The Bank of Japan will conclude its two-day policy meeting on Thursday and will be publishing its quarterly outlook report along with its decision statement. The Bank does not provide a precise time for its announcement, but they tend to be made around 0300 GMT. As the global economic slowdown continues to drag on Japanese exporters, policymakers are in a bind as after years of easy monetary policy, inflation is far below the BoJ’s 2% target and growth remains sluggish. The Bank is expected to keep policy unchanged in April with limited reaction anticipated in the yen.

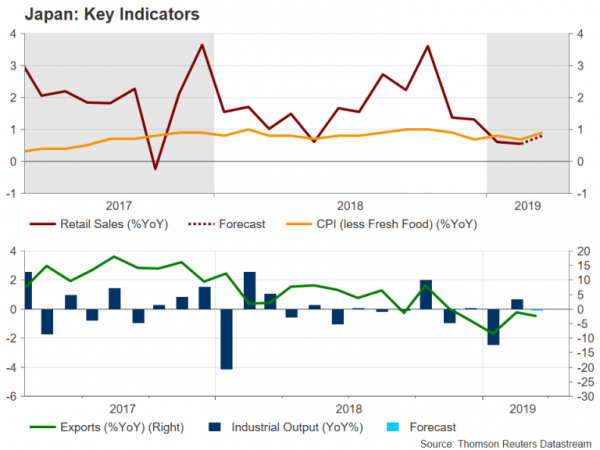

There was some good news for the BoJ on Friday from the latest inflation numbers that showed core CPI, which excludes fresh food prices, ticked up to 0.8% year-on-year in March. But with few signs that prices are about to shoot substantially higher and doubts about the sustainability of the growth momentum, which has been weakening, the Bank will likely predict in its quarterly report that inflation will stay below the 2% target until the end of the current forecast period in March 2022.

Growth forecasts could also be revised lower, particularly for the current fiscal year of 2019/20. Japan’s massive manufacturing sector has been hit hard by trade tensions and the sharp slowdown in China and elsewhere at the end of last year. But despite some tentative signs of a turnaround in China and the United States, Japanese exports continued to decline in the first few months of 2019 and were down 2.4% in the 12 months to March.

Data due on Friday is expected to show industrial output contracted again in March after spurting out monthly growth of 0.7% in February. Retail sales numbers out the same day are not projected to be upbeat either. Annual growth in retail sales is forecast to edge up modestly from 0.6% to 0.8% in March, having decelerated sharply from 3.6% in October.

With a sales tax increase looming in October, there are fears the economy could tip into recession if growth hasn’t rebounded by then. In the meantime, BoJ policymakers keep reassuring investors that there is room for further easing if needed. While this may keep some downward pressure on the yen, most analysts think the Bank is unlikely to announce additional easing unless there’s a much more severe deterioration in the economy.

Governor Haruhiko Kuroda will probably stick to familiar script when he briefs reporters on the BoJ’s decision on Thursday. But investors will still be on the lookout for any increased concerns on the outlook as well as on the emphasis on the possible side-effects of a prolonged period of ultra-loose monetary policy on the banking system.

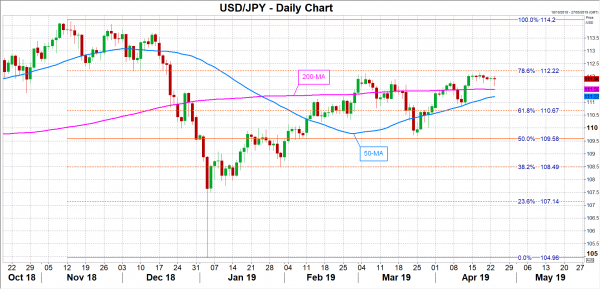

The yen could weaken slightly against the US dollar if there are downward revisions in the BoJ’s economic projections and/or Kuroda puts greater weight on the downside risks to inflation than on the side-effects of unconventional policy. In such a scenario, dollar/yen has the potential to break above immediate resistance around 112.20, near the 78.6% Fibonacci retracement of the downleg from 114.20 to 104.96.

However, if there are only minor revisions in the Bank’s forecasts and Kuroda offers few clues on the likelihood of fresh stimulus should conditions worsen, the yen could appreciate slightly, driving dollar/yen towards key support in the 111.20 region, where the 50-day moving average lies.

Looking ahead over the coming months, trade talks between the US and Japan will become the main focus for local businesses, and potentially the BoJ too, just as the Trump administration appears to be closing in on a deal with China. This could weigh on sentiment in corporate Japan even if growth does start to rebound globally.