Live Comments

US NFP beats at 130k, unemployment rate dips to 4.3%

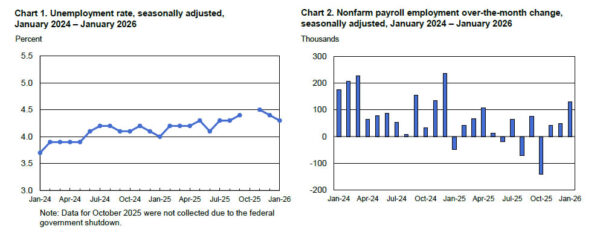

US non-farm payrolls surprised to the upside in January, rising 130k against expectations for just 66k. The gain was also well above the 15k average monthly increase seen through 2025.

Unemployment rate edged down from 4.4% to 4.3%, beating forecasts for no change, while the participation rate ticked up 0.1 percentage point to 62.5%. The combination suggests labor supply and demand both strengthened modestly at the start of the year.

Wage pressures also remained firm. Average hourly earnings rose 0.4% month-on-month, above the 0.3% consensus, with annual wage growth holding at 3.7% yoy. For markets, the report challenges expectations of rapid Fed easing and reinforces the narrative of a labor market that remains resilient.

Low-bar NFP to set up yield-driven USD/JPY reaction

The delayed January US non-farm payroll report finally lands today, but expectations are already deeply tempered. Markets are braced for just 66k job growth, with unemployment seen holding at 4.4%. While hiring is seen slow, wage pressure is expected to remain firm. Average hourly earnings are forecast to rise 0.3% mom. Labor demand may be cooling, but without translating into meaningful disinflation pressure.

Meanwhile, officials from the US administration appeared keen to talk down expectations around job creation. National Economic Council Director Kevin Hassett said this week that tighter immigration enforcement and rapid productivity gains driven by artificial intelligence are suppressing demand for new workers. Those dynamics, he argued, could keep payroll growth low even as output remains strong.

Despite that, Hassett struck an upbeat tone, suggesting the economy could still deliver a powerful mix of lagging job creation alongside surging productivity, profits, and GDP. That framing implies that slower hiring should not automatically be read as economic stress.

Markets, however, are unlikely to to put too much attention on rhetoric. The more immediate focus remains on Treasuries. US 10-year yields have fallen sharply this week, extending losses after yesterday’s retail sales miss. The question now is whether bonds are genuinely front-running a more aggressive Fed easing path, or whether investors are simply reassessing “Sell America” narrative as overstated once hard data failed to confirm it. Today’s reaction to payrolls release could help resolve that ambiguity.

Technically, 10-year yield's strong break below 55 D EMA suggests the rebound from the 3.947 low may already have completed at 4.311 as a corrective bounce. Decisive break below 4.108 support would solidify that view and reopen downside toward the 3.947 area.

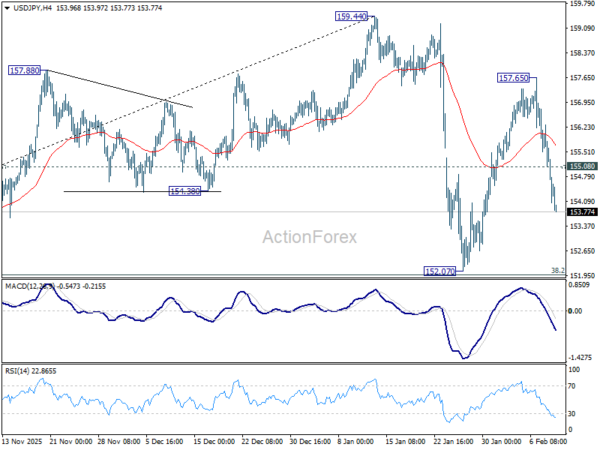

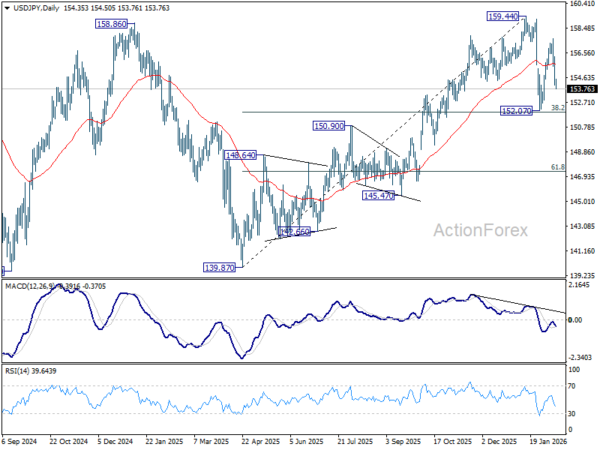

In the currency markets, the corresponding pair to watch is USD/JPY. The pair initially dives this week as reaction to Japan's election results. But the last leg was clearly driven by the fall in US yields. Decline from 157.65 is seen as part of the corrective pattern from 159.44. While deeper fall could be seen to 152.07, strong support is expected from 38.2% retracement of 139.87 to 159.44 at 151.96 to bring rebound. However, decisive break of 151.96 would argue that USD/JPY is already in bearish trend reversal.

China CPI at 0.2% misses, but CNH breaks higher on Dollar weakness

The offshore Chinese yuan surged to its strongest level against Dollar in more than 33 months, with upside momentum showing signs of acceleration. However, the move has been driven far more by broad-based Dollar weakness than by any material improvement in China’s domestic fundamentals.

Today's Chinese data continue to highlight persistent deflationary pressure. January inflation slowed sharply from a three-year high of 0.8% yoy to just 0.2%, undershooting expectations of 0.4% and reinforcing doubts that the economy has decisively turned the corner on pricing power. Underlying details offered little reassurance. Core CPI rose 0.8% from a year earlier, easing from 1.2% in December.

At the producer level, prices remained firmly in deflation, with PPI improving from -1.9% to -1.4% yoy, extending a factory-gate deflation streak that has now lasted more than three years.

Despite efforts to curb destructive price wars across industries plagued by overcapacity, excess supply continues to weigh on margins and pricing.

Policy signals offer little near-term support for the currency. The PBoC reiterated this week that it will maintain a moderately loose monetary stance, prioritizing growth support and gradual price recovery. That guidance reinforces the view that Yuan strength is unlikely to be domestic policy-driven.

Technically, the break below the medium-term falling channel floor suggests USD/CNH’s decline from the 2025 high at 7.4287 is entering a renewed acceleration phase. Near-term outlook remains bearish as long as 6.9956 resistance caps rebounds, with the next downside target seen at 138.2% projection of 7.4287 to 7.1608 from 7.2224 at 6.8522.