The dollar is in retreat from the recent highs. Futures on S&P500 has just touched the all-time peaks. Brent remains at $71 since the drop on Friday.

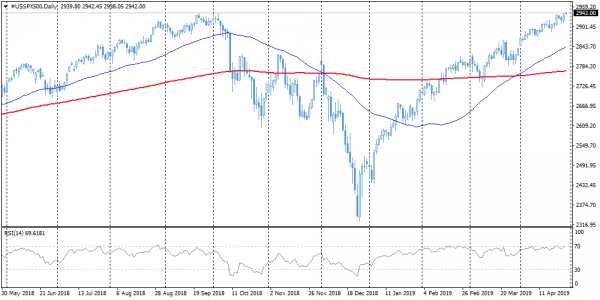

Stocks

S&P500 and Nasdaq continue their climb to the historic highs. Particularly encouraging that this growth has intensified by the end of the trading session on Friday. This dynamic indicates demand from professional market participants and, often, sets the tone for the next trading day. It works this time as the Shanghai’s China A50 index has jumped by 2.5%, while S&P500 futures has just touched all-time highs at 2945. Monday trading is usually calm but traders should pay attention to the fact that the coming days may turn out to be the turning points on the markets, due to the extremely high concentration of macroeconomic events: from FOMC and BoE meetings to US Payrolls and EU PMI and CPI.

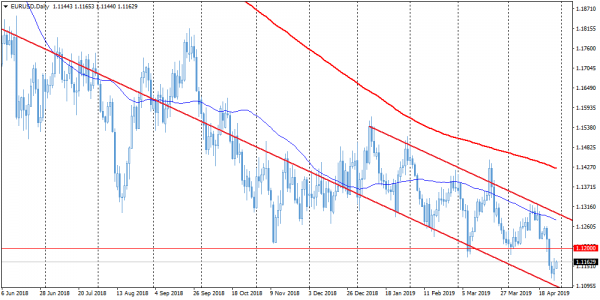

EURUSD

On Monday morning, the pair is near 1.1160, showing attempts to turn to growth after touching levels near 1.1100. Weak European statistics has contributed to the downtrend in EURUSD, which even managed to break through support at 1.1200. Nevertheless, the current trend has to pass an important test this week. Further softening of the Fed tone and a weak labour report are able to reverse the USD upward trend. It is also worth to remember about Trump’s possible pressure on the Fed’s actions that can cause the dollar growth.

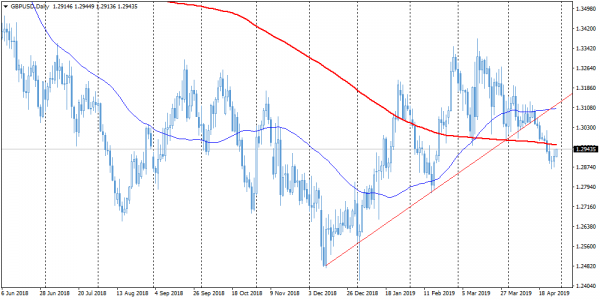

GBPUSD

The British pound is growing cautiously Monday morning, trading at 1.2940. Fans of technical analysis should pay attention to the pair’s dynamics near 1.2960, through which the 200-day moving average passes. The return to the area above this level can increase purchases, making investors confident that GBPUSD can consolidate above 1.30.

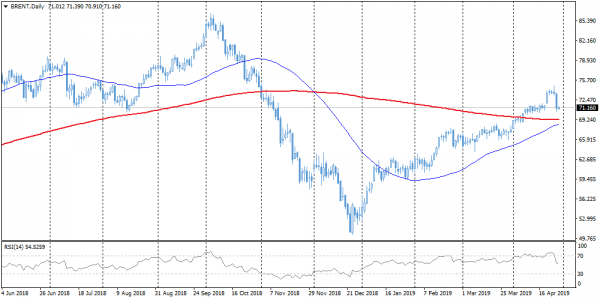

Brent

On Friday, oil declined by 5% against Thursday’s levels. It is equally important that the pressure on Brent persists this morning. By the time of writing, Brent is trading near $71, against peak levels of $74.70. It seems that now investors are waiting for the new impulses of growth above $75.