Despite stellar report of job growth, Dollar fails to secure upside momentum so far due to sluggish wage growth. Non-farm payrolls report showed 313k growth in February, much better than expectation of 205k. Prior month’s figure was also revised up from 200k to 239k. Unemployment rate was unchanged at 4.1%, above expectation 4.0%. Most disappointingly, average hourly earnings rose 0.1% mom only, below expectation of 0.2% mom, slowed from prior months 0.3% mom. The set of data is a repeat of the mystery that many Fed officials have pointed out. That is, strong job growth exists without wage pressure. The report does nothing to secure the chance of a fourth hike by Fed this year.

Released from Canada, the economy added 15.4k jobs in February, below expectation of 21.0k. But unemployment rate dropped to 5.8%, versus expectation of 5.9%.

DOW to take on 25000 again on improved sentiments

There were talks that market sentiments were boosted by breakthrough in tension between the US and North Korea. Politically, the agreement on meeting between US President Donald Trump and North Korean leader Kim Jong-un is welcomed globally. But Nikkei gained a mere 0.47% today. European index are mixed with FTSE trading up 0.25%, DAX Up 0.15% and CAC up 0.42% at the time of writing. Nonetheless, US futures point to higher open and DOW might have another go at 25000 handle.

NAFTA collapse could cost Canada 0.5% reduction in growth in first year

The Conference Board of Canada warned that failure to resolve the difference with the US and ending NAFTA could cost -0.5% reduction in real GDP growth in the first year. And that’s even taken a lower exchange rate and easing in monetary policy into consideration. The Canadian economy could also lose as many as 85k jobs the first year.

In case of a NAFTA collapse, Conference Board predicts CAD 3.3b drop in real business spending in the first year. Real exports and imports will decline by -1.8%. Tariffs are predicted to revert to WTO most-favored nation rates. That is, Canadian exports to US would face 2.0% tariff. US exports to Canada would face 2.1% tariff.

Little reaction to European economic data

Markets have little reaction to economic data released in the European session. Released in European session, UK trade deficit narrowed to GBP -12.3b in January, slightly larger than expectation of GBP -12.0b. UK industrial production rose 1.3% mom, 1.6% yoy, vs expectation of 1.5% mom, 1.8% yoy. Manufacturing production rose 0.1% mom, 2.7% yoy, versus expectation of 0.2% mom, 2.8% yoy. UK construction output dropped -3.4% mom in January versus expectation of -0.5% mom. NIESR GDP estimate rose 0.3% in February versus expectation of 0.4%. German trade surplus narrowed slightly to EUR 21.3b in January. German industrial production dropped -0.1% mom in January.

BoJ stands pat. Moderate economic expansion to continue

BoJ left monetary policy unchanged today as widely expected. Short term policy rate is kept at -0.1%. BoJ will continue to purchase assets at a pace of JPY 80T per annum to keep 10 year JGB yields at around 0%. Goushi Kataoka dissented again, continued his push to lower yields on JGBs with maturities longer than 10 years. In the statement, BoJ noted that the economy is “expanding moderately, with a virtuous cycle from income to spending operating”. And it expects such “moderate expansion” to continue. Core CPI is expected to “continue on an uptrend and increase toward 2percent”. Risks to the outlook include US policies, outcome and Brexit negotiation and geopolitical risks. BoJ maintained the pledge on “continuing expanding the monetary base.” until core CPI exceeds 2% and stays above in a “stable manner.

Japan household spending rose 2.0% yoy in January versus expectation of -0.8% yoy. M2 rose 3.3% yoy in February. Labor cash earnings rose 0.7% yoy versus expectation of 0.6% yoy.

From China, CPI jumped sharply to 2.9% yoy in February, up from 1.5% yoy and beat expectation of 2.4% yoy. PPI slowed to 3.7% yoy, down from 4.3% yoy and below expectation of 3.8% yoy.

EUR/USD Mid-Day Outlook

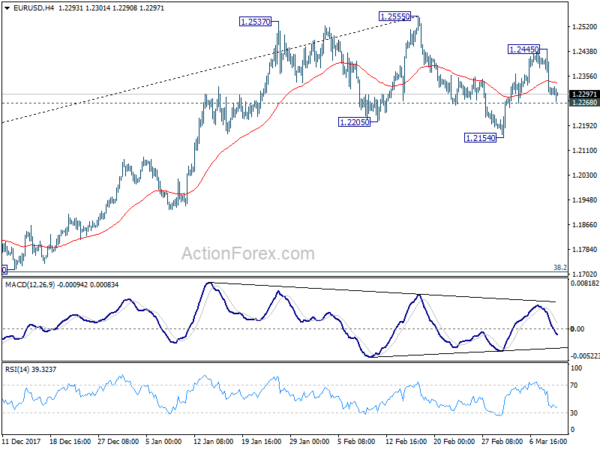

Daily Pivots: (S1) 1.2257; (P) 1.2351 (R1) 1.2406; More….

EUR/USD dips in early US session but is still staying above 1.2268 minor support. Intraday bias remains neutral at this point. On the downside, break of 1.2268 will argue that fall from 1.2555 is likely resuming. And intraday bias will be turned back to the downside for 1.2154 support and below. Om the upside, above 1.24455 will turn bias to the upside for retesting 1.2555 key resistance.

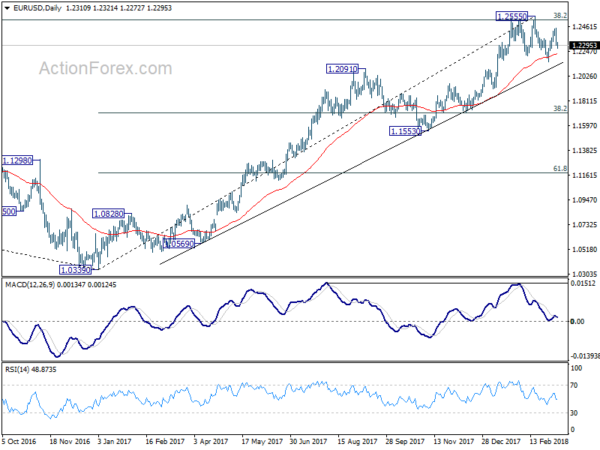

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BOJ Monetary Policy Statement | |||||

| 23:30 | JPY | Overall Household Spending Y/Y Jan | 2.00% | -0.80% | -0.10% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Feb | 3.30% | 3.30% | 3.40% | |

| 00:00 | JPY | Labor Cash Earnings Y/Y Jan | 0.70% | 0.60% | 0.70% | |

| 01:30 | CNY | CPI Y/Y Feb | 2.90% | 2.40% | 1.50% | |

| 01:30 | CNY | PPI Y/Y Feb | 3.70% | 3.80% | 4.30% | |

| 07:00 | EUR | German Trade Balance Jan | 21.3B | 21.1B | 21.4B | |

| 07:00 | EUR | German Industrial Production M/M Jan | -0.10% | 0.60% | -0.60% | |

| 09:30 | GBP | Visible Trade Balance (GBP) Jan | -12.3B | -12.0B | -13.6B | |

| 09:30 | GBP | Industrial Production M/M Jan | 1.30% | 1.50% | -1.30% | |

| 09:30 | GBP | Industrial Production Y/Y Jan | 1.60% | 1.80% | 0.00% | |

| 09:30 | GBP | Manufacturing Production M/M Jan | 0.10% | 0.20% | 0.30% | |

| 09:30 | GBP | Manufacturing Production Y/Y Jan | 2.70% | 2.80% | 1.40% | |

| 09:30 | GBP | Construction Output M/M Jan | -3.40% | -0.50% | 1.60% | |

| 12:00 | GBP | NIESR GDP Estimate Feb | 0.30% | 0.40% | 0.50% | 0.40% |

| 13:30 | CAD | Net Change in Employment Feb | 15.4K | 21.0K | -88.0K | |

| 13:30 | CAD | Unemployment Rate Feb | 5.80% | 5.90% | 5.90% | |

| 13:30 | USD | Change in Non-farm Payrolls Feb | 313K | 205K | 200K | 239K |

| 13:30 | USD | Unemployment Rate Feb | 4.10% | 4.00% | 4.10% | |

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.10% | 0.20% | 0.30% | |

| 15:00 | USD | Wholesale Inventories M/M (JAN F) | 0.70% | 0.70% |