The UK services PMI for February will be watched on Tuesday at 09:30 GMT amid increasing evidence that the Brexit uncertainty is putting the brakes on growth. However, with recent developments at Westminster significantly reducing the odds of a no-deal Brexit scenario, the pound is revelling near 7½-month highs and could take any negative reading in its stride.

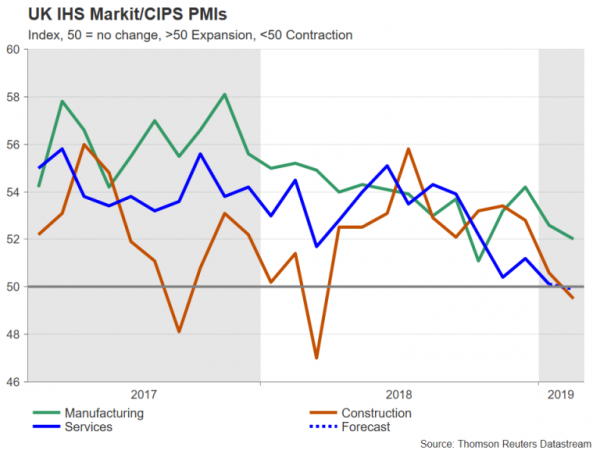

Activity in the services sector, which comprises about 80% of Britain’s economic output, moderated in January to the slowest level since immediately after the Brexit referendum in June 2016, according to IHS Markit/CIPS. The PMI gauge is forecast to dip further in February, falling to 49.9. If the expected figure is met or missed, it would take the index below the critical 50 level that separates expansion from contraction.

It would also point to stagnant growth in the first quarter, with the UK’s other sectors not faring any better. Data on Friday showed manufacturing activity eased to 52.0 in February to a 4-month low, while the construction PMI unexpectedly fell to 49.5 on Monday to the lowest since March 2018. As Parliament continues to wrangle over Brexit and the global economy also undergoes a steep a slowdown, there’s not much to be optimistic about the near-term outlook for the UK economy.

But even though there’s no clear end in sight to the Brexit saga, with a possible extension of Article 50 looking increasingly likely, markets are at least able to take some comfort from the receding fears of a disorderly Brexit. The odds of Britain crashing out of the EU have fallen dramatically after the prime minister, Theresa May, offered MPs a vote on extending Article 50 if they oppose a no-deal outcome in the event that her tweaked Brexit deal gets voted down again when the next meaningful vote is held by March 12.

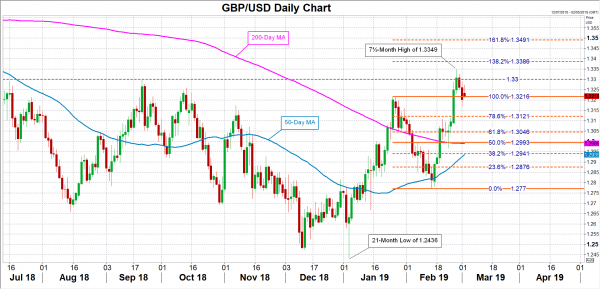

The turn of events has catapulted sterling to above the 1.33 level against the US dollar, while the euro has plummeted to 21-month lows, hitting 0.8527 pounds. Cable has since eased to around 1.3220 and could retreat further if the services PMI falls below the consensus estimate. Downside pressure could see pound/dollar initially seeking support at the 78.6% Fibonacci of the downleg from 1.3216 to 1.2770, at 1.3121, before testing the 61.8% Fibonacci at 1.3046. A bigger test for the pair, though, would be the 50% Fibonacci at 1.2993, which is also where the 200-day moving average has flatlined.

A better-than-expected reading could help cable nudge upwards, but a bigger boost is more likely to come from headlines suggesting that the EU has provided the UK legal assurances that the Irish backstop is a temporary arrangement as this would help May win her party’s backing for her deal. Should pound/dollar resume its uptrend, immediate resistance could come at the 1.33 handle before aiming to match last week’s top of 1.3349. Clearing these hurdles would bring the 138.2% Fibonacci extension into range at 1.3386. Even higher, the 161.8% Fibonacci at 1.3491 would be the next significant level to watch.