The price of crude oil jumped in the Asian session after Saudi Arabia announced measures to reduce supply. The Saudi Arabian Minister of Energy – Khalid al-Falih – said that the country will slash oil output by 500K barrels a day. He attributed this to lower demand. This was against the agreement within OPEC and Russia which called for an increased supply. The news was a relatively good one for the oil market, which saw the price of Brent jump from $61.95 to $71.05.

The Japanese yen fell against the USD today even after the better-than-expected producer price index (PPI). The PPI measures the change in selling price of goods purchased by companies and is a good measure of inflation. The data showed that the PPI rose by an annualized rate of 2.9%. This was higher than the estimated increase of 2.8%. It was, however, lower than September’s increase of 3.0%. On a monthly basis, the PPI rose by 0.3%, which was higher than the consensus estimates of 0.1%. Later today, the country will release the preliminary numbers of machine tools.

Gold received some support in the Asian session after the slide that happened on Friday. Last week, it had the worst week in more than three months after the Federal Reserve eyed more rate increases. In the monetary policy decision last week, the Fed said that the economy was strong and was capable of accommodating multiple rate hikes. Rate hike expectations often lead to a stronger dollar and weaker gold because the latter offers no yield.

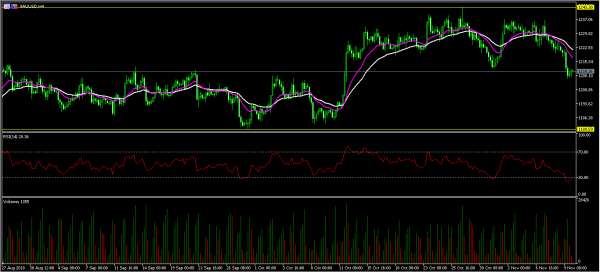

XAU/USD

Gold rose slightly today after the sharp decline last week. Starting from last month, its price has gained from $1180 to a high of $1243. The XAU/USD pair is now trading at 1210, which is slightly higher than Friday’s close of 1206. This price is below the 30 and 15-day EMA. The RSI has fallen to 28, which is considered an oversold position. However, this has happened with the volumes being low, which means that the pair will likely continue with the decline. If it does, it could test the important 1200 level.

EUR/USD

The EUR/USD fell slightly during the Asian session. It reached an intraday low of 1.1312. It then recovered slightly, reaching an intraday high of 1.1330. Last week, the pair declined sharply from a high of 1.1500 to a weekly low of 1.1315. The decline accelerated after the indications by the Fed that it will continue to hike rates. On the hourly chart, the double EMA appear to be changing direction, which will be an indication that a crossover could happen. The RSI has risen to the current level of 40. At this level, it is likely that the pair will start moving up. If it does, it could test the 1.1350 resistance level, which is also the 23.6% Fibonacci Retracement level.

USD/JPY

In the final week of October, the USD/JPY pair reached a low of 111.36. It then started rising and reached a high of 114.01 today as it tries to reach the important resistance level of 114.54. The RSI on the four-hour chart rose to 65 while the double EMA showed that the pair could continue moving higher. The momentum indicator is currently above 100, which means that the pair will likely move higher. If it does, it will test the previous high of 114.54.