The financial markets are sending mixed messages today, with risk sentiment seemingly improving as European indexes and US futures trade higher. US and German 10-year yields are also recovering. However, the currency markets paint a different picture, with Swiss Franc leading as the best performer, followed by Canadian Dollar and Sterling. In contrast, Yen is the worst, trailed by New Zealand and US Dollars. Euro is mixed, disregarding the improved German business climate. Trading could stay subdued due to an empty US economic calendar.

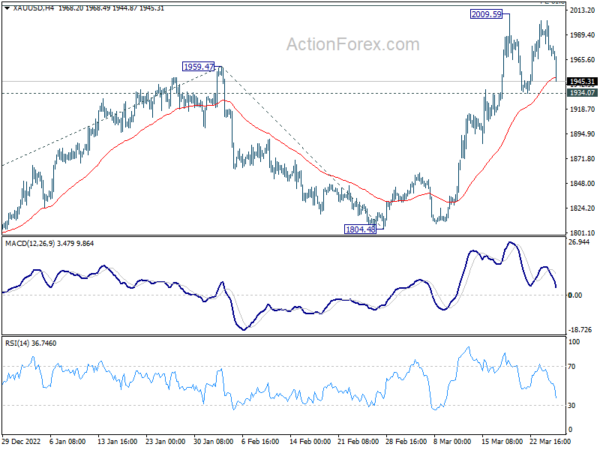

From a technical perspective, Gold’s performance may hint at the direction of risk sentiment. Today’s decline suggests another rejection by 2000 handle. For now, further gains are anticipated as long as 1934.07 support level holds, potentially pushing through 2009.59 to resume the larger uptrend. However, decisive break below 1934.07 would indicate a deeper pullback is underway, possibly coinciding with a further recovery in risk markets.

In Europe, at the time of writing, FTSE is up 1.05%. DAX is up 1.35%. CAC is up 1.14%. Germany 10-year yield is up 0.124 at 2.253. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI dropped -1.75%. China Shanghai SSE dropped -0.44%. Singapore Strait Times rose 0.82%. Japan 10-year JGB yield rose 0.0189 to 0.295.

ECB Nagel: Balance reduction could accelerate from summer

Bundesbank President Joachim Nagel emphasized the growing importance of determining future monetary policy steps on a meeting-to-meeting basis, taking into account economic and financial developments.

Meanwhile, he assured that the central bank will “continue to move forward resolutely on the path of monetary normalization until inflation is contained and price stability is restored.”

he pointed out that the cumulative 350 basis points in rate hikes since last July have yet to fully impact the economy. Given the persistently high inflation rates and the considerable distance from the 2% medium-term target, he suggested that it’s time for policymakers to expedite the reduction of the ECB’s bond holdings, which commenced this month.

“In my view, it can be accelerated from the summer,” Nagel said. “Markets will be able to handle it well, and in terms of monetary policy, it’s necessary to reduce the balance sheet of the Eurosystem more quickly.”

ECB de Cos: Future policy dependent on various sources of risks

ECB Governing Council member Pablo Hernandez de Cos has emphasized that the central bank’s future monetary policy decisions will be highly dependent on the development of various risk sources, including recent financial market turmoil.

De Cos also noted that the intensity of monetary policy transmission will be taken into account in policy decisions. He observed that the ongoing tensions in financial markets have led to a further tightening of financial conditions, impacting the outlook for economic activity and inflation.

As the ECB prepares for its next meetings, De Cos highlighted that all these factors must be considered.

Regarding inflation, he warned, “over the medium term, the main risk for inflation comes from a persistent rise in price expectations above our inflation target.”

However, “the disinflation process could be accelerated further if the high tensions in financial markets were to be prolonged,”he added.

Germany Ifo rose to 93.3, economy stabilizing despite banking turbulence

Germany Ifo Business Climate rose form 91.1 to 93.3 in March, above expectation of 92.0. That’s also the fifth consecutive rise. Current Assessment index rose from 93.9 to 95.4, above expectation of 94.0. Expectations index rose from 88.4 to 91.2, above expectation of 87.4.

By sector, manufacturing rose from 1.5 to 6.6. Services rose from 1.3 to 8.9. Trade ticked up from -10.6 to -10.0. Construction also improved from -19.0 to -17.9.

Ifo said, the upward development in business climate was “driven primarily by business expectations”. “Despite turbulence at some international banks, the German economy is stabilizing,” it added.

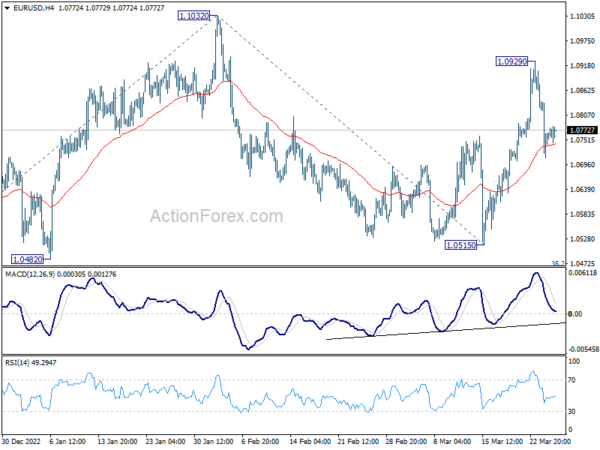

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0702; (P) 1.0771; (R1) 1.0828; More…

EUR/USD is gyrating in tight range today and intraday bias remains neutral. Strong rebound from current level, followed by break of 1.0929 will reaffirm near term bullishness, and extend the rise from to retest 1.1032 high. Firm break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level next. However, sustained trading below 4 hour 55 EMA (now at 1.0742) will likely extend the corrective pattern from 1.1032 and bring deeper decline back towards 1.0515.

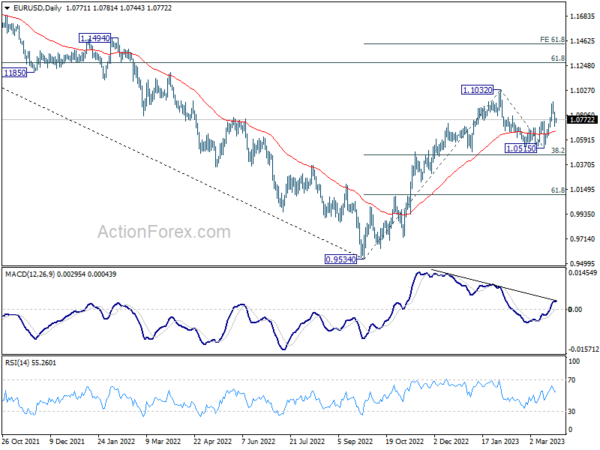

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0623) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidity the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | 1.80% | 1.80% | 1.60% | |

| 08:00 | EUR | Germany IFO Business Climate Mar | 93.3 | 92 | 91.1 | |

| 08:00 | EUR | Germany IFO Current Assessment Mar | 95.4 | 94 | 93.9 | |

| 08:00 | EUR | Germany IFO Expectations Mar | 91.2 | 87.4 | 88.5 | 88.4 |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 2.90% | 3.30% | 3.50% |