Activity in global financial markets remain generally subdued due to the extended Easter holiday in many regions. Nevertheless, Japan’s markets kicked off the new fiscal year on a tumultuous note, with Nikkei index having a sharp sell-off. Analysts have largely dismissed the latest quarterly Tankan survey as the catalyst for this downturn. Instead, the sell-off could be attributed to institutional investors engaging in profit-booking activities typical of the financial year’s commencement. Meanwhile, Yen remained relatively stable, showing little reaction and maintaining a very tight range amid the market activity.

Currency markets elsewhere have mirrored this calm, with minimal activity observed among the major currencies. However, this tranquility could be disrupted by the upcoming ISM Manufacturing data release, which has the prospect of introducing some volatility. Moreover, the economic calendar ahead is brimming with significant events that could influence market dynamics, including US non-farm payroll, Eurozone CPI flash, Swiss CPI, and Canada’s employment data, all poised to capture investors’ attention in the days ahead.

Technically, Gold’s rally accelerates further in thin markets and hits new record high today. 100% projection of 1614.60 to 2062.95 from 1810.26 at 2258.61 is already met. Despite overbought conditions as seen in D RSI, there is no clear sign of topping yet. Sustained trading above 2258.61 will pave the way to 161.8% projection at 2535.69 in medium term. In any case, near term outlook will stay bullish as long as 2156.88 support holds.

Japan’s Tankan survey: Service sector’s optimism at highest since 1991

Japan’s Q1 quarterly Tankan survey unveils mixed economic sentiment among the nation’s large businesses. Service sector expressed their highest levels of optimism in over three decades, contrasting with a slight decline in confidence among manufacturers.

Large manufacturing index dropped from 13 to 11, still surpassing expectation of 10. However, outlook for large manufacturing firms saw modest increase from 8 to 10, slightly below forecasted 11.

On the brighter side, non-manufacturing index climbed from 32 to 34, exceeding expectations of 31 and marking the highest level since 1991. Despite this, non-manufacturing outlook remained steady at 27, falling short of anticipated 30.

Additionally, large all-industry Capex gauge, which measures capital expenditure plans across industries, is projected to grow by 4% in the new fiscal year. This figure, though positive, falls significantly below the anticipated 9.2% growth.

Japan’s PMI manufacturing finalized at 48.2, worst of weakness has passed

Japan’s PMI Manufacturing was finalized at 48.2 in March, up from February’s 47.2, highest in four months.

Usamah Bhatti of S&P Global Market Intelligence noted that while the sector’s performance remained “downbeat,” there were emerging signs that the “worst of the weakness had passed”. This observation is based on softer reductions observed in both output and new orders inflows.

However, it’s important to highlight that the average PMI reading for Q1 stood at 47.8, indicating the weakest quarterly performance since Q3 2020, when it was 46.7.

Inflationary pressures “remained marked” Although the rate of input price inflation has moderated to its weakest in over three years, the challenge of high costs persists. In response to these pressures, selling price inflation has intensified to a three-month high, reflecting manufacturers’ efforts to safeguard profit margins by transferring higher expenses onto their customers.

China’s NBS PMI manufacturing rises to 50.8, first expansion in six months

China’s official NBS PMI Manufacturing climbed from 49.1 to 50.8 in March, surpassing expectations of 50.1. This uptick not only marks the sector’s first expansion in six months but also represents its highest reading in a year

Details showed notable increases in manufacturing production, which leaped from 49.8 to 52.2, and new orders, which surged from 49.0 to 53.0. Furthermore, new export orders rose from 46.3 to 51.3.

PMI Non-Manufacturing also showed positive momentum, climbing from 51.4 to 53.0, slightly above anticipated figure of 51.3. PMI Composite index, which encompasses both manufacturing and non-manufacturing activities, improved from 50.9 to 52.7,

Zhao Qinghe, senior statistician at NBS, attributed the March surge to increased production resumption efforts following Lunar New Year holiday, alongside improvement in market vitality.

China’s Caixin PMI manufacturing ticks up to 51.1

China’s Caixin PMI Manufacturing rose from 50.9 to 51.1 in March, above expectation of 51.0, marking the highest level in 13 months.

Wang Zhe, Senior Economist at Caixin Insight Group, noted acceleration in both supply and demand within sector with “overseas demand picking up”.

Despite the overall improvement, employment continued “contraction. Additionally, “depressed price level worsened”.

ECB members discuss rate cut, timing, and frequency

ECB Governing Council members Robert Holzmann, in an interview with Austria’s Kronen Zeitung, noted the possibility of Europe reducing interest rates ahead of the US, citing the slower economic growth in Europe compared to its transatlantic counterpart.

Holzmann underscored that the timing of such cuts would “depend largely on what wage and price developments look like by June.”

Yannis Stournaras, in remarks to Greece’s Proto Thema, articulated a more aggressive stance, positing that “cutting rates four times this year, by 25 basis points each, is possible.”

This perspective reveals a division within ECB, as Stournaras acknowledged skepticism among some colleagues who advocate for a more cautious approach to rate reductions.

Anticipating US ISMs and NFP, Eurozone CPI Flash, and more

This week is spotlighted by a series of heavyweight data releases from the US, including ISM indexes and non-farm payroll figures. The focal point for analysts and investors alike hinges on the insights these reports will provide into the ongoing concerns of inflationary pressures and labor market tightness. Notably, prices and employment components of ISM indexes, along with wage growth data from NFP, are poised to offer vital clues.

In light of recent comments from Fed Chair Jerome Powell, emphasizing the necessity of “more good inflation readings” before considering interest rate cuts, the anticipation surrounding these data releases is high. With Fed fund futures suggesting 63% probability of an initial rate cut in June, the market’s confidence seems to hang in balance. The outcomes of this week’s US data releases are poised to recalibrate these market expectations.

Shifting the gaze to Europe, Eurozone’s CPI flash report stands as another central piece of this week’s economic puzzle, with analysts keen to assess the pace of disinflation in both headline and core figures. ECB officials have been vocal about an impending rate cut this spring, with a consensus leaning towards June. The upcoming ECB meeting accounts are expected to echo this sentiment, providing further clarity on the bank’s policy outlook.

Beyond these focal points, additional events deserving attention include Swiss CPI, employment data from Canada, minutes from RBA, and China’s Caixin PMIs. Speculation abounds regarding SNB’s next steps, particularly the possibility of another rate cut in June, contingent on forthcoming inflation data.

Here are some highlights of the week:

- Monday: Japan Tankan survey, PMI manufacturing final; China Caixin PMI manufacturing. Canada PMI manufacturing; US PMI manufacturing final, ISM manufacturing, construction spending.

- Tuesday: Japan monetary base; Australia RBA minutes; Germany CPI flash; Swiss PMI manufacturing, retail sales; Eurozone PMI manufacturing final; UK PMI manufacturing final; US factor orders.

- Wednesday: China Caixin PMI services; Eurozone CPI flash, unemployment rate; US ADP employment, PMI services final, ISM services.

- Thursday: New Zealand building permits; Australia building approvals; Swiss CPI; Eurozone PMI services final, PPI, ECB meeting accounts; UK PMI services final; Canada trade balance; US jobless claims, trade balance.

- Friday: Japan household spending, leading indicators; Australia trade balance; Germany factor orders, import prices; France industrial production; Swiss foreign currency reserves, SECO consumer climate; UK PMI construction; Eurozone retail sales; Canada employment, Ivey PMI; US non-farm payrolls.

GBP/JPY Daily Outlook

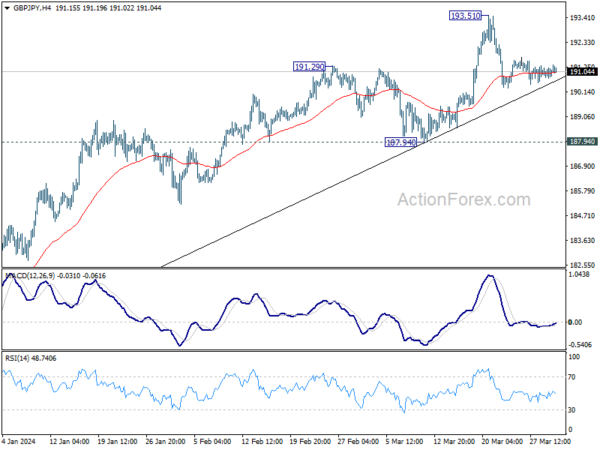

Daily Pivots: (S1) 190.78; (P) 191.02; (R1) 191.25; More…..

GBP/JPY is gyrating in tight range around 55 4H EMA and intraday bias remains neutral. More consolidations could be seen. But outlook will stay bullish as long as 187.94 support holds. On the upside, break of 193.51 will resume larger up trend towards 195.86 long term resistance.

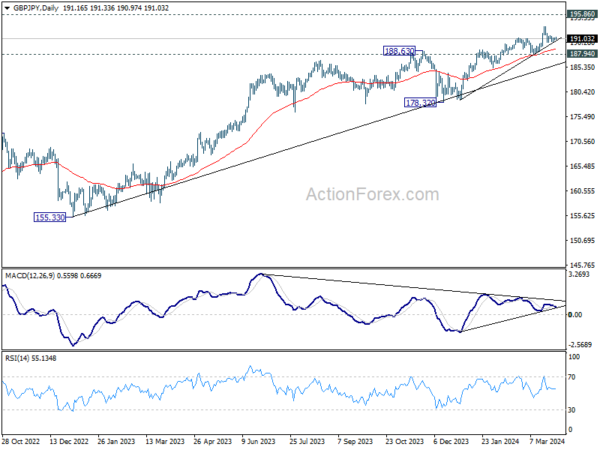

In the bigger picture, current rally is part of the up trend from 123.94 (2020 low), and is in progress for long term resistance (2015 high). Break of 187.94 support is needed to be the first sign of medium term topping. Otherwise, outlook will remain bullish in case of retreat.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 11 | 10 | 12 | 13 |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 34 | 31 | 30 | 32 |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 10 | 11 | 8 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | 27 | 30 | 24 | 27 |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 4.00% | 9.20% | 13.50% | |

| 00:30 | JPY | Manufacturing PMI Mar F | 48.2 | 48.2 | 48.2 | |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 51.1 | 51 | 50.9 | |

| 13:30 | CAD | Manufacturing PMI Mar | 49.7 | |||

| 13:45 | USD | Manufacturing PMI Mar F | 52.5 | 52.5 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 48.5 | 47.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 52.8 | 52.5 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 45.9 | |||

| 14:00 | USD | Construction Spending M/M Feb | 0.50% | -0.20% | ||

| 14:30 | CAD | BoC Business Outlook Survey |