For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1335.

On the macro front, the Euro-zone’s seasonally adjusted trade surplus expanded to €17.0 billion in January, amid rise in exports for the second straight month and surpassing market expectations for a surplus of €15.0 billion. The nation had posted a revised trade surplus of €16.0 billion in the prior month.

In the US, data indicated that the US NAHB housing market index remained unchanged at 62.0 in March, defying market anticipations for a rise to a level of 63.0.

In the Asian session, at GMT0400, the pair is trading at 1.1347, with the EUR trading 0.11% higher against the USD from yesterday’s close.

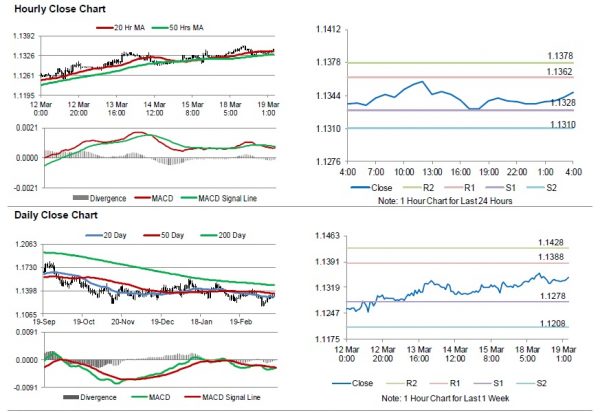

The pair is expected to find support at 1.1328, and a fall through could take it to the next support level of 1.1310. The pair is expected to find its first resistance at 1.1362, and a rise through could take it to the next resistance level of 1.1378.

Looking forward, traders would keep an eye on the Euro-zone’s construction output for January and the ZEW economic sentiment index for March along with Germany’s ZEW survey indices for March, slated to release in a few hours. Later in the day, the US factory orders and durable goods orders, both for January, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.