The inflation data from Eurozone and the US has left traders somewhat disappointed, as it triggered minimal volatility in the markets. Eurozone headline inflation slowed more than anticipated, while core inflation aligned with consensus. In the US, both headline and core PCE inflation fell short of expectations. Canadian Dollar also remained stagnant despite better-than-expected monthly GDP growth. As the markets take a breather, traders may anticipate a more dynamic comeback in the first week of May.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.59%. CAC is up 0.65%. Germany 10-year yield is down -0.030 at 2.344. Earlier in Asia, Nikkei rose 0.93%. Hong Kong HSI rose 0.45%. China Shanghai SSE rose 0.36%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield rose 0.0043 to 0.330.

US PCE price index slowed to 5% yoy, core PCE down to 4.6% yoy

US personal income rose 0.3% mom or USD 72.9B in February, matched expectation. Personal spending rose 0.2% mom or USD 27.9B below expectation of 0.3% mom.

PCE price index rose 0.3% mom, above expectation of 0.2% mom. Core PCE price index, excluding food and energy, rose 0.3% mom, below expectation of 0.4% mom. Prices for goods increased 0.2% mom and prices for services increased 0.3% mom. Food prices increased 0.2% mom and energy prices decreased -0.4 mom.

From the same month one year ago, PCE price index slowed from 5.3% yoy to 5.0% yoy, below expectation of 5.3% yoy. Core PCE price index slowed from 4.7% yoy to 4.6% yoy, below expectation of 4.7% yoy.

Canada GDP grew 0.5% mom in Jan, to grow further 0.3% mom in Feb

Canada GDP grew 0.5% mom in January, above expectation of 0.3% mom. Goods-producing industries grew 0.4% mom while services-producing industries grew 0.6% mom. 17 of 20 industrial sectors posted increases.

Advance information indicates that real GDP increased 0.3% mom in February. Increases in the mining, quarrying, and oil and gas extraction, manufacturing, and finance and insurance sectors were slightly offset by decreases in construction, wholesale trade, and accommodation and food services.

Eurozone CPI slowed to 6.9% yoy in Mar, core CPI ticked up to 5.7% yoy

Eurozone CPI slowed from 8.5% yoy to 6.9% yoy in March, below expectation of 7.2% yoy. CPI core (all item ex energy, food, alcohol & tobacco) roes from 5.6% yoy to 5.7% yoy, matched expectations.

Looking at the main components , food, alcohol & tobacco is expected to have the highest annual rate in March (15.4%, compared with 15.0% in February), followed by non-energy industrial goods (6.6%, compared with 6.8% in February), services (5.0%, compared with 4.8% in February) and energy (-0.9%, compared with 13.7% in February).

Also released, Eurozone unemployment rate was unchanged at 6.6% in February. Germany unemployment rate ticked up from 5.5% to 5.6% in February, retail sales dropped -1.3% mom, import prices dropped -2.4% mom. France consumer spending dropped -0.8% mom in February.

UK GDP was finalized at 0.1% qoq qoq in Q4. Swiss retail sales rose 0.3% yoy in February

Japan reported strong industrial production and retail sales growth

Japan reported strong industrial production growth of 4.5% mom in February, surpassing expectations of 2.8% mom growth. The seasonally adjusted production index for the manufacturing and mining sectors reached 94.8, with the industry ministry predicting a 2.3% mom increase in March and a 4.4% mom advance in April.

Retail sales also exceeded expectations, rising 6.6% yoy compared to the anticipated 5.9% yoy. However, the unemployment rate increased from 2.4% to 2.6%, higher than the expected 2.4%.

Inflation in Tokyo experienced a slight decline, with the March CPI dropping from 3.4% yoy to 3.3% yoy, still above the expected 2.7% yoy. The core CPI (excluding fresh food) eased from 3.3% yoy to 3.2% yoy, meeting expectations. Meanwhile, the core-core CPI (excluding fresh food and energy) rose from 3.2% yoy to 3.4% yoy, surpassing the anticipated 3.3% yoy.

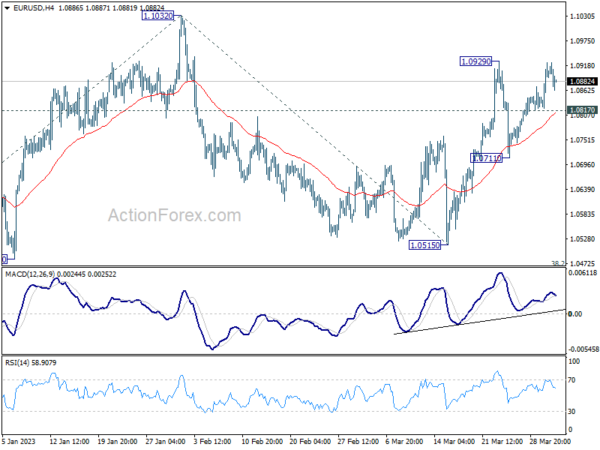

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0818; (P) 1.0845; (R1) 1.0872; More…

Intraday bias in EUR/USD remains neutral for the moment. On the upside, break of 1.0929 will resume the rally from 1.0515 to retest 1.1032 high. Decisive break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level next. On the downside, though, break of 1.0711 will turn bias to the downside to extend the corrective pattern from 1.1032 with another decline.

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0623) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Mar | 3.20% | 3.20% | 3.30% | |

| 23:30 | JPY | Unemployment Rate Feb | 2.60% | 2.40% | 2.40% | |

| 23:50 | JPY | Industrial Production M/M Feb P | 4.50% | 2.80% | -5.30% | |

| 23:50 | JPY | Retail Trade Y/Y Feb | 6.60% | 5.90% | 6.30% | |

| 00:30 | AUD | Private Sector Credit M/M Feb | 0.30% | 0.30% | 0.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Mar | 51.9 | 51.9 | 52.6 | |

| 01:00 | CNY | Non-Manufacturing PMI Mar | 58.2 | 54.3 | 56.3 | |

| 05:00 | JPY | Housing Starts Y/Y Feb | -0.30% | -0.50% | 6.60% | |

| 06:00 | GBP | GDP Q/Q Q4 F | 0.10% | 0.00% | 0.00% | |

| 06:00 | GBP | Current Account (GBP) Q4 | -2.5B | -17.5B | -19.4B | -12.7B |

| 06:00 | EUR | Germany Import Price Index M/M Feb | -2.40% | -0.80% | -1.20% | |

| 06:00 | EUR | Germany Retail Sales M/M Feb | -1.30% | 0.50% | -0.30% | 0.10% |

| 06:30 | CHF | Real Retail Sales Y/Y Feb | 0.30% | -1.00% | -2.20% | |

| 06:45 | EUR | France Consumer Spending M/M Feb | -0.80% | 0.20% | 1.50% | 1.70% |

| 07:55 | EUR | Germany Unemployment Change Feb | 16K | 2K | 2K | |

| 07:55 | EUR | Germany Unemployment Rate Feb | 5.60% | 5.50% | 5.50% | |

| 09:00 | EUR | Eurozone Unemployment Rate Feb | 6.60% | 6.70% | 6.70% | 6.60% |

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 6.90% | 7.20% | 8.50% | |

| 09:00 | EUR | Eurozone Core CPI Y/Y Mar P | 5.70% | 5.70% | 5.60% | |

| 12:30 | CAD | GDP M/M Jan | 0.50% | 0.30% | -0.10% | |

| 12:30 | USD | Personal Income M/M Feb | 0.30% | 0.30% | 0.60% | 0.50% |

| 12:30 | USD | Personal Spending Feb | 0.20% | 0.30% | 1.80% | 2.00% |

| 12:30 | USD | PCE Price Index M/M Feb | 0.30% | 0.20% | 0.60% | |

| 12:30 | USD | PCE Price Index Y/Y Feb | 5.00% | 5.30% | 5.40% | 5.30% |

| 12:30 | USD | Core PCE Price Index M/M Feb | 0.30% | 0.40% | 0.60% | |

| 12:30 | USD | Core PCE Price Index Y/Y Feb | 4.60% | 4.70% | 4.70% | |

| 13:45 | USD | Chicago PMI Mar | 43.6 | 43.6 | ||

| 14:00 | USD | Michigan Consumer Sentiment Mar F | 63.4 | 63.4 |