Risk appetite continued to be generally strong. DOW closed up 205.6 pts, or 0.81% overnight to 25574.73. S&P 500 and NASDAQ were up 0.7% and 0.8% respectively. All hit new record highs. Positive sentiments continue in Asian session with gains in China and HK markets even though Nikkei weakens mildly on recent Yen strength. WTI crude oil also extended recent rally to as high as 64.77 and is set to test 65 handle. Gold is firm, consolidation around 1320, as Dollar is back under pressure. The greenback will look into today’s CPI reading for direction.

Euro surged on ECB minutes

Euro jumped sharply yesterday the December ECB minutes signaled that policymakers might begin changing the forward guidance in coming months in response to a better macroeconomic backdrop. As the minutes noted, "the view was widely shared among members that the Governing Council’s communication would need to evolve gradually… if the economy continued to expand and inflation converged further towards the Governing Council"s aim. The language pertaining to various dimensions of the monetary policy stance and forward guidance could be revisited early in the coming year". Moreover, the minutes suggested that the members noticed "a gap appeared to be emerging between favorable economic conditions and a policy stance that remained in a crisis configuration". More in Hawkish ECB Signals To Revisit Forward Guidance As Recovery Pace Accelerates.

The news sent EUR/USD above 1.2 handle while EUR/GBP is also back pressing 0.89. But EUR/JPY remains in near term decline despite a relatively weak recovery. EUR/CHF is also still limited below 1.1777 resistance. Underlying strength in Euro remains to be confirmed.

Fed Dudley warned tax cuts will come at a cost

A key Fed official, New York Fed President William Dudley warned that the Republican’s tax cuts "will come at a cost. After all, there is no such thing as a free lunch". He said that "the economy has considerable forward momentum, monetary policy is still accommodative, financial conditions are easy, and fiscal policy is set to provide a boost. But, there are some significant storm clouds over the longer term". He added further that "keeping the economy on a sustainable path may become more challenging" for the Fed due to the risk of "overheating."

Earlier in the week, Dallas Fed President Robert Kaplan also said that the short-term boost from the tax cuts to the economy will eventually "tail off". The government would be saddled with more debt in the future and "it would create a future headwind for economic growth".

On the data front

China trade surplus widened sharply to USD 54.7b, or in Yuan term CNY 362b. US CPI and retail seals will bee the main focus for today.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1953; (P) 1.2006 (R1) 1.2084; More….

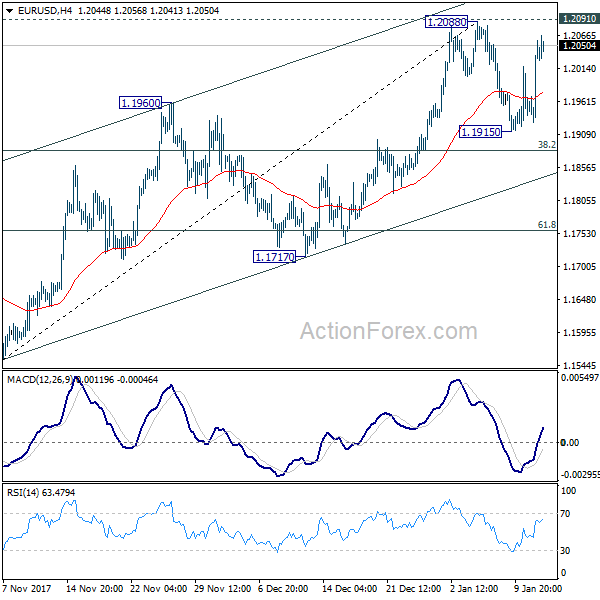

EUR/USD’s rebound from 1.1915 extends higher but it’s still limited below 1.2091 key resistance. Intraday bias remains neutral at this point. Again, decisive break of 1.2091 key resistance is needed to confirm up trend resumption. Otherwise, more corrective trading should be seen with risk of another fall. Below 1.1915 will turn bias to the downside for 38.2% retracement of 1.1553 to 1.2088 at 1.1884. Break will target 61.8% retracement at 1.1757 and below. Nonetheless, firm break of 1.2091 will resume whole medium term rise from 1.0339 towards 1.2516 long term fibonacci level.

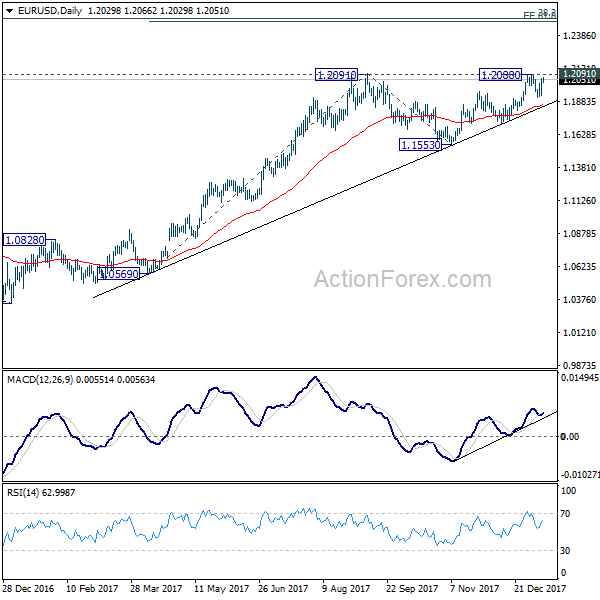

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494.