Yen is staying strong today and it’s extending recent rally. Falling major European and US treasury yields and risk aversion are the main factors. German 10 yield bun yield closed at 0.353% yesterday’s concern. That’s nearly half of this month’s high at 0.651%. US 10 year yield’s decline continues in Asian session hitting as low as 2.886, now at 2.902. TNX reached as high as 3.115 less than two weeks ago.

Elsewhere in the currency markets, Swiss Franc is finally picking up some strength today and is trading as the second strongest. But for the week it remains the weakest one. Notable selling is seen in Aussie and New Zealand Dollar today. But Dollar is the third weakest.

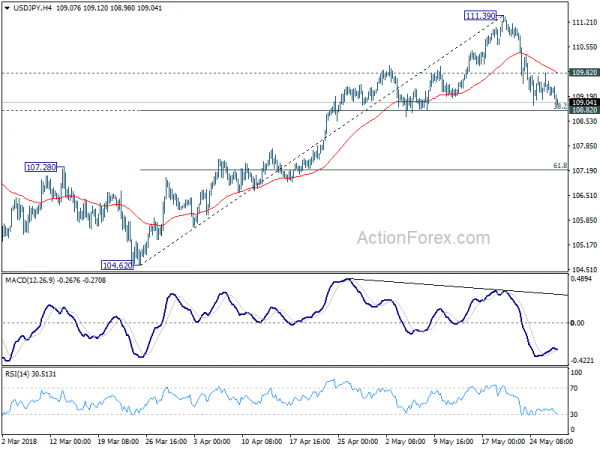

Technically, USD/JPY could be pressing 108.82 key near term support today. Reaction to this level will tell whether the fall from 111.39 is corrective or reversing the near term trend.

North Korean and US officials working on the June 12 summit

North Korea and the US are starting the preparation for the June 12 summit between Kim Jong-un and Donald Trump.

On the North Korean side, Kim Jong-un’s “butler” Kim Chang-son, de factor chief of staff, flew to Singapore via Beijing overnight. Separately, a form spy chief Kim Yong-chol is flying to Washington.

On the US side, White House deputy chief of staff for operations Joe Hagin flew to Singapore from Japan with a team of other officials.

Separately, Trump talked with Japan prime minister Shinzo Abe on phone yesterday. And the White House said Trim and Abe “affirmed the shared imperative of achieving the complete and permanent dismantlement of North Korea’s nuclear, chemical, and biological weapons and ballistic missile programs.” And they would meet before the Kim-Trump summit.

St. Louis Fed Bullard urged caution on further rate hike with three reasons

St. Louis Fed President James Bullard urged caution on further rate hike in near term in a presentation at a seminar in Tokyo.

And he laid out three reasons for discussions.

First, market-based inflation expectations in the U.S. remain somewhat low.

Second, the current level of the policy rate appears to be neutral, meaning it is putting neither upward nor downward pressure on inflation.

Third, the U.S. nominal yield curve could invert later this year or in 2019, which would be a bearish signal for U.S. macroeconomic prospects,.

Here is the full presentation.

Canada Freeland in Washington again for NAFTA talks

Canadian Foreign Minister Chrystia Freeland will fly to Washington on Tuesday to continue NAFTA negotiations. Her spokesman Adam Austen said she will be there on Tuesday and Wednesday. And he added that “we’ve said all along we are ready to go (to Washington) at any time.”

A spokesman for US Trade Representative Robert Lighthizer said Freeland would meet the U.S. trade chief on Tuesday, but did not give details of the meeting.

Mexican Economy Minister Ildefonso Guajardo said last week that there is around 40% chance of concluding NAFTA talks before Mexican presidential election on July 1. But Guajardo will not be there at the Tuesday meeting. Instead, he is in Paris for meetings of OECD and WTO.

German Merkel concerned with weakening international cooperations

German Chancellor Angela Merkel expressed her concerns on weakening international cooperation at a conference in Berlin yesterday.

She said “international agreements and institutions are being weakened. This is worrying, since our multilateral global order comes from the lessons we learned from the terrible world wars of the last century.” She added that “the people who experienced World War Two, the last true global catastrophe, are dying out and are no longer there as eyewitnesses.” And, these people “learned from that terrible experience not to embed emnity but that you had to try and build friendships with each other.”

Regarding trade with the US, She said “we are happy to negotiate, but it mustn’t be under a sword of Damocles.”

On the data front

Japan unemployment rate was unchanged at 2.5% in April. Swiss trade balance and Eurozone M3 will be featured in European session. Later in the day, US will release S&P Case-Shiller house price, but main focus is on Conference Board consumer confidence.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.13; (P) 109.52; (R1) 109.80; More…

USD/JPY weakens again today but near term outlook remains unchanged. We’d continue to expect strong support from 108.82 cluster support (38.2% retracement of 104.62 to 111.39 at 108.80) to contain downside and break rebound. Above 109.82 minor resistance will argue that the pull back from 111.39 is completed. Intraday bias would be turned back to the upside for retesting 111.39. However, on the downside, firm break of 108.82 will argue that the rise from 104.62 is possibly over. Deeper would then be seen to 61.8% retracement at 107.20 and possibly below.

In the bigger picture, corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Rise from 104.62 is possibly resuming the up trend from 98.97 (2016 low). This will be the preferred case as long as108.82 support holds. Decisive break of 114.73 resistance will confirm our view and target 118.65 and above. However, sustained break of 108.82 will dampen the bullish outlook and revive the case of a break of 104.62 low before bottoming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Jobless Rate Apr | 2.50% | 2.50% | 2.50% | |

| 6:00 | CHF | Trade Balance (CHF) Apr | 2.23B | 1.77B | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 3.90% | 3.70% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Mar | 6.40% | 6.80% | ||

| 14:00 | USD | Consumer Confidence May | 128 | 128.7 |