Dollar is trading mixed in Asian session today as market participants eagerly anticipate April’s consumer inflation data from the US. The much-anticipated meeting between US President Joe Biden and Republican House Speaker Kevin McCarthy unfolded as expected, with no resolution on the government’s self-imposed USD 31.4T debt limit. This issue, if unresolved, could plunge the country into an unprecedented default in as few as three weeks. However, both parties agreed to continue discussions and reconvene on Friday.

At this time, New Zealand and Australian dollars remain the week’s strongest performers. However, their upward momentum appears to be stalling at resistance levels against the greenback and Euro. Despite consistent hawkish remarks from ECB officials, Euro remains the weakest performer. Japanese Yen follows closely, trailed by Canadian dollar. Sterling is showing mixed performance as traders maintain a holding pattern in anticipation of tomorrow’s BoE rate decision.

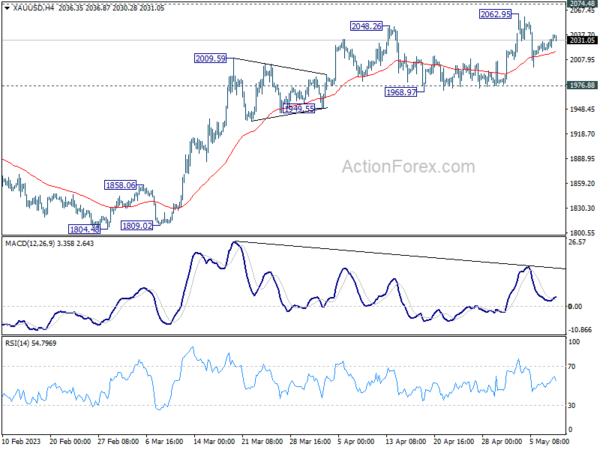

From a technical standpoint, it appears that gold isn’t quite ready to shatter 2074.48 record high yet. It’s likely to see another fall in the consolidation from 2062.95. Yet, as long as 1,976.88 support level holds, near-term outlook remains bullish, with an eventual upside breakout anticipated. However, given bearish divergence condition in the 4H MACD, firm break of 1976.88 could trigger deeper near term correction.

In Asia, at the time of writing, Nikkei is down -0.52%. Hong Kong HSI is down -0.72%. China Shanghai SSE is down -1.40%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is down -0.0069 at 0.418. Overnight, DOW dropped -0.17%. S&P 500 dropped -0.46%. NASDAQ dropped -0.63%. 10-year yield closed flat at 3.521.

Fed Williams: Not my baseline to cut interest rates this year

New York Fed President John Williams maintained a hawkish stance on Fed’s monetary policy, asserting the necessity of persisting with rate hikes to control surging inflation.

“We haven’t said we are done raising rates,” Williams stated yesterday, emphasizing that future decisions would be data-driven, aligning with Fed’s goals. He stressed, “We’ve made incredible progress” on tackling inflation, but left the door open for further policy tightening, saying, “if additional policy firming is appropriate, we’ll do that.”

Williams projected that a restrictive monetary policy stance would be necessary for an extended period to curb inflation from 4% to the targeted 2%. He denied any likelihood of rate cuts in the current year, quashing speculations of such a move. He said, “I do not see in my baseline forecast any reason to cut interest rates this year.”

Addressing the inflation conundrum, Williams declared price pressures “too high” and acknowledged a discrepancy between demand and supply, with the former outpacing the latter. He noted signs of a “gradual cooling in the demand for labor,” as well as for certain goods and commodities, yet emphasized that these were outweighed by the overall demand-supply mismatch.

ECB Schnabel: Tightening to continue until clear sustained decline in core inflation

Executive Board member Isabel Schnabel reaffirmed the bank’s commitment to stringent measures to restore inflation to 2% target during an event in Frankfurt yesterday. Citing current data, she stated, “there is no doubt that we have to do more to bring inflation back to our 2% target in a timely manner.”

Schnabel emphasized ECB’s readiness to “raise rates decisively until it becomes clear that core inflation is also declining on a sustained basis.” This stance aligns with recent remarks by ECB President Christine Lagarde, who Schnabel notes, “has made it absolutely clear that the slowdown in rate hikes is not an indication that we’ll stop raising rates any time soon.”

Contrary to market expectations for potential rate cuts this year, Schnabel argued such predictions were “highly unlikely for the foreseeable future,” pointing to the likelihood of prolonged high rates.

She observed that inflation momentum in Eurozone remained high for all items except energy, and price pressures were spreading across most consumption basket components. Despite the fading supply-side shocks from bottlenecks and energy prices, Schnabel highlighted the strength of the labor market, the uptick in wage growth, and high corporate profit margins. These factors underline the complex economic the ECB must navigate to achieve its inflation target.

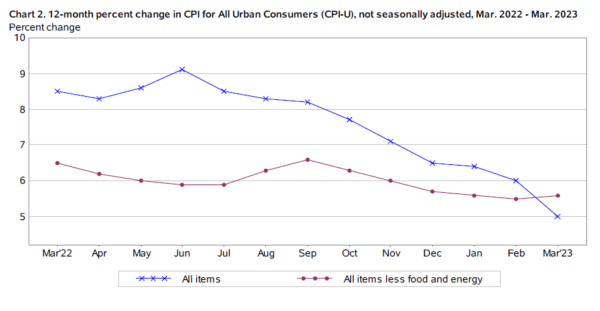

US consumer inflation in focus as investors gauge Fed’s next move

Today’s spotlight is on US consumer inflation data, which is expected to show that headline CPI remained unchanged at 5.0% yoy in April, after falling for nine straight months. Core CPI, which excludes volatile food and energy prices, is predicted to slightly drop from 5.6% yoy to 5.5% yoy. Both the trajectory of inflation and unfolding regional bank issues in the US will play a critical role in Fed decision-making about the peak interest rate in the current cycle (if it hasn’t been reached yet) and the timing of the first rate cut.

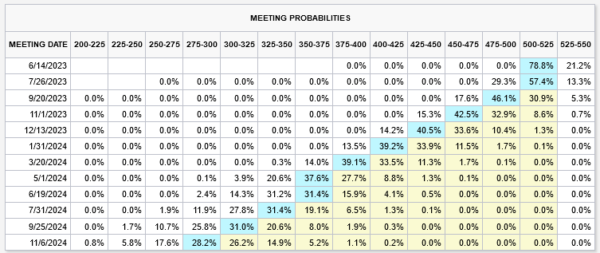

Current fed funds futures data suggests a 78.8% probability that Fed will maintain interest rate at 5.00-5.25% following FOMC meeting on June 14. There’s a 21.2% chance of an additional 25bps hike to 5.25-5.50%. Notably, there’s a 63.8% likelihood of a rate cut beginning in September, marking the start of a potential loosening cycle.

Despite these uncertainties, investor sentiment remains relatively resilient, with major stock indexes preserving their near-term bullish trajectories. NASDAQ, for instance, is expected to continue rallying as long as 11798.77 support level holds. The key test, however, will be 8.2% retracement of 16212.22 to 10088.82 at 12436.48. Decisive break above this level could trigger further rallies towards 13181.08 cluster resistance level (50% retracement at 13157.41) and possibly beyond.

Conversely, if NASDAQ breaks below 11798.77 support level, it would suggest a rejection by 12436.48 Fibonacci resistance level, possibly triggering a deeper decline towards 10982.80 and potentially retesting 10088.82 low.

As always, these movements in risk sentiment will likely have a correlated impact on currency market trends.

Elsewhere

Germany will release April CPI final, together with Italy industrial output in European session.

AUD/USD Daily Report

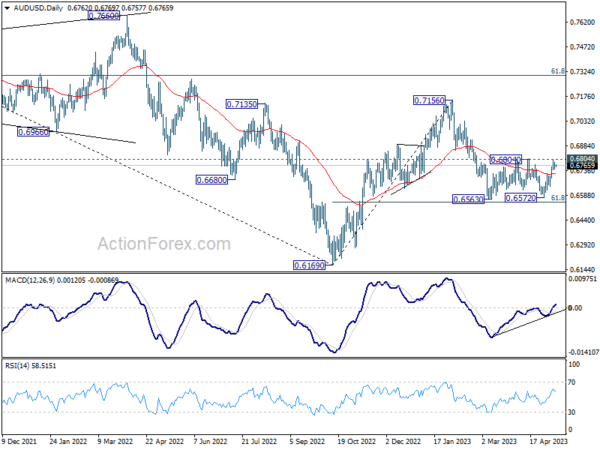

Daily Pivots: (S1) 0.6744; (P) 0.6766; (R1) 0.6786; More…

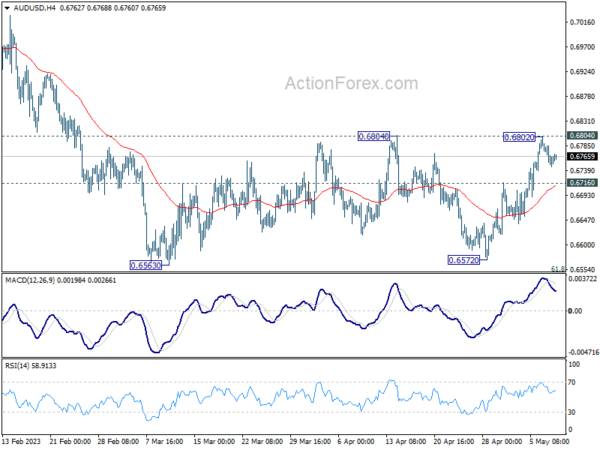

Intraday bias in AUD/USD is turned neutral with current retreat. On the upside, decisive break of 0.6804 resistance will indicate completion of whole fall from 0.7156, and turn near term outlook bullish for retesting this high. However, break of 0.6716 minor support will indicate rejection by 0.6804. That would retain near term bearishness, and turn bias back to the downside for retesting 0.6563/72 support zone, with prospect of resuming the whole decline from 0.7156.

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 05:00 | JPY | Leading Economic Index Mar P | 97.90% | 98.00% | ||

| 06:00 | EUR | Germany CPI M/M Apr F | 0.40% | 0.40% | ||

| 06:00 | EUR | Germany CPI Y/Y Apr F | 7.20% | 7.20% | ||

| 08:00 | EUR | Italy Industrial Output M/M Mar | 0.20% | -0.20% | ||

| 12:30 | CAD | Building Permits M/M Mar | 2.30% | 8.60% | ||

| 12:30 | USD | CPI M/M Apr | 0.40% | 0.10% | ||

| 12:30 | USD | CPI Y/Y Apr | 5.00% | 5.00% | ||

| 12:30 | USD | CPI Core M/M Apr | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Core Y/Y Apr | 5.50% | 5.60% | ||

| 14:30 | USD | Crude Oil Inventories | -2.2M | -1.3M |