The risk on mode continued in yesterday’s trading session with Asian, European and US markets closing higher. After the US close President Trump threatened to expand tariffs on additional $200B worth Chinese products. This led to a selloff in stocks wiping out all of yesterday’s modest gains and eating into the gains from Monday. Risk off extended to other markets as traders flew to safety with the yen gaining in value,

USDJPY fall from 111.263 to 110.791, while AUDUSD took a hit falling from 0.74728 to 0.74045. The market is now waiting for the promised Chinese response, who said the US action was “shocking” and “unacceptable” and that they have no choice but to respond. Risk off sentiment is expected to dominate the European session.

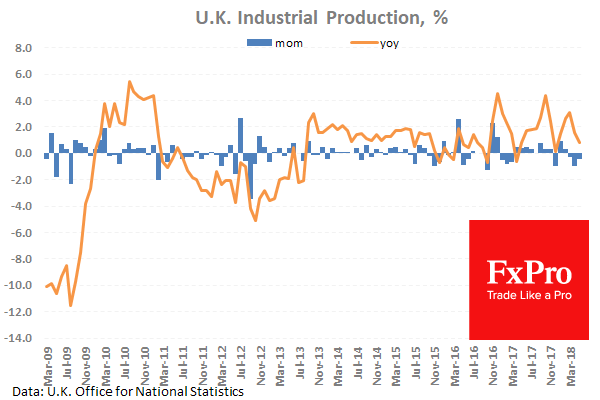

UK Industrial Production (May) was -0.4% (MoM) and 0.8% (YoY) against an expected 0.5% (MoM) and 2.7% (YoY) from a previous -0.8% (MoM) and 2.9% (YoY) which were revised to -1.0% (MoM) and 1.6% (YoY) respectively. This data missed expectations and the previous readings were revised lower showing weakness in the sector.

Manufacturing Production (May) was 0.4% (MoM) and 1.1% (YoY) against an expected 0.7% (MoM) and 3.1% (YoY) from -1.4% (MoM) and 2.9% (YoY) previously which was revised to -1.3% (MoM) and 0.9% (YoY). The negative impact from Brexit is continuing to plague the economy as orders are delayed and production postponed. The UK got a new data metric in the form of GDP (MoM) . The expectation was for a reading of 0.3% and the data came in on target at 0.3%. GBP weakened as a result of the data release because the expectations were missed despite the uptick from previous readings with GBPUSD falling from 1.32936 to 1.32340.

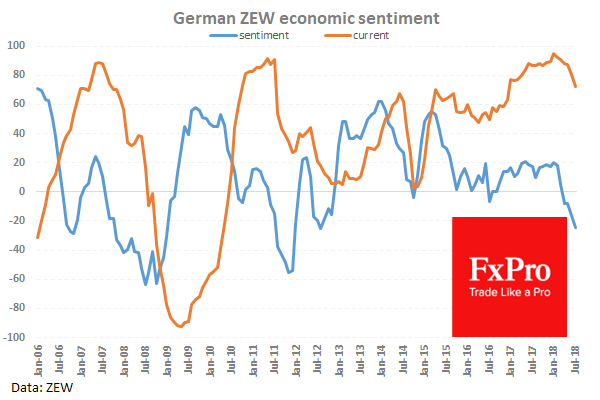

German ZEW Survey – Current Situation (Jul) was 72.4 against an expected 78.0 from a prior 80.6. ZEW Survey – Economic Sentiment (Jul) was -24.7 against an expected -18.2 from -16.1 previously. These data points have continued to soften as the economic data in Germany and the wider Eurozone disappoints. The deteriorating trade environment is also a head wind for business outlook with global trade war fears concerning participants. If these issues continue then sentiment will weaken further as businesses hold off on investments and expansion creating a negative cycle. The EUR weakened as a result of the decline.

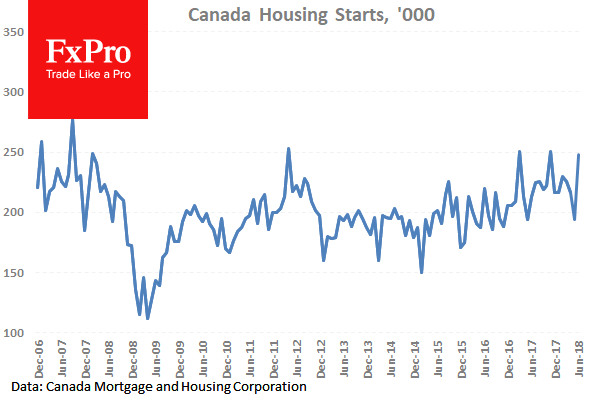

Canadian Housing Starts s.a (YoY) (Jun) were released with a reading of 248.1K against an expected number of 210K from a previous 196K last month which was revised down to 193.9K. This data is showing a strong performance beating the expected number. CAD weakened against the USD from 1.31280 to 1.31435 in an odd reaction but reversed 15 minutes later with stronger Canadian Building Permits data. This can possibly be explained by the expected hike in Interested Rates from the Bank of Canada today. The BOC would see this strong data as a sign that rates can be comfortably increased with CAD expected to weaken against the USD if they do increase.

EURUSD is down -0.13% overnight, trading around 1.17289.

USDJPY is up 0.07% in the early session, trading at around 111.067

GBPUSD is down -0.09% this morning trading around 1.32618

Gold is down -0.36% in early morning trading at around $1,250.96

WTI is down -0.88% this morning, trading around $72.43