For the 24 hours to 23:00 GMT, the EUR declined 0.10% against the USD and closed at 1.1217 on Friday.

Data showed that Germany’s retail sales unexpectedly climbed by 4.7% on a yearly basis in February, suggesting that household consumption would be one of the growth driver this year. Retail sales recorded a rise of 2.6% in the previous month. Additionally, the region’s unemployment rate declined to 4.9% in March, hitting its lowest rate since the German reunification in 1990 and in line with market forecast. In the previous month, jobless rate had recorded a rate of 5.0%.

In the US, data showed that personal income rose by 0.2% in February, after falling 0.1% in the previous month. However, market participants had expected personal income to climb 0.3%. Also, personal spending climbed 0.1% in February, undershooting market consensus for a rise of 0.3%. In the previous month, personal spending had recorded a revised drop of 0.6%. Additionally, the Chicago Purchasing Managers’ Index (PMI) fell to 58.7 in March, more than market forecast for a fall to 61.0. The Chicago PMI had recorded a level of 64.7 in the previous month. New home sales advanced 4.9% to an annual rate of 667.0K in February, compared to a revised level of 636.0K. Economists had expected new home sales to increase by about 2.1%. The final Reuters/Michigan consumer sentiment index rose more than initially estimated to 98.4 in March, following a reading of 93.8 in the previous month. Both preliminary figures and market expectations had indicated an increase to a level of 97.8.

In the Asian session, at GMT0300, the pair is trading at 1.1231, with the EUR trading 0.12% higher against the USD from Friday’s close.

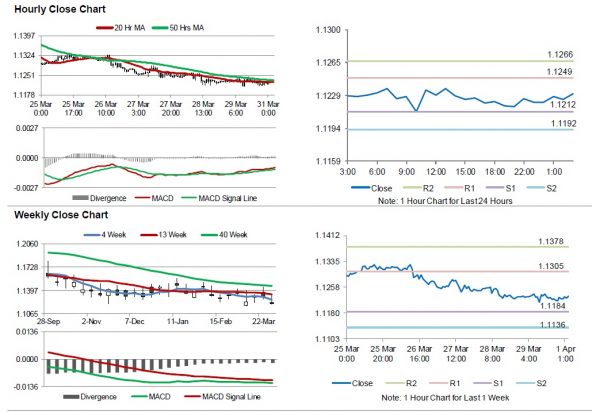

The pair is expected to find support at 1.1212, and a fall through could take it to the next support level of 1.1192. The pair is expected to find its first resistance at 1.1249, and a rise through could take it to the next resistance level of 1.1266.

Looking ahead, investors would keep an eye on the Euro-zone’s consumer price index for March and unemployment rate for February along with the manufacturing PMI for March, slated to release across the euro bloc in a few hours. Later in the day, the US advance retail sales and construction spending, both for February, will keep traders on their toes. Additionally, the nation’s Markit manufacturing PMI and the ISM manufacturing PMI, both for March, will pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.