The foreign exchange are mostly stable today, with major currency pairs and crosses staying confined within the boundaries set yesterday. Both Sterling and Euro have had a lackluster week, emerging as the weakest performers. US Dollar, while subdued, still fares better, positioned ahead of Canadian Dollar as the third least impressive for the week.

In an unexpected turn, Australian Dollar has taken the lead as this week’s strongest contender, with New Zealand Dollar following closely. Yen, meanwhile, is mixed amidst these shifts.

Today’s economic docket is relatively thin, spotlighting only US jobless claims and durable goods orders. However, neither is anticipated to induce significant market ripples. Instead, all eyes are glued to the unfolding developments at the Jackson Hole Symposium.

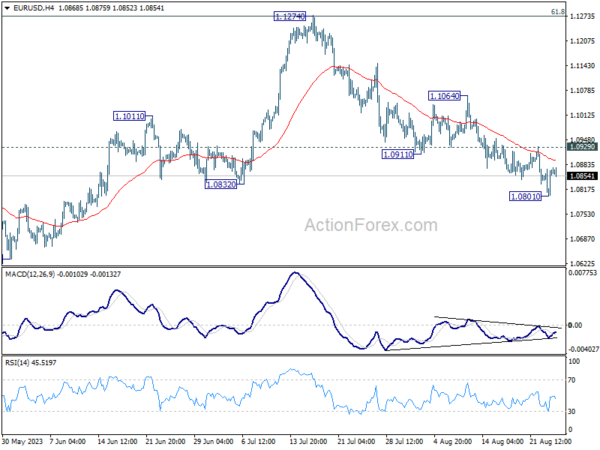

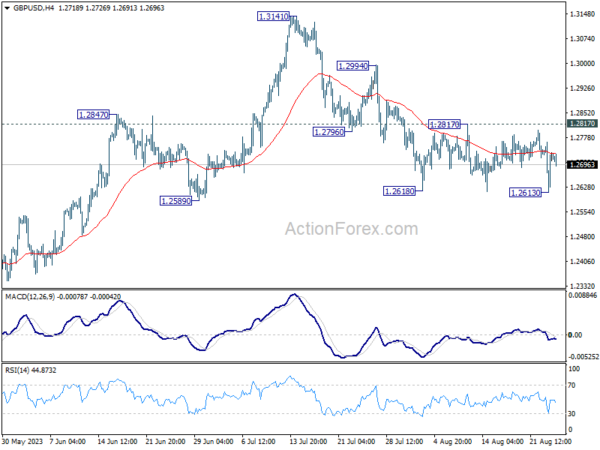

On the technical front, the Dollar’s momentary surge from yesterday lost momentum just as swiftly. Yet, the greenback hasn’t witnessed any pressing sell-off. As long as 1.0929 minor resistance in EUR/USD and 1.2817 in GBP/USD hold, further rally is expected in the greenback. Break of 1.0861 and 1.2613 temporary lows will suggest Dollar buyers are back in.

In Asia, Nikkei closed up 0.87%. Hong Kong HSI is up 1.87%. China Shanghai SSE is up 0.18%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield is down -0.0158 at 0.662. Overnight, DOW rose 0.54%. S&P 500 rose 1.10%. NASDAQ rose 1.59%. 10-year yield dropped -0.13 to 4.198.

Eyes on NASDAQ’s next move after Nvidia’s earnings triumph boosts confidence

Investor sentiment is given a strong lift as Nvidia’s earnings results demolish expectations, despite a high bar set for the AI darling. The strong performance was driven by its data center business, which includes the A100 and H100 AI chips that are needed to build and run artificial intelligence applications like ChatGPT. The company also said it expects fiscal third-quarter revenue of about USD 16B, suggests sales in the current quarter will grow 170% from the year-earlier period.

NASDAQ traders jumped the gun and pushed the index up 1.59% on close, before the Nvidia’s earnings announcement. The development now argues that pull back from 14446.55 has completed at 13161.76, just ahead of the medium term channel support, as well as 38.2% retracement of 10982.80 to 14446.55 at 13123.39.

More importantly, if this turn out to be true, rise from 10088.82 should then remain intact for another high above 14446.55. The upside momentum for the rest of the week, in particular in reaction to Fed Chair Jerome Powell’s Jackson Hole speech, would be watched to decide the odds of this bullish scenario.

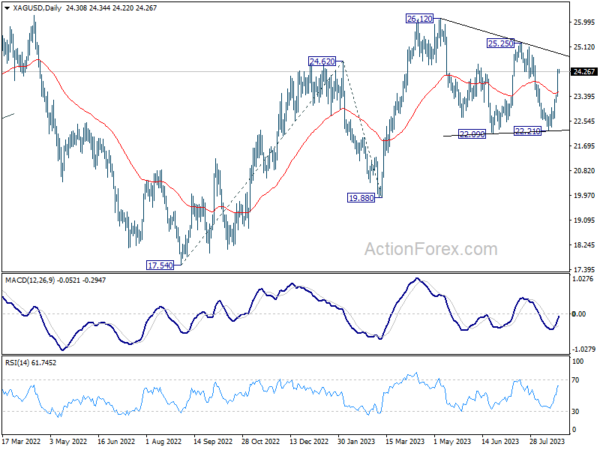

Silver accelerates up, taking Gold higher

Silver’s impressive rally intensified yesterday, pulling Gold upwards in its wake. This surge seems to be a direct response to the retracement of benchmark treasury yields in both the US and Europe, which were affected by less-than-stellar PMI figures. Market sentiment is now swaying towards the belief that major central banks might be quickly approaching the finale of their tightening cycle. All eyes are set on upcoming Jackson Hole Symposium. While the spotlight is certainly on the speech by Fed Chair Jerome Powell, insights and comments from other prominent central bankers are also poised to influence market directions.

Technically, Silver’s strong break of 55 D EMA affirms the case that consolidation pattern from 26.12 has completed with three waves to 22.21. Further rise is now expected as long as this 55 D EMA (now at 23.56) holds, to 25.25 resistance first. Decisive break there should confirm this bullish case, and should also resume whole up trend from 17.54 (2022 low). Next target would be 100% projection of 17.54 to 24.62 from 19.88 at 26.96.

As for Gold, a short term bottom is in place at 1884.83, with D MACD crossed above signal line. Further rebound is now in favor to 55 D EMA (now at 1932.52). Sustained break there will argue that whole corrective pattern from 2062.95 has completed with three waves down to 1884.83, after defending 38.2% retracement of 1614.60 to 2062.95 at 1891.68. Stronger rally would then be seen to 1987.22 resistance to confirm this bullish scenario.

Looking ahead

US jobless claims and durable goods orders will be released today. But attention will definitely be on news flows out of Jackson Hole Symposium.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2638; (P) 1.2702; (R1) 1.2788; More…

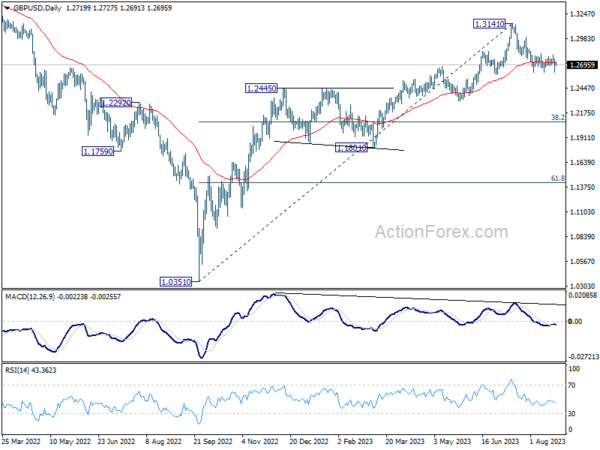

GBP/USD is still bounded in established sideway pattern from 1.2618, despite yesterday’s volatility. On the downside, firm break of 1.2613 and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, break of 1.2817 minor resistance will indicate that the pull back from 1.3141 has completed, and turn bias back to the upside for stronger rebound.

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2723) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 12:30 | USD | Initial Jobless Claims (Aug 18) | 241K | 239K | ||

| 12:30 | USD | Durable Goods Orders Jul | -4.00% | 4.60% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Jul | 0.20% | 0.50% | ||

| 14:30 | USD | Natural Gas Storage | 35B |