The responses to FOMC’s announcement overnight were very clear. Stocks rebounded with DJIA gained 112.273 pts or 0.54% to close at 20950.10. S&P 500 rose 19.81 pts or 0.84% to close at 2385.26. NASDAQ jumped to as high as 5911.20, just missed record high at 5911.79 before closing at 5900.05, up 43.23 pts or 0.74%. Long term treasury yields, on the other hand, tumbled sharply. 10 year yield was rejected from 2.621 resistance and closed at 2.508, down -0.087 for the day. 30 year yield lost -0.066 to close at 3.106. Dollar index dips to as low as 100.43 and broke 100.66 near term support level, suggesting more downside ahead.

Fed hiked but kept outlook unchanged

FOMC raised the fed funds target range, by 25 bps, to 0.75%-1.00% with 9-1 vote. Minneapolis Fed President Neel Kashkari dissented as he favored leaving the monetary policy unchanged. The disappointments came from the fact that the Summary of Projections (SEP) shows virtually the same macroeconomic outlook. The median projection of federal fund rates was held at 1.4% by the end of 2017, same as December projection. Median projection for rate by the end of 2.18 was held at 2.1%, also same as December projection. Median projection for rate by the end of 2019 was revised by a mere 0.1% to 3.0%. Fed fund futures are pricing pricing in 49.6% chance of another hike in June, down from prior day’s 53.2%.

More on FOMC:

- FOMC Delivered, Market Disappointed

- FOMC: Anticipated Rate Increase in Domestic/Global Context

- FOMC: Replay Of The December Meeting Stings The Dollar

- FOMC Recap – Rates Rise But Gradual Path Remains

BoJ on hold as widely expected

BoJ left monetary policies unchanged today as widely expected. Policy makers voted 7-2 to keep the Yield Curve Control unchanged. Short term policy rate is held at -0.1%. And BoJ will continue asset purchase at JPY 80T per annum. T. Sato and . T. Kiuchi voted against the decision. Regarding the economy, BoJ noted that it has "continued its moderate recovery trend", "exports have picked up". BoJ is optimistic that "Japan’s economy is likely to turn to a moderate expansion." Risks to outlook include development in US and Fed’s rate hikes, emerging economies, the consequences of Brexit.

SNB and BoE to hold

SNB is widely expected to keep the site deposit rate unchanged at -0.75% today. Meanwhile, the Libor target range would be held at -1.25% to -0.25%. The Swiss franc has been rather sensitive to political uncertainties in Europe as it gyrated higher against Euro since last September. But EUR/CHF is so far holding above 1.06 for the moment and the rebound since February should give SNB policy makers some relief. It’s believed that SNB won’t act unless they see the risk of persistent appreciation in Franc’s exchange rate.

BoE is also widely expected to keep monetary policies unchanged. That is, the benchmark interest rate to be held at 0.25%. The asset purchase target will also be kept at GBP 435b. The decisions should also be made with unanimous 9-0 vote. The depreciation in Sterling’s exchange rate in the past year has given BoE much room for not loosening monetary policies further. It’s generally expected inflation would continue to climb this year and could overshoot BoE’s target briefly. And policymakers expressed their tolerance on that already. There has been some speculation of a BoE hike in early 2018. But that is very much subject to the development for the rest of the year, as Prime Minister Theresa will trigger Brexit negotiation this month.

Aussie and Kiwi pare gains on weak data

Both Aussie and Kiwi pare some gains against Dollar after weak economic data. The Australian economy lost -6.4k jobs in February, much worse than expectation of 16.3k growth. Unemployment rate jumped 0.2% to 5.9%, above expectation of 5.7%. That’s also the highest rate in more than a year. Contraction in job markets was led by -33.5k loss in part-time jobs. The 27.1k rise in full-time jobs couldn’t make up the number. Some economists noted that there is basically no inflationary pressure from the labor market and wage growth. Meanwhile, further surge in unemployment rate could pressure the RBA for a rate cut despite facing bubbling in the housing markets. Also from Australia, consumer inflation expectation dropped to 4.0% in March.

New Zealand GDP rose only 0.4% qoq in Q4, slowed from prior quarter’s downwardly revised 0.8 qoq. It also missed expectation of 0.7% qoq. The earthquake near Kaikoura back in November is seen as a factor skewing the data. But StatsNZ didn’t directly mention any disruption to activity due to that earthquake. Meanwhile, weakness in manufacturing, which contracted by -1.6%, has trimmed -0.2% from GDP growth. For 2016 growth averaged 3.1%, which was an improvement over 2.5% in 2016. That’s also the second straight year of above 3% growth.

PBoC raised short term repo and MLF rates

In China, the PBoC raised the key seven-day repo rate by 0.1% to 2.45%. The 14-day repo rate was also raised by 0.1% to 2.60%. Same amount was raised in 28-day repo rate to 2.75%. Meanwhile, For medium-term lending facility loans, the 6-month rate was raised by 0.1% to 3.05%. One-year MLF rate was raised by 0.1% to 3.2%. PBoC said that the hikes doesn’t not constitute a benchmark rate increase. Instead, it’s just a move to add flexibility for deleverage "deflating bubbles" and risk preventions.

Elsewhere on data…

Eurozone will release CPI final in European session. Canada will release international securities transaction in US session. US will release new residential construction, jobless claims and Philly Fed survey.

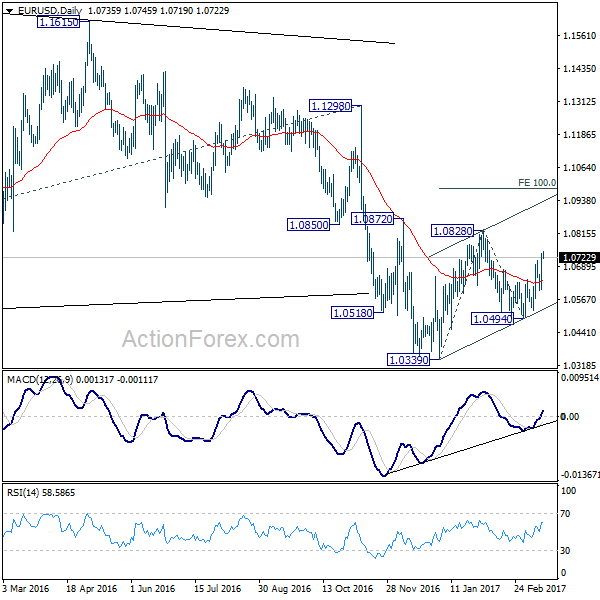

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0642; (P) 1.0691 (R1) 1.0780; More…..

EUR/USD was supported by 4 hour 55 EMA and rebounded strongly. The break of 1.0713 indicates that whole rise from 1.0494 has resumed. It also revived the case that rise from 1.0494 is the third leg of the pattern from 1.0339. Intraday bias is turned back to the upside for 1.0828 resistance and above.

Still, rise from 1.0339 is seen as a corrective move. Hence, we’d upside to be limited by 100% projection of 1.0339 to 1.0828 from 1.0494 at 1.0983 to bring larger down trend resumption. On the downside, break of 1.0599 will turn bias back to the downside for 1.0494 support.

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | 0.40% | 0.70% | 1.10% | 0.80% |

| 0:00 | AUD | Consumer Inflation Expectation Mar | 4.00% | 4.10% | ||

| 0:30 | AUD | Employment Change Feb | -6.4K | 16.3K | 13.5k | |

| 0:30 | AUD | Unemployment Rate Feb | 5.90% | 5.70% | 5.70% | |

| 2:54 | JPY | BoJ Monetary Policy Statement | -0.10% | -0.10% | -0.10% | |

| 8:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | ||

| 8:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | ||

| 8:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | ||

| 10:00 | EUR | Eurozone CPI M/M Feb | 0.40% | 0.40% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 1.80% | 1.80% | ||

| 10:00 | EUR | Eurozone CPI – Core Y/Y Feb F | 0.90% | 0.90% | ||

| 12:00 | GBP | BoE Rate Decision | 0.25 | 0.25% | ||

| 12:00 | GBP | BoE Asset Purchase Target Mar | 435B | 435B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 12:30 | CAD | International Securities Transactions (CAD) Jan | 9.45B | 10.23B | ||

| 12:30 | USD | Housing Starts Feb | 1.26M | 1.25M | ||

| 12:30 | USD | Building Permits Feb | 1.26M | 1.29M | ||

| 12:30 | USD | Initial Jobless Claims | 245K | 243K | ||

| 12:30 | USD | Philly Fed Survey Mar | 25 | 43.3 | ||

| 14:30 | USD | Natural Gas Storage | -68B |