The latest British employment data are due for release on Tuesday, at 09:30 GMT. Forecasts point to some further acceleration in wage growth during December, which is encouraging and could support the pound on the news. That said, with less than six weeks left until the UK exits the EU, and still no agreement in place, any data-induced rallies in sterling may remain limited until the political fog clears a little.

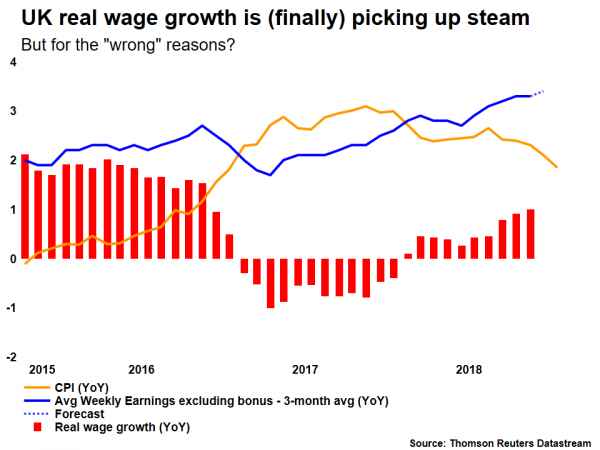

The UK labor market remains the economy’s bright spot, with the unemployment rate hovering near decade-lows and wage growth having picked up steam in recent months. The latter is particularly encouraging, as combined with slowing inflation, it pushes workers’ real incomes higher, theoretically boosting future consumption.

In December, the unemployment rate is forecast to have held steady at 4.0%, while average weekly earnings excluding bonuses are expected to have accelerated to 3.4% on a yearly basis, from 3.3% previously. Indeed, the wages forecast is supported by surveys like the Markit/REC Report on Jobs, which noted that starting salaries rose at one of the fastest rates in over three years during the month. An overall strong set of prints could support the pound a little on the news.

However, it’s not all good news, as the same survey found that most of the pay gains are a result of Brexit uncertainties, with UK citizens being unwilling to move jobs due to uncertainty, and fewer EU citizens are entering the UK for work. In other words, wages aren’t necessarily accelerating because the labor market is exceptionally tight, but rather because British workers are afraid to change jobs and EU workers are avoiding the island altogether.

Economics aside, what matters most for the pound right now are politics. On that front, PM May is trying to squeeze out some last-minute concessions from the EU, to push her deal through Parliament. For that to happen, lawmakers want legally-binding assurances that the Irish backstop will either be time limited, or the UK will have a mechanism to exit from it unilaterally, without consent from Brussels. The concern is that the UK may be trapped in a customs arrangement with the EU, that prevents it from striking trade deals with foreign nations, indefinitely.

Yet, the EU is extremely unlikely to grant legally binding changes. Reports suggest Brussels could meet half way, for instance including a clause that the “need” for the backstop will be “reexamined” every six months, but again, such changes probably won’t be enough to appease Parliament. Therefore, uncertainty is set to remain elevated at least until February 27, when lawmakers will vote on some amendments that could force the government to take certain actions, like extending Article 50. This implies that any rallies in sterling may remain relatively limited until that date.

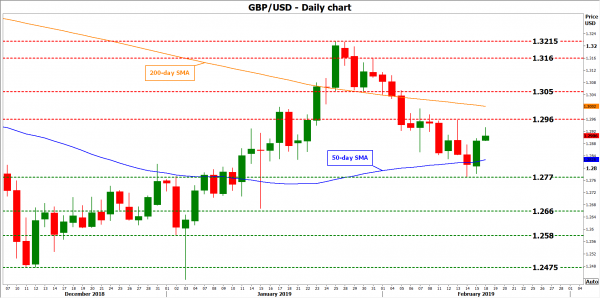

Looking at sterling/dollar technically, initial resistance to advances may be found near 1.2960, the February 13 high. An upside break could open the way for the 200-day simple moving average (SMA), which currently lies near the psychological 1.3000 handle.

On the other hand, another wave of declines may meet support near the 50-day SMA at 1.2828, with a downside violation aiming for the February 14 lows at 1.2770. Even lower, the bears may stall around 1.2660, which was a previous low back in August and roughly coincides with the January 15 trough.