Mostly euro-friendly election outcomes, at least in the eyes of investors, and economic data pointing to a strong pickup in economic activity were the factors that rendered the euro the best performing major currency in 2017. Specifically, the common currency advanced by 14.1% versus its US counterpart. This compares to the -6.1% so far in 2018, partially owed to the absence of the aforementioned euro-supportive drivers, something that also paves the way for further underperformance during the remainder of the year.

Eurozone & US: different growth stories

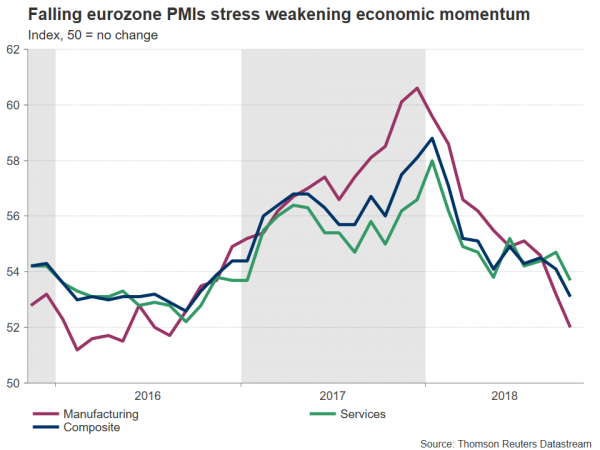

Eurozone PMIs have been on a declining path since late 2017 for manufacturing and early 2018 for the prints on services and the composite measure than blends the two sectors. Particularly, the composite PMI, which is also viewed as a good overall growth indicator for eurozone economies, has fallen to its lowest since September 2016 of 53.1 during October. On the upside, the measure remains in growth territory above 50. However, the retreat from January’s more-than-a-decade high of 58.8 is profound and clearly points towards slowing economic activity in the euro area. Relating to this, the freshly released forecasts by the European Commission make reference to 2018 eurozone GDP growth of 2.1%, which reflects a notable moderation from 2017’s decade high of 2.4%, while the Commission also projects further easing in the years ahead.

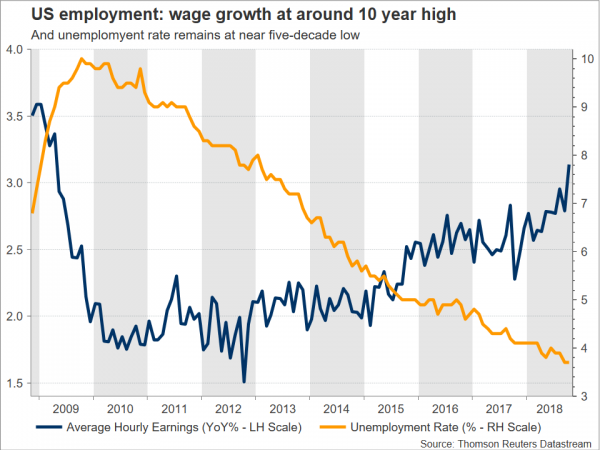

How does the world’s largest economy compare to the abovementioned? A contrast is at play: overall, US economic releases are pointing to a vibrant economy that is expanding at its fastest pace in years. Indicatively, key labor market data for October showed the unemployment rate holding at the near five-decade low of 3.7%, while wage growth, as gauged by average earnings, grew by 3.1% annually, its strongest in around ten years. (Yes, wage growth appears to be making a comeback in the US!) Economic growth differentials in the favor of the US are supportive of higher yield differentials again in the US’ favor, which in turn are dollar-positive.

Monetary policy divergence also supports case for stronger dollar

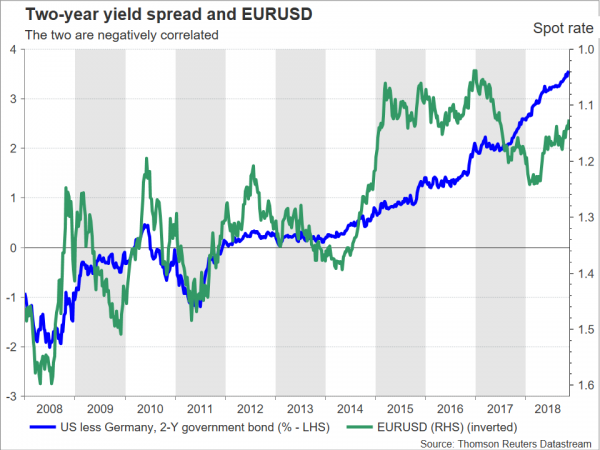

A divergence is also at play on the monetary policy front that again is advocating for a weakening euro/dollar pair as the year unfolds. Namely, the Fed remains firmly on track to continue normalizing rates. In September, the central bank delivered its eighth 25bps rate increase since it started its tightening cycle in late 2015. Additionally, it is expected to proceed with the ninth such hike in December and remain on a normalization path in 2019 as well. Comparing with the ECB: market-derived pricing at the moment suggests the Bank will deliver its very first post-crisis rate rise no earlier than Q4 2019. Additionally, there are growing fears that the soft patch of economic data out of the eurozone may force ECB policymakers to downgrade their growth projections at the Bank’s December meeting, something that may push even further back in time the beginning of rate increases.

As a bare minimum, the previous are acting in favor of a wider US-eurozone (using Germany as a proxy) yield spread in the short-end of the maturity spectrum, something which is typically associated with a firmer dollar relative to the euro.

Icing on the cake: downside risks from Italy

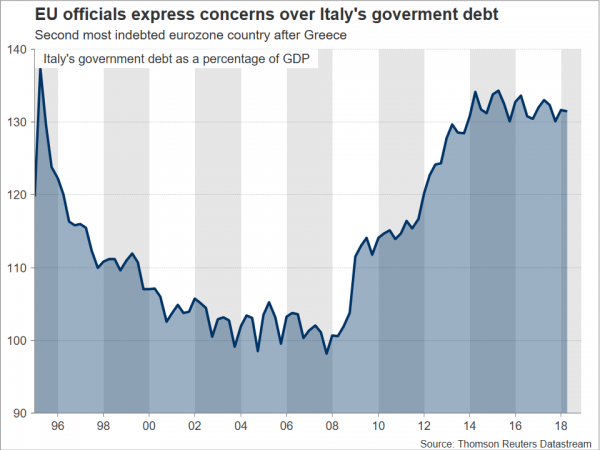

Clouding the outlook for the euro even more, is the EU-Italy budget battle over the latter’s spending plans, which according to the European Commission deviate from the bloc’s fiscal rules. The Italian government faces a deadline on Tuesday (today) to revise its budget proposal. The country’s officials, though, seem unwilling to push forward a revision that would satisfy EU demands, something which could theoretically see Italy facing fines.

Proceeding with fines though is not the likely course of action on behalf of the EU, as that could close any window for a constructive discussion between the two sides. What should the markets expect then? It seems that this story still has room to run, with a “kick the can down the road” approach possibly emerging. (Can it be argued that the EU has a long history of kicking the can down the road on major issues?) This though could keep the euro hostage to headlines on the topic, putting a lid on gains from potentially upbeat prints out of the eurozone moving forward, as investor angst over Italy may limit bullish tendencies on the currency.

As a reminder, the fading of political risks was a theme that acted as a catalyst for the euro’s positive performance in 2017. Now that such risks are making a comeback, even posing existential threats to the eurozone, they’re haunting the single currency. Analogies to Greece come to mind. In this case though, it should also be kept in mind that Italy, unlike Greece, is “too big to fail”. The repercussions from an Italian crash would be destructive.

And the Italian saga is perhaps only the tip of the iceberg. Further muddying the outlook for the euro are the somewhat fragile government coalition in Germany, an evasive Brexit deal, and global trade tensions which have the capacity to hurt the common currency much more than the greenback. In fact, not only is the dollar not hurt by trade skirmishes, but it also attracts safe-haven flows, something which is likely to continue, at least by the end of the year – the current report’s forecasting period.

Conclusion and caveats in place

Taking everything into account, political and trade risks, a much more hawkish Fed compared to the ECB, in conjunction with a slowing eurozone economy that stands in contrast to booming activity on the other side of the Atlantic, are tilting the outlook for euro/dollar to the downside by the end of 2018. For the record, futures markets’ short positions on the euro are currently the most bearish since March 2017.

However, there are some caveats in place that could see the single currency posting sizable gains instead. A Brexit deal for example is likely to see EURUSD edging higher together with GBPUSD, as the two are highly positively correlated lately; EURGBP though is expected to depreciate under such a scenario. Also, a relief rally would most probably be in store should the Italian story close in a manner that is seen as removing euro area uncertainty.

Technical picture for EURUSD

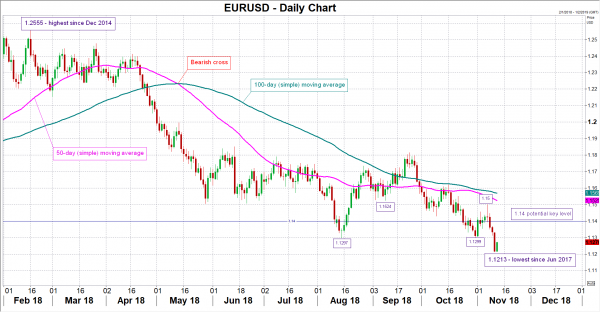

Euro/dollar is looking bearish in both the short- and medium-term at the moment, with the pair trading not far above its lowest in around one-and-a-half years.

In terms of key levels: further declines may see EURUSD finding initial support around the 1.12 round figure; the zone around this mark encapsulates a key technical point, namely 1.1187, which is the 61.8% Fibonacci retracement of the pair’s upleg from early 2017 to February 2018. Steeper losses would turn the focus to the region around the 1.11 handle, which also captures the June 2017 nadir near 1.1120.

On the upside, advances could meet resistance around 1.13, 1.14 and 1.15, which may be of psychological importance. The areas around some of these also include numerous tops and bottoms from the recent past.

For perspective, being lower by 6.1% year-to-date, the euro is the third worst performing major currency, only doing better relative to the Aussie and the Swedish krona, the latter one being the lead decliner.