The Bank of Japan (BoJ) will announce its policy decision during the Asian session on Wednesday. As per usual, no action is anticipated, with the yen instead likely to take its cue from any updates in the Bank’s economic assessment and forecasts – if any. Although the inflation picture remains tepid, growth-related indicators have picked up steam lately, which may lead the BoJ to appear a tad more optimistic. Beyond monetary policy, how risk appetite evolves will be crucial for the yen.

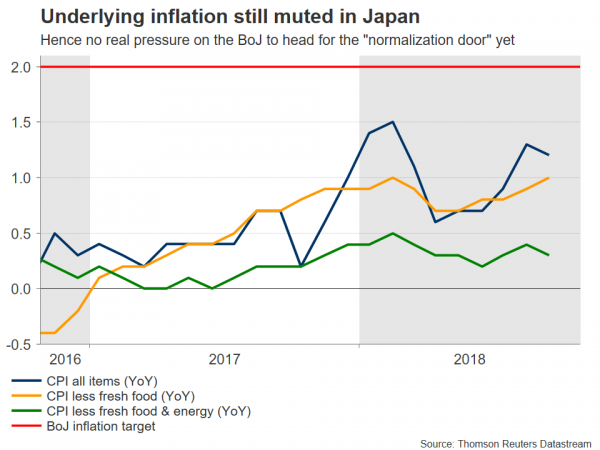

Investors do not seem to expect any further action by the BoJ in the foreseeable future, after the Bank tweaked its policy framework in a slightly more hawkish direction in July. For perspective, under its current framework the central bank has pledged to keep the yields on longer-dated Japanese government bonds fixed “around 0%” in an effort to stimulate borrowing and investment, but in July it took steps to allow yields to move a little more flexibly around this 0% target. While this was initially interpreted as a first step towards a normalization of policy, that theme gradually faded as Japanese economic data – and particularly underlying inflation – continued to tread water, dampening the prospect of further near-term moves.

Indeed, even though headline inflation has risen to 1.2% lately on the back of higher oil prices, core inflation (excluding fresh food) remains at 1.0% in yearly terms, while the BoJ’s own measure which excludes both food and energy items is even more subdued, resting at a mere 0.3%. Perhaps even more troubling, wage growth has decelerated markedly in recent months, and in August it fell short of inflation – bringing real wage growth back to negative territory. Slower wage growth spells downside risks for future inflation, as consumers may find it more difficult to make ends meet, leading them to cut back some of their spending.

While the above suggest there’s little immediate pressure on policymakers to realistically consider normalization, there may be some cause for optimism yet, if one focuses on the growth outlook. Household spending has picked up steam, accelerating to its quickest pace in three years in August, while machinery orders that are seen as a leading gauge of capital spending have also gathered speed in recent months. Hence, both consumers and businesses appear to have been a little more cheerful lately, perhaps to an extent compensating for the unimpressive inflation picture.

Put together, the above suggest that although the BoJ is unlikely to make any changes to its ultra-loose policy framework, it could appear a tad more optimistic on the economy overall given the recent strong patch in growth-related indicators. That said, trade risks continue to lurk in the background, particularly as Japan may be caught in the crossfire of a continued Sino-US trade skirmish, so the central bank will likely avoid appearing too upbeat.

In case of a more optimistic assessment by the Bank, the yen could come under renewed buying pressure. Looking at dollar/yen technically, support to declines may be found near the 111.70 zone, defined by the lows of October 26. Even lower, the bears could stall first near the September 12 trough of 111.10, before the September 7 low of 110.35 comes into view.

On the flipside, a cautious assessment by policymakers, that places more emphasis on the recent slowdown in wages for instance, could be met with selling interest in the yen. Preliminary resistance to advances could come around the 113.00 handle, defined by the peak on October 30. An upside break may pave the way for a test of the 113.50 territory, defined by the inside swing low on October 2, with even steeper bullish extensions eyeing the one-year high of 114.54.

Beyond monetary policy, the other – and perhaps more important – determinant for the yen will be how investors’ risk appetite develops. The Japanese currency is widely considered to be a safe-haven asset, and has accordingly regained ground since early October on the back of the broader risk aversion seen in financial markets. Continued fragility in risk sentiment coupled with a slightly more optimistic tone by the BoJ, could be a recipe for some further near-term gains in the yen, at least against the battered euro and sterling.