Markets bounce on political developments

It promised to be an eventful week in Parliament and that’s exactly how it’s playing out and so far, the pound is the winner.

Sterling has been battered in recent months as no-deal Brexit odds have soared and extraordinary measures have been touted to ensure it happens, if the EU doesn’t remove the backstop.

Recent developments, while not altogether unexpected, have slightly reopened the second referendum door if a new election sees the Conservatives under-perform. This has brought some reprieve to the pound, just as it slid below 1.20 against the dollar, although no-deal still appears the far more likely outcome in traders eyes.

GBPUSD Daily Chart

The pair is now trading back at the upper end of the downward channel it has trended within since April. A break above here could signal more optimism for the pair in the near-term after such a strong decline, particularly given how quickly it bounced back from the dip below 1.20.

GBPUSD 4-Hour Chart

The current level also runs into potential resistance from the 200 and 233-period simple moving average on the 4-hour chart, which proved to similarly be a barrier last week. If this breaks, then 1.23 above looks very interesting, being the level it last found resistance, with the area around 1.25 looking notable above. A failure to break through the channel could put further pressure on 1.20 which has held up so far.

There’s surely a few more twists and turns to come this week, starting with votes today on the extension bill and then a new election, assuming Parliament backs the first as is expected. Sterling volatility is going nowhere.

Market Recap

Italian stocks are outperforming on Wednesday and the country’s 10 year yield earlier touched a new low after Five Star Movement members overwhelmingly backed a coalition with the Democratic Party. Giuseppe Conte will now get the go-ahead to form a new government and bring some stability back to Italian politics as it prepares its 2020 budget.

While I don’t expect Salvini to go down without a fight, this gamble has quite clearly backfired and he now must hope that he can maintain his popularity in opposition until the next election. There’s no guarantee the current coalition will fare any better than the last, with them being long-term foes, and Salvini will be ready to pounce when the opportunity arrives.

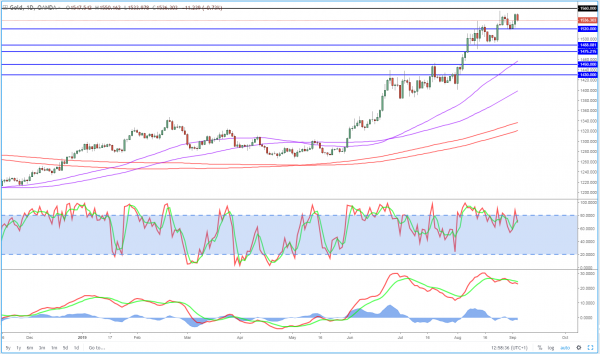

Gold stumbles at key resistance

Gold has once again stumbled around $1,550 following another surge on Tuesday, as US stocks stumbled on a couple of weak manufacturing reports. Both survey’s fell into contraction territory, providing further evidence of a global slowdown that we’ve already had plenty of evidence of this week. Again, momentum was lacking in the latest push higher but bulls are not giving up easily.

Gold Daily Chart

Oil remains range-bound despite selling

Oil prices are edging higher today, paring losses earlier in the week that accompanied a broader risk-off move. Brent has traded in a tighter range over the last few weeks, between $57-61 and these boundaries held once again. Hurricane Dorian in the US has raised questions about demand impacts in the region, which some have suggested may have weighed on prices, particularly of WTI contracts, but not enough to move us out of these ranges.

Brent Daily Chart