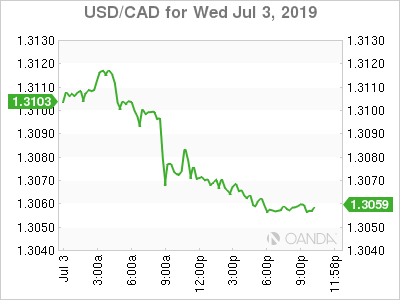

The Canadian dollar rose 0.34 percent on Wednesday. The US market closed early to start the fourth of July celebrations, but the dollar is on the back foot as the ADP came in lower than expected and the services PMI put together by the ISM is slowing down. The loonie got a boost from a surprise surplus in the trade balance. Oil prices rebounded with a softer dollar and the market reacting to the third consecutive drawdown of US crude stocks.

The miss in the US employment data, puts even more emphasis on the June NFP report. The Fed signalled it is ready to cut its benchmark interest rate. The Bank of Canada (BoC) does not face that much pressure to act as stronger economic indicators have given the central bank some breathing room.

Low volumes are expected on Thursday with the US on holiday and little on the economic calendar, this contrasts Friday that will start the North American session with a bang, with US and Canadian employment data at 8:30 am.

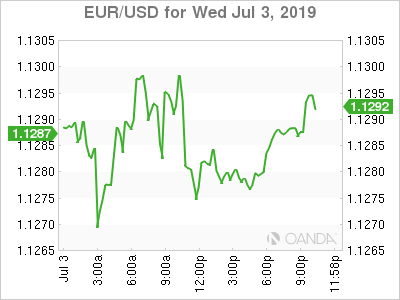

The US dollar is mixed against major pairs. Commodity currencies appreciated against the greenback, while the dollar gained against the CHF, EUR and GBP. US markets will be close for the US independence holiday, but it will be a short break for the market that will get back to their trading screens for the release of the June employment report to be published on Friday.

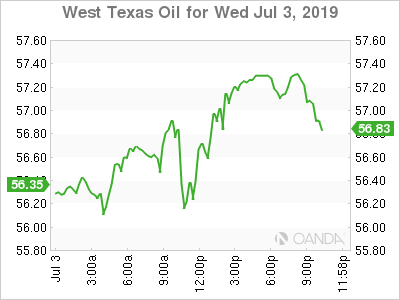

OIL – Crude Higher on Lower US Crude Inventories

Oil prices rebounded on Wednesday ahead of the July 4th weekend. The API delivered another drop in inventories with crude falling by 5 million barrels. The EIA weekly report showed a similar drawdown with crude stock shrinking by 1.1 million barrels and gasoline by 1.6 million.

West Texas Intermediate gained 2.06 percent and Brent 2.53 percent, but the two are still in the red on a weekly basis by more than 1 percent despite the best efforts of the OPEC+. The meeting at the G20 between Presidents Trump and Xi was not a success, and with declining economic indicators and more trade battles gearing up, energy demand is under pressure.

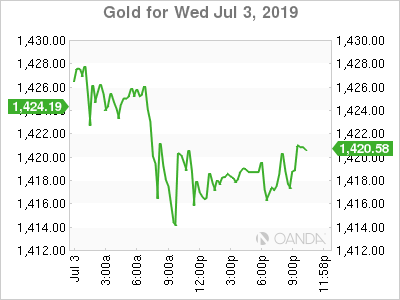

GOLD – Gold Rebounds as Trade Hopes Fade

Gold rose 0.89 percent on Wednesday. The yellow metal remains trading above $1,400 as the G20 trade optimism started to dissipate. Weak global manufacturing and comments from US officials on the length and difficulty of the US-China deal put gold back in play as a safe haven.

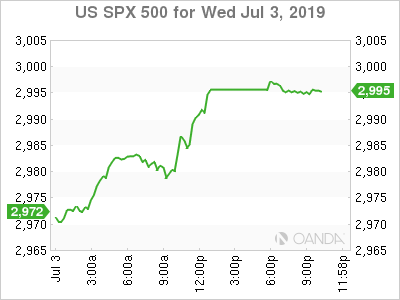

STOCKS – US Stocks Hit New High Ahead of Short Trading Session

US stocks posted another record as central bank stimulus is boosting equities. The biggest challenge for global equities to keep rising will be economic strength of the major economies. Central banks are ready to keep rates low to avoid growth losing momentum, but if economic indicators start showing signs that a recession is inevitable, consumer and investor confidence would suffer.

The US non farm payrolls (NFP) report to be published on Friday is expected to rebound from last month’s disappointment, but if the ADP is any indication it could fall further triggering more red flags of economic uncertainty. The market is now pricing in a Fed rate cut at 100 percent with the biggest debate on if it will be a 50 or 25 basis points. The ISM manufacturing PMI also showed a slowdown of the services industry and is now at a 2 year low.