Market reactions to the ongoing banking crisis reveal a shift away from Swiss Franc, traditionally considered a safe-haven currency, as Credit Suisse shares lose over two-thirds of their value following the acquisition announcement by UBS. The broader markets in Europe are, however, relatively steady. Euro and Sterling are experiencing notable increases today, with the Yen emerging even stronger. Dollar faces pressure in general but fares slightly better than commodity currencies. Today’s market response suggests that the banking crisis is far from over, and further volatility is expected in the days ahead.

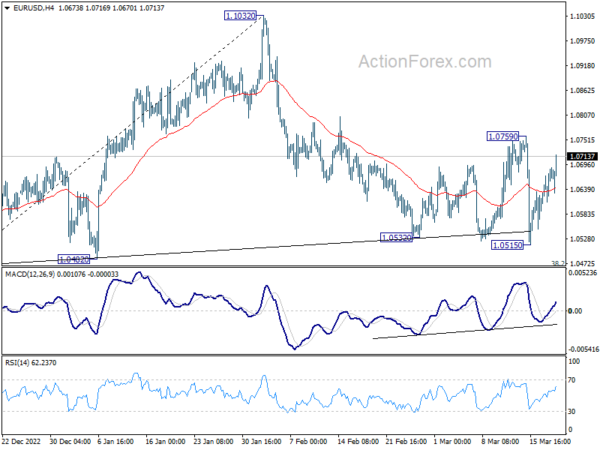

Technically, 1.0759 resistance in EUR/USD is quickly within radar with today’s rise. Firm break there will indicate completion of whole corrective fall from 1.1032, and bring stronger rally back to retest this high. At the same time, GBP/USD is already taking the lead by breaking through last week’s high and it’s on track to retest 1.2445/6 resistance zone.

In Europe, at the time of writing, FTSE is up 0.37%. DAX is up 0.50%. CAC is up 0.76%. Germany 10-year yield is down -0.011 at 2.099. Earlier in Asia, Nikkei dropped -1.42%. Hong Kong HSI dropped -2.65%. China Shanghai SSE dropped -0.48%. Singapore Strait Times dropped -1.37%. Japan 10-year JGB yield fell -0.0262 to 0.247.

Bundesbank: German economy faces slight Q1 decline, core inflation extraordinarily persistent

Bundesbank’s latest monthly report suggests that Germany’s economic activity is set to decline in the current quarter, though the contraction is anticipated to be smaller than the -0.4% qoq witnessed in Q4 2022.

Despite the downturn, employment leading indicators remained largely stable in positive territory in February, which bodes well for a continued positive development in employment over the coming months.

Inflation in Germany rose slightly to 9.3% in February 2023, up 0.1 percentage points from January. Meanwhile, the core inflation rate increased by 0.3 percentage points to 5.4%, matching the historical high set in December 2022.

Bundesbank predicts a significant drop in the headline inflation rate for March, primarily attributed to the base effect in energy prices. However, the report said, “the core rate is proving to be extraordinarily persistent”.

Eurozone exports rose 11.0% yoy in Jan, imports rose 9.7% yoy

Eurozone exports of goods rose 11.0% yoy to EUR 222.9B in January. Imports rose 9.7% yoy to EUR 253.5B. Trade deficit came in at EUR -30.6B. Intra-eurozone trade rose 11.6% yoy to EUR 223.8B.

In seasonally adjusted term, exports fell -1.1% mom to EUR 241.5B. Imports declined -1.8% mom to EUR 252.9B. Trade deficit narrowed slightly from EUR -13.4B to EUR -11.3B, smaller than expectation of EUR -17.3B. Intra-eurozone trade dropped from 239.1B to EUR 229.2B.

BoJ members support persistent monetary easing, discussed side effects

In the Summary of Opinions from BoJ’s March meeting, many members expressed support for continuing with the current monetary easing and yield curve control. However, there were also discussions on potential side effects and concerns related to the policy.

One member acknowledged the side effects of the current monetary easing, such as distortions in the yield curve. They stressed the need for BoJ to examine market functioning without preconceptions while assessing the balance between positive effects and side effects. Nonetheless, this member believed that the bank should “persistently continue with large-scale monetary easing” in the current phase.

Another member commented that it would take time to examine the effects of modifications in yield curve control on market functioning. They expect that when observed CPI inflation declines and market projections of interest rates calm down, “distortions on the yield curve are expected to be corrected”.

A member warned against hasty policy changes, stating that the risk of missing the chance to achieve the price stability target should be considered more significant than the risk of delaying policy changes, given the current improvements in the price environment.

Another member emphasized the importance of BoJ maintaining its commitment to the 2% price stability target. They argued that starting a discussion on the target could lead to “unnecessary speculation” on monetary policy conduct, despite the growing possibility of achieving the target. Similarly, this member saw no need to revise the joint statement of the government and BoJ.

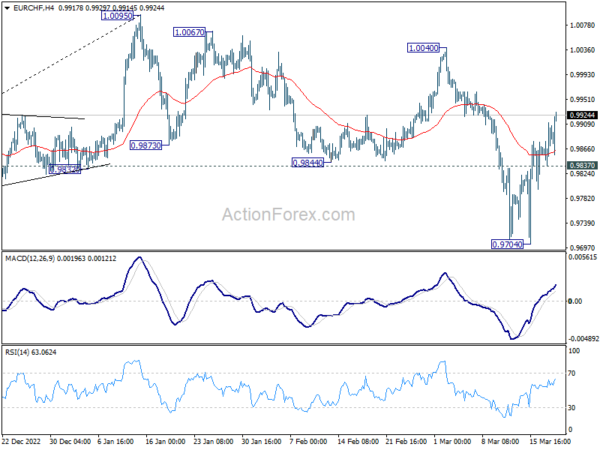

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9843; (P) 0.9877; (R1) 0.9915; More…

EUR/CHF’s rise from 0.9704 accelerations higher today and the development argues that decline form 1.0095 has completed as a correction, with three waves down to 0.9704. Intraday bias is back on the upside for 1.0040 resistance first. Firm break there would argue that larger rise from 0.9407 is resuming through 1.0095. On the downside, though, break of 0.9837 minor support will turn intraday bias neutral first.

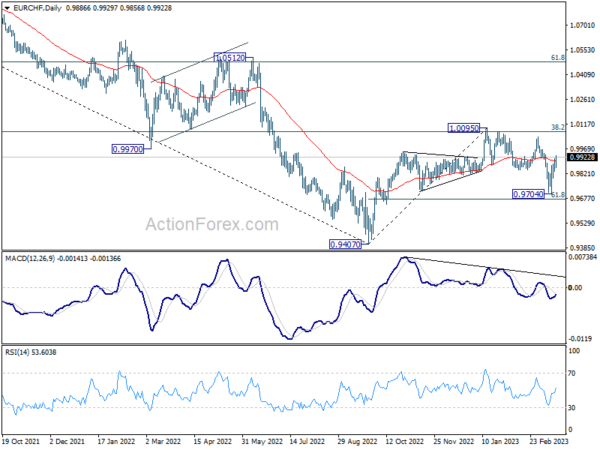

In the bigger picture, prior rejection by 55 week EMA (now at 1.0011) and 38.2% retracement of 1.1149 to 0.9407 at 1.0072 suggests that medium term outlook is staying bearish. That is, down trend from 1.2004 is not completed yet and is in favor to resume through 0.9407 at a later stage. However, decisive break of 1.0095 resistance will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:01 | GBP | Rightmove House Price Index M/M Mar | 0.80% | 0.00% | ||

| 07:00 | EUR | Germany PPI M/M Feb | -0.30% | -1.20% | -1.00% | -1.20% |

| 07:00 | EUR | Germany PPI Y/Y Feb | 15.80% | 12.40% | 17.80% | 17.60% |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | -11.3B | -17.3B | -18.1B | -13.4B |

| 11:00 | EUR | German Buba Monthly Report |