Yen declines broadly in Asian session, appears to be more of a reaction to rally in Nikkei, which broke through 29500 level for the first time since November 2021, and now seems poised to challenge 30000 psychological level. Dollar, along with its safe-haven counterpart, Swiss Franc, also trended lower as these currencies recalibrate following last week’s gains. In the meantime, Australian and New Zealand Dollars are experiencing modest recoveries, while Euro, British Pound, and Canadian Dollar are mixed.

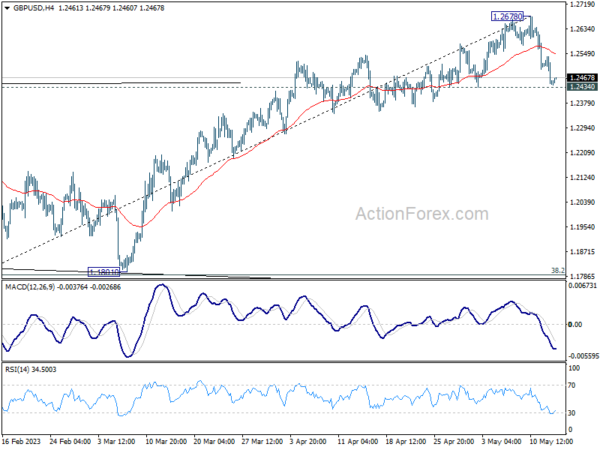

From a technical standpoint, there are two key points to watch: 1.2434 support level for GBP/USD and 0.8993 resistance level for USD/CHF. Decisive break of these levels would align the outlook with EUR/USD, suggesting that Dollar has formed short-term bottom against European majors. If this scenario unfolds, we may see further gains for the greenback, potentially extending its rally throughout the remainder of the month.

In Asia, at the time of writing, Nikkei is up 0.62%. Hong Kong HSI is up 0.21%. China Shanghai SSE is down -0.76%. Singapore Strait Times is down -0.10%.

ECB de Guindos indicates final phase of monetary policy tightening

In an interview with Il Sole 24 Ore, ECB Vice President Luis de Guindos highlighted the central bank’s shift towards a more conventional monetary policy approach, stating, “We have now entered the home stretch of our monetary policy tightening path,” adding, “And that’s why we are returning to normality, to 25 basis-point steps.”

He reiterated ECB’s position that future policy decisions will be determined on a meeting-by-meeting basis, reliant on incoming data. The decisions will hinge on “the evidence of how the tightening of financing conditions has worked — and on the path of inflation, headline and core,” Guindos explained. He voiced concern over service prices, which constitute a significant portion of core inflation.

Guindos also pointed to the impact of quantitative tightening, noting it “has led to an increase of 60-70 basis points in ten-year government bond yields.”

Japan cabinet office stresses importance of avoiding relapse into deflation

Japan’s Cabinet Office emphasized, at a meeting of the government’s economic council, the need for stability and sustainability in these positive signs to ensure that Japan does not fall back into a deflationary spiral. They stated, “While there have been some positive signs in recent data, we must ensure they are stable and sustainable so that Japan won’t revert to deflation.”

In a separate discussion involving academics and private-sector experts, some participants called for BoJ to end quantitative easing once inflation stabilizes around its 2% target. Meanwhile, some participants suggested BoJ should mull over altering its extraordinary stimulus measures if inflation and wages continue their upward trajectory.

Prime Minister Fumio Kishida emphasized the need for a coordinated approach between the government and the BoJ amidst the growing uncertainty surrounding the economic outlook. He said, “We’re aiming to pull Japan out of deflation and achieve sustained, private demand-driven economic growth” by influencing public perceptions that growth and inflation will continue to rise.

A week of key economic events across the globe

There is no definitive main event in the week as each country or region have something important to offer.

In the US, retail sales figures will shed light on the impact of deteriorating consumer sentiment on spending. Additionally, the usual weekly jobless claims will become increasingly important in indicating whether the job market continues to loosen. North of the border, Canada’s CPI and retail sales figures will be closely monitored, but it remains uncertain whether extended string of strong data would be enough to push BoC out of its pause.

Turning to Europe, Germany’s ZEW economic sentiment index will be a highlight, while Eurozone CPI final and GDP revisions are unlikely to trigger significant reactions. European Union will publish new economic forecasts, and ECB will release its monthly economic bulletin. In the UK, focus will be on employment data and consumer confidence.

Over in Asia Pacifica batch of Chinese data, including industrial production and retail sales, is expected to be the most market-moving. Japan will release its GDP and CPI figures, but these are unlikely to change BoJ’s ultra-loose policy stance in the short term. In Australia, the upcoming week will see release of employment data, consumer sentiment, wage price index, and RBA minutes, while New Zealand will publish PPI and trade balance figures.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ services index; Japan PPI; Swiss PPI; Eurozone industrial production; Canada housing starts, wholesale sales; US Empire state manufacturing index.

- Tuesday: Australia Westpac consumer sentiment, RBA minutes; China industrial production, retail sales, fixed asset investment; UK employment, Germany ZEW economic sentiment, GDP revision, trade balance; Canada CPI, manufacturing sales; US retail sales, industrial production, business inventories, NAHB housing index.

- Wednesday: Japan GDP, Australia wage price index; Swiss trade balance; Eurozone CPI final; US housing starts and building permits.

- Thursday: New Zealand PPI; Australia employment; Japan trade balance; Canada new housing price index; US jobless claims, Philly Fed survey, existing home sales, leading index.

- Friday: New Zealand trade balance; Japan CPI, tertiary industry index; UK Gfk consumer confidence; Germany PPI; ECB monthly bulletin; Canada retail sales.

USD/JPY Daily Outlook

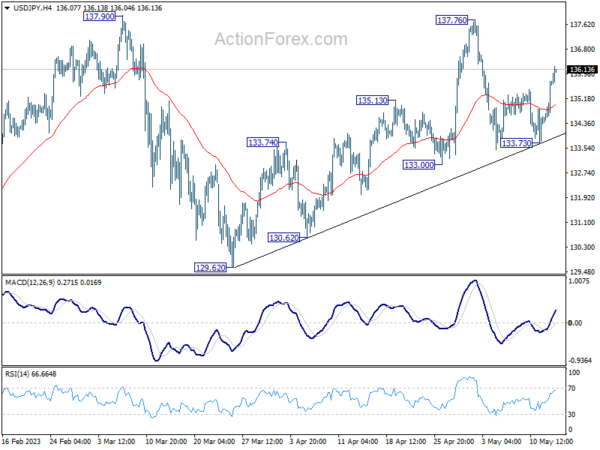

Daily Pivots: (S1) 134.85; (P) 135.30; (R1) 136.20; More…

Intraday bias in USD/JPY remains on the upside at this point. Pull back from 137.76 should have completed at 133.73. Further rise would be seen for retesting 137.76/90 resistance zone. Decisive break there will resume whole rebound from 127.20. On the downside, break of 133.73 will resume the fall from 137.76 through 133.00 instead.

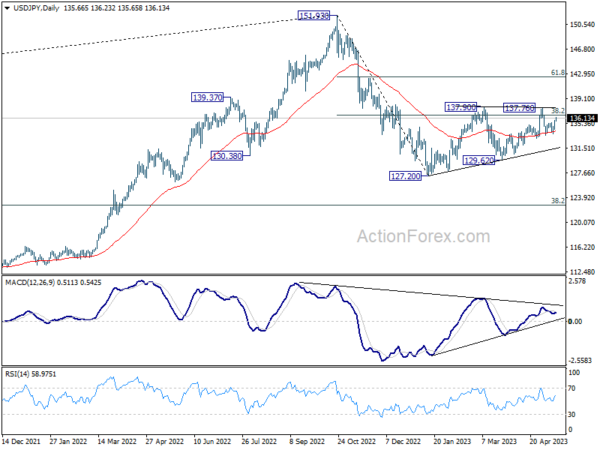

In the bigger picture, price actions from 151.93 high are currently seen as a corrective pattern to the long term up trend. The first leg should have completed at 127.20. Rebound from there is seen as the second leg. Sustained break of 38.2% retracement of 151.93 to 127.20 at 136.34 will bring stronger rise to 61.8% retracement at 142.48. Meanwhile, break of 129.62 will argue that the third leg is starting through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Apr | 49.8 | 54.4 | 53.8 | |

| 23:50 | JPY | PPI Y/Y Apr | 5.80% | 5.60% | 7.20% | 7.40% |

| 06:30 | CHF | Producer and Import Prices M/M Apr | -0.10% | 0.20% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | 1.10% | 2.10% | ||

| 09:00 | EUR | EU Economic Forecasts | ||||

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | -1.20% | 1.50% | ||

| 12:15 | CAD | Housing Starts Y/Y Apr | 221K | 214K | ||

| 12:30 | CAD | Wholesale Sales M/M Mar | 0.20% | -1.70% | ||

| 12:30 | USD | Empire State Manufacturing Index May | -1.9 | 10.8 |