Dollar is having a renewed attempt to extend its near-term rebound, buoyed by mild risk-off sentiment prevalent in Europe and US premarkets. This resurgence in the greenback’s strength coincides with ongoing selloff in technology stocks, which has now extended to major Asian markets, with key indexes in South Korea and Taiwan closing down. Additionally, Dollar is finding support from a recovery in the benchmark 10-year treasury yield, which appears to be on track to test the 4% psychological level.

In terms of currency performance, Japanese Yen is currently the weakest for the day, followed by Australian Dollar and Swiss Franc. Euro and Canadian Dollar are mixed while British Pound is demonstrating some resilience. The direction of the next move for these currencies is highly contingent on the forthcoming release of FOMC minutes. Market participants are keenly awaiting insights into Fed’s discussions on the planned rate cuts for this year, including specifics on the timing of the initial cut.

On the technical front, a short term top is likely in place at 15150.06 in NASDAQ, with this week’s deep retreat. For now, as long as 23.6% retracement of 12543.85 to 15150.06 at 14534.99 holds, consolidations from 15150.06 should be relatively brief, and larger rally should resume sooner rather than later. However, firm break of 14534.99 will indicate that lengthier correction is underway, and risk deeper fall to 55 D EMA (now at 14256.20). That would provide additional support to Dollar for extending its near term rebound.

In Europe, at the time of writing, FTSE is down -0.69%. DAX is down -1.06%. CAC is down -1.49%. Germany 10-year yield is down -0.0133 at 2.055. UK 10-year yield is up 0.011 at 3.656. Earlier in Asia, Hong Kong HSI fell -0.85%. China Shanghai SSE rose 0.17%. Singapore Strait Times fell -0.94%. Japan was still on holiday.

Germany’s unemployment rises 5k, still holding up well

In December, Germany’s unemployment count rose by 5k to 2.703m, a figure notably lower than the anticipated increase of 20k. This increment brings the total number of unemployed in Germany to 183k higher compared to the same period a year ago. Additionally, unemployment rate inched up from revised 5.8% to 5.9%, aligning with expectations.

Andrea Nahles, chair of Federal Employment Agency, acknowledged that economic challenges of 2023 have indeed impacted the labor market, but she also emphasized the market’s relative resilience in the face of these stressors.

She noted, “If we look back at 2023, we can see that the weak economy has left its mark on the labor market — however, considering the extent of the stress and uncertainty, the labor market is still holding up well.”

EUR/USD Mid-Day Outlook

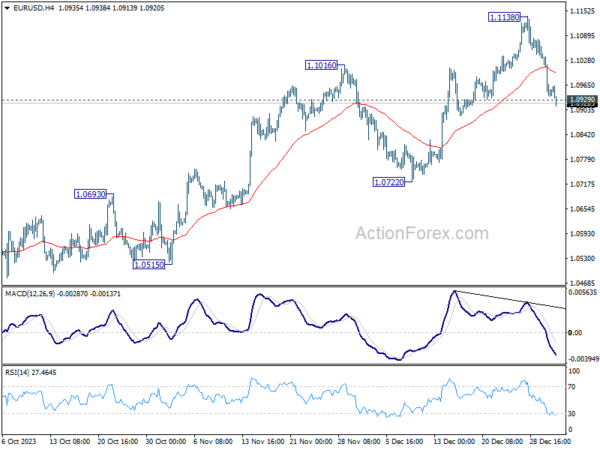

Daily Pivots: (S1) 1.0901; (P) 1.0978; (R1) 1.1019; More…

EUR/USD’s break of 1.0929 minor support confirms short term topping at 1.1138, on bearish divergence condition in 4H MACD. Intraday bias is back on the downside for 1.0772 support. Sustained break there will argue that whole rise from 1.0447 has completed, and break deeper fall back to this support. For now, risk will stay mildly on the downside as long as 55 4H EMA (now at 1.0998) holds, in case of recovery.

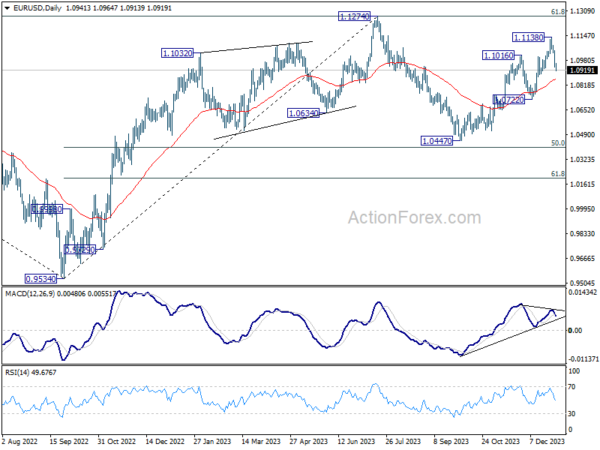

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:30 | CHF | Manufacturing PMI Dec | 43 | 43 | 42.1 | |

| 08:55 | EUR | Germany Unemployment Change Dec | 5K | 20K | 22K | |

| 08:55 | EUR | Germany Unemployment Rate Dec | 5.90% | 5.90% | 5.90% | 5.80% |

| 15:00 | USD | ISM Manufacturing PMI Dec | 47.1 | 46.7 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Dec | 50 | 49.9 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Dec | 45.8 | |||

| 19:00 | USD | FOMC Minutes |