and especially underlying inflation, is converging back to our 2% target and stabilizes there.”

BoC Macklem: Tightening pause announced is a conditional pause

BoC Governor Tiff Macklem said in a speech that “recent developments have reinforced our confidence that inflation is coming down.” The bank expects CPI to fall to around 3% in the middle of 2023, and the reach 2% target in 2024. But, “if those things don’t happen, inflation won’t come back to our 2% target, and additional monetary tightening will be required.”

Macklem noted that the tightening pause as announced in January was “conditional”. He said, “it is conditional on economic developments evolving broadly in line with the outlook published in January.”

“The transmission mechanism takes time—typically we don’t see the full effects of changes in our overnight rate for 18 to 24 months. That’s why policy needs to be forward looking,” he explained. “In other words, we shouldn’t keep raising rates until inflation is back to 2%. Instead, we need to pause rate hikes before we slow the economy and inflation too much. And that is what we are doing now.”

“If new evidence begins to accumulate that inflation is not declining in line with our forecast, we are prepared to raise our policy rate further,” he said. “But if new data are broadly in line with our forecast and inflation comes down as predicted, then we won’t need to raise rates further.”

EUR/USD Daily Outlook

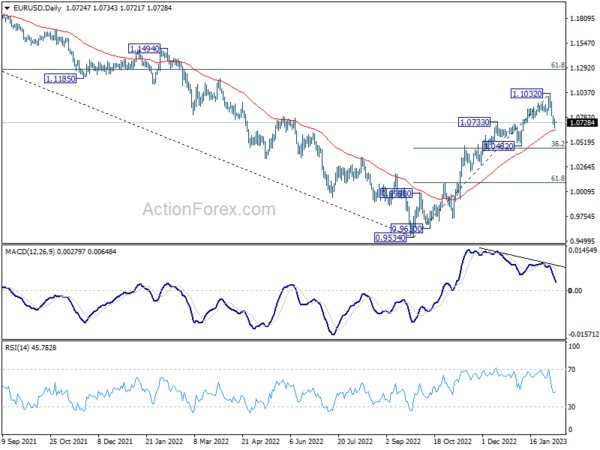

Daily Pivots: (S1) 1.0676; (P) 1.0721; (R1) 1.0773; More…

Intraday bias in EUR/USD is turned neutral with 4 hour MACD crossed above signal line, and some consolidations could be seen. Correction from 1.1032 short term top could still extend lower. Break of 1.0668 will target 38.2% retracement of 0.9534 to 1.1032 at 1.0463. Nevertheless, firm break of 4 hour 55 EMA (now at 1.0822) will bring retest of 1.1032 high instead.

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jan | 3.10% | 2.60% | 2.70% | |

| 23:50 | JPY | Current Account (JPY) Dec | 1.18T | 1.25T | 1.92T | |

| 05:00 | JPY | Eco Watchers Survey: Current Jan | 48.1 | 47.9 | ||

| 15:00 | USD | Wholesale Inventories Dec F | 0.10% | 0.10% | ||

| 15:30 | USD | Crude Oil Inventories | 2.0M | 4.1M |