Canadian employment numbers for July due on Friday at 12:30 GMT could add to the recent run of strong data for the North American economy. Jobs growth is expected to slow but remain solid in July, as the country enjoys a bounce in economic momentum amid strained relations with the United States and Saudi Arabia, and ongoing efforts to renegotiate NAFTA. The Canadian dollar could be set for fresh highs against its US counterpart after reaching a near 2-month peak this week before reversing to a 2-week low.

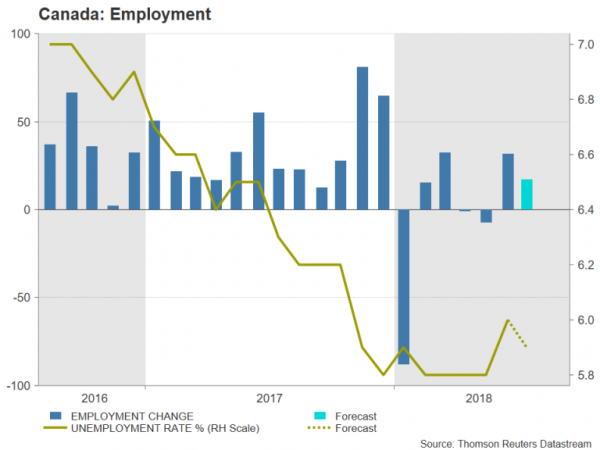

Employment is forecast to grow by 17k in July after rebounding strongly in June when 31.8k jobs were created. The healthy jobs gains invited more people into the workforce, with the participation rate rising from 65.3% to 65.5%, though this pushed up the jobless rate from 5.8% to 6.0%. The unemployment rate is expected to nudge down slightly to 5.9% in July.

Other recent indicators also point to the Canadian economy going from strength to strength in the second quarter. Housing starts jumped higher in June and annual inflation ticked up to 2.5%. GDP rose by a bigger than expected 0.5% month-on-month in May, while retail sales soared by 2% over the same month. The positive trend continued this week with much better-than-expected trade figures. Canada’s trade deficit shrunk to its lowest in 17 months in June as exports surged to a record high.

The Bank of Canada is now almost certain to raise its overnight target rate by at least one more time before the year is out, having increased it twice already in 2018. And while uncertainty about the future of NAFTA remains a major downside risk to the BoC’s outlook, there is growing optimism about a successful renegotiation of the treaty. In the meantime, another robust jobs report on Friday would reinforce expectations of one more rate move, with a very strong reading perhaps even leading to some investors betting on two additional rate hikes.

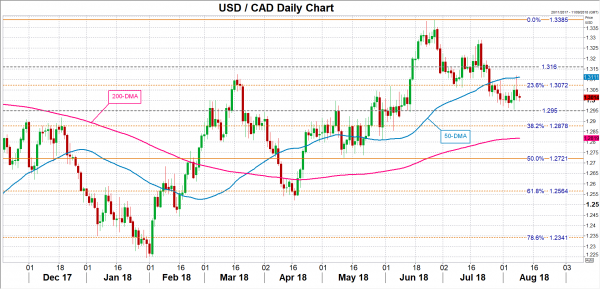

The loonie, which hit a 7½-week high of C$1.2957 per US dollar on Tuesday, would likely advance further if there is a positive surprise. Dollar/loonie could seek initial support at around 1.2950, before eyeing the 1.2880 level, which is the 38.2% Fibonacci retracement of the upleg from 1.2057 to 1.3385. A breach of that level would open the way to the 50% Fibonacci level of 1.2720.

On the other hand, the loonie is vulnerable to a sharp negative correction in the event of a disappointing or an unremarkable set of employment numbers (such as the jobs created consisting mostly of part-time employment). Traders could drive dollar/loonie to test the 23.6% Fibonacci level at 1.3072, which is an immediate resistance area. Above it, Wednesday’s 2-week high of 1.3119 near the 50-day moving average is the next possible hurdle to the upside, followed by the 1.3160 mark.